Feb 2021

Feb 2021

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

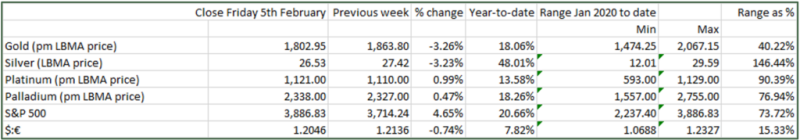

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Cinderella has left the Ball

We warned last week that “Silver is notoriously volatile and has a history of sharp spikes upward and equally vicious downward moves”. This is what happened last week, with a spike up to just over $30 and then a rapid retreat; as we write on Monday morning silver is trading at just under $27, just 1% higher than at the start of the year, but a good 8% higher than the low at the end of the downtrend in late January.

The peak was last Monday 1st February and by the close of business on Tuesday, the day on which the CFTC Commitment of Traders’ weekly report is filed, it had dropped to close at $26.29, posting a 10% fall on the day. Both the rally and subsequent direction will have involved momentum trades and technically triggered orders so that the Tuesday-to-Tuesday price change was a gain of 4.1%. The CFTC report shows that over the week the managed money (hedge funds, speculators etc) positions actually saw a reduction in the outstanding long positions and also a small contraction in the short positions. So some of these positions will have been taken out through technical or automated trading, while some will have been quick enough to take profits.

These moves are, as we noted last week, not uncommon in silver, because it has an inherently volatile nature. This si partly due to its much lower unit cost by comparison with gold. This, along with the fact that from 1934-1968 U.S. citizens were not allowed to hold gold for investment purposes as the dollar was on the gold standard, means that it has an inherent appeal to retail investors. Prices can rapidly build up momentum as, the level of re-selling into price strength is not usually as high, in relative terms, as it can be in the gold market. But when the futures markets kick in, automated orders can make the price moves very rapid.

Figures from the U.S. Mint (most mints ran out of silver coins last week) show that in the first week of February the Mint sold 64.500 ounces of Gold Eagles compared with 191,000 ounces in January. January is always a high number as that is the month in which the Mint sells to distributors so a month-on -month comparison is misleading; more telling is that sales in the whole month of February 2020 were just 3,500 ounces and in February 2019, 11,000 ounces. Silver sales in the week were 1.62M ounces, against 650,000 for the full month last February and 2.06M in the whole of February 2019. Approximate dollar expenditure was $117M for Gold Eagles and $44.0M for silver, against $11.1M and $10.8M respectively in the full month of February 2019.

For the long term, silver’s relationship with gold remains unsullied. Last week’s action should not deter those taking a longer-term view; it is the short term that carries the risks.

The precious metals; 2nd January 2021=100

The gold: silver ratio and silver spot