Feb 2021

Feb 2021

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

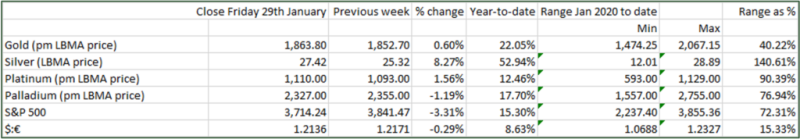

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

We wish all our readers and clients a safe and happy 2021.

Cinderella is back at the Ball

The silver market has been hitting the headlines since the middle of last week with a concerted effort from a retail investor forum that has prompted a stampede into the metal, including a claim, in a headline of a post, that the silver market is massively short and the price therefore is way undervalued. We would urge caution here. Silver is notoriously volatile and has a history of sharp spikes upward and equally vicious downward moves.

As a long-term investment silver has a deserved reputation as a leveraged proxy for gold. This is due not only to its history as legal tender (this is a historical legacy, it is not legal tender anywhere any more) but also to the fact that only 24% of silver supply is price-elastic, and that it logically follows that 76% of supply is not price-elastic. This is because so much silver is a by-product of lead-zinc, copper, or gold mines, plus we have the steady return of industrial scrap. So, from a total supply of roughly 31,000t per annum, over 18,000t is coming out of the ground as a by- or co-product from other metals, and over 5,000t is from recycling.

These two key elements, plus silver’s use in jewellery, lead to its long-term association with gold and its very high correlation (frequently as high as 0.8) with gold price movements. With gold as an important hedge against risk, silver’s long-term price action allies it to gold. But its much higher volatility means that short-term trading can be fraught with danger. The relative strength component of the chart below shows how very frequently it moves into overbought or oversold territory.

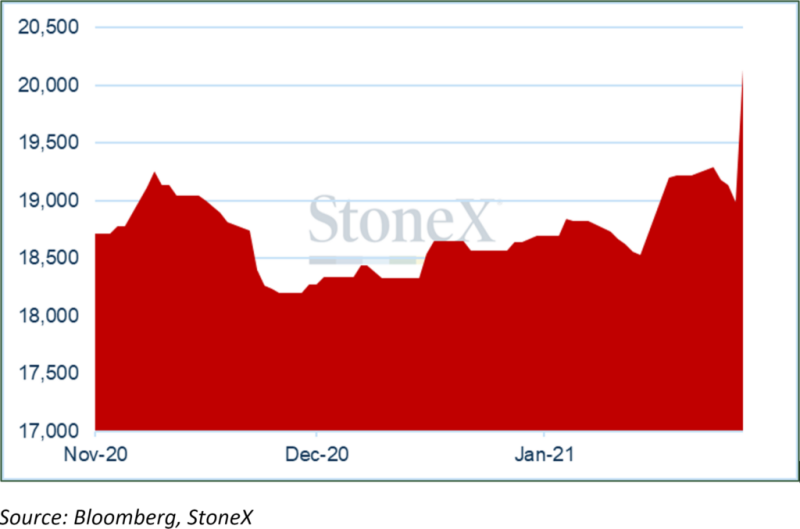

These past few days have seen the market in a feeding frenzy and a number of coin and small bar suppliers are running very low on stock. The world’s largest silver ETP, the iShares Silver Trust, has added over 900t in the past week, to reach 20,146t. We have often written about silver as the Cinderella metal; she labours in the background for a long time and then when she comes to the Ball, she causes a lot of excitement. But when she goes, she goes just as quickly as she arrived – if not more so.

Here we show some key facts about silver and the level of inventory that is theoretically available to the market.

Spot silver, technical indicators

The iShares silver trust ETF, tonnes