Mar 2024

Mar 2024

After a quiet time, gold has been revitalised

By StoneX Bullion

Is the range change sustainable?

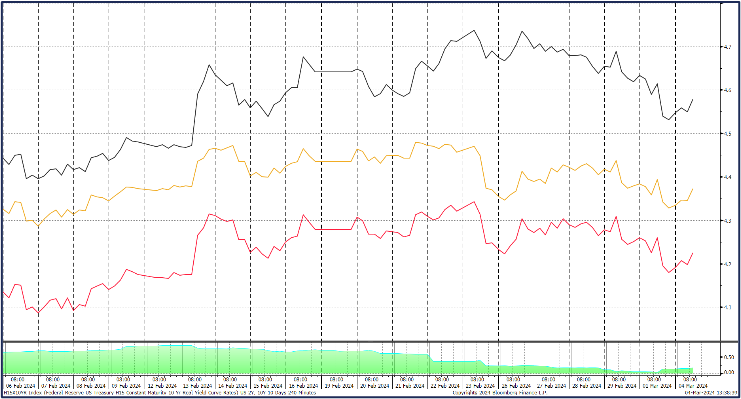

Since we last wrote I have been on holiday and it seems that for much of the middle part of February both gold and silver were quiet, and range-bound but with a marginally positive bias. As is often the case this allows for a period of pressure to build and heralds a change of range. That came about last Friday with gold testing $2,090 on the back of weaker US economic figures than had been expected, combined with a slippage in the tentative progress that had been underway over the problems with the Red Sea.

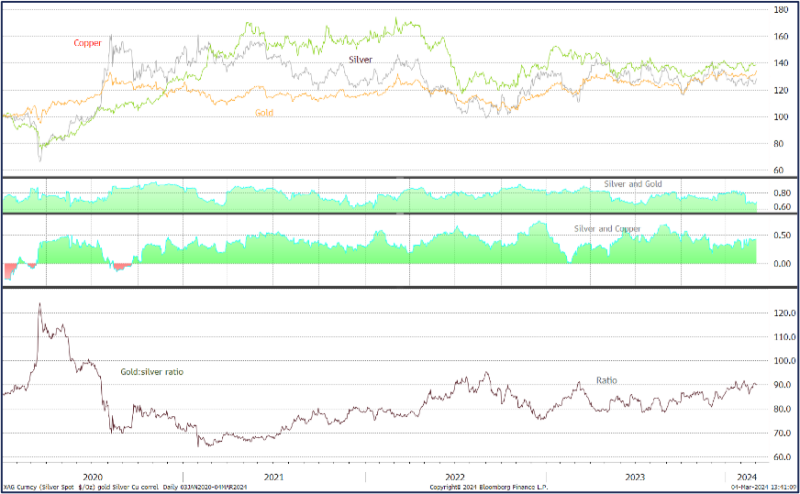

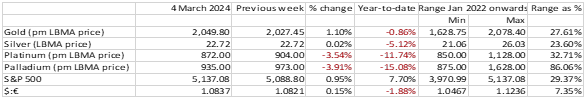

This morning gold is trading between $2,080 and $2,085, a gain of 2.8% since the start of February and of just 1% since the start of the year. Silver’s price action has been similar, gaining 2.9% since the start of February but losing 2.7% since the start of the year. Despite silver’s robust fundamentals for the medium term, driven particularly by the hefty growth in the solar cell market, it is still being hampered by concerns over the global economy, even though the United States has continued to surprise to the upside.

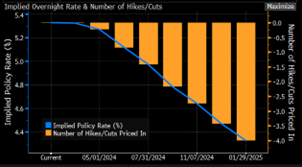

Until, that is, last Friday. Earlier in the week the US economic numbers, of which there were plenty, were underlining the resilience of the economy. The Core PCE deflator, which is a key metric for the Fed, posted a print of 2.4% year-on-year, but was up from 0.2% to 0.3% month-on-month, while the personal consumption index for the fourth quarter came in at 3.0%. Much of the rest of the week, however, especially Friday, saw numbers coming in below expectations, with durable goods orders down 6.1% and consumer confidence falling. Then on Friday the University of Michigan consumer confidence numbers, which always attract attention, were well below the market consensus, as were the Institute of Supply Managers‘ numbers, failing across all three sectors (Manufacturing, New Orders and Employment). US bond yields dropped and gold took off. Prices have remained broadly steady since, although the local Shanghai premium over London is easing after a strong purchase period during the Chinese New Year holiday.

Sentiment remains mixed but geopolitical tensions continue to simmer and continued niggles in the smaller banking sector in the States and property issues in China tend to point to a supportive (if not necessarily outright bullish) environment for gold. Silver will benefit from any strength in gold, but does remain under something of a short term cloud.

Gold; year to date

Source: Bloomberg, StoneX

Bond yields one month view

Source: Bloomberg, StoneX

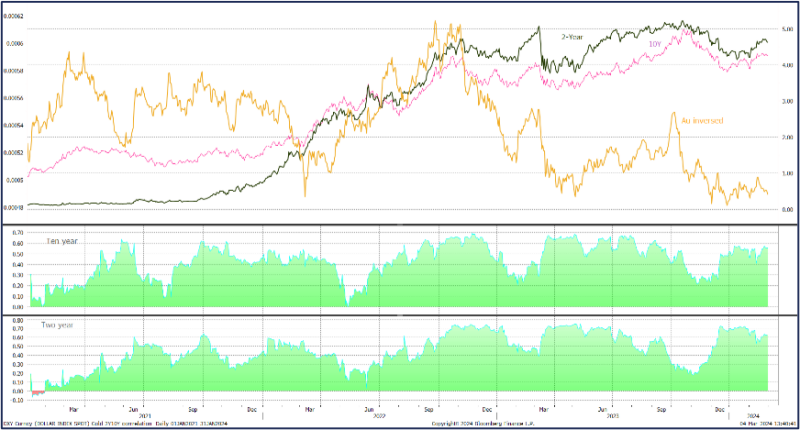

Source: Bloomberg

Gold and the two-year and ten-year yields, January 2021 to date

Source: Bloomberg, StoneX

Gold silver and the ratio; silver’s correlation with gold and with copper

Source: Bloomberg, StoneX

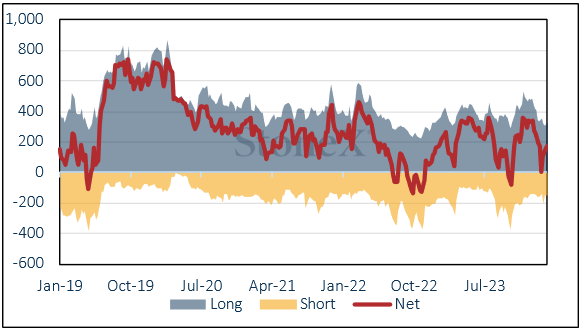

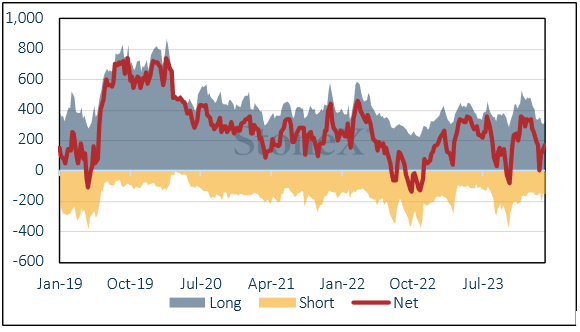

In the background the change in Commitments of Traders in the week to 27th February with gold edging higher over the period, saw a minor increase in outright longs and a small contraction in outright shorts, taking the net long to 175t, a gain of 20t over the week and unwinding part of the weakness from earlier in the month. Silver was the other way around, with long liquidation and fresh shorts taking the net position back into a short, standing at 656t against a twelve-month average of 1334t long.

Amongst the Exchange Traded Products, the latest figures from the World Gold Council (to 26th February) showed a 163.5t fall over the week and a drop of 105.6t year-to-date to 3,133t; Bloomberg figures, which are not as comprehensive as those from the Council, but nonetheless give a good gauge of sentiment, suggest a further reduction since then of 3.6t, to an estimated total of 3,130t.

Silver ETPs have also been under pressure. There has been some scattered buying interest, but sellers have kept the upper hand, for a net drop of 286t year0to-date, to 21,484t (world mine production is approximately 26,500t).

Silver technical; resistance from the 200D moving average

Source: Bloomberg, StoneX

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX