Mar 2021

Mar 2021

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

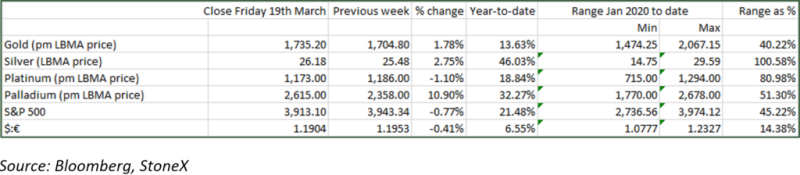

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Since our last note (8th March), when gold posted the lowest intraday prices since 8th June 2020, it has traced an upward recovery and the technical (i.e. chart-based) picture has improved. The low on 8th March was $1,677 and on 18th March the spot price reached $1,754 (a 4.6% gain); as we write it is consolidating between $1,730 and $1,750. On a technical basis the price is in neutral territory, but is now finding support from the ten-day and 20—day moving averages, although it is also finding some resistance from the top of the downtrend (see chart below); so while the price is working higher it is premature to say that the most recent downtrend has been broken.

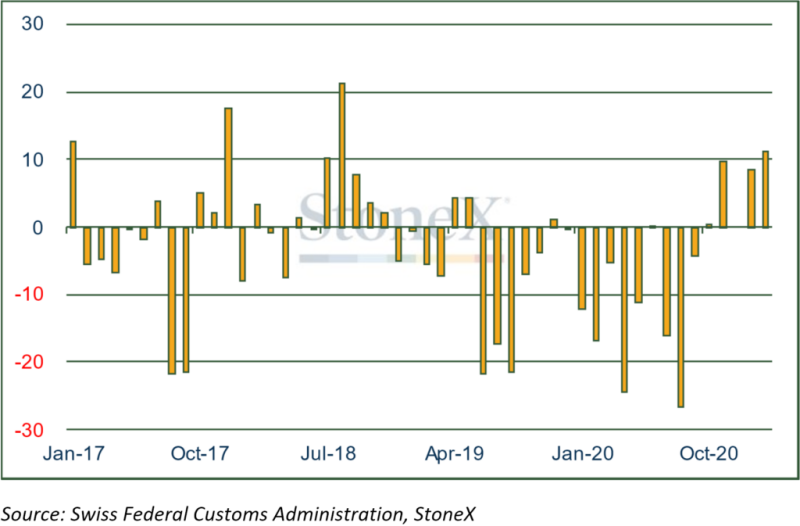

To some extent this is reflecting the stirring in the physical market. The Indian and Chinese populations have been back as buyers for some weeks; now, the appetite is spreading across south-east Asia and in the Gulf and there have certainly been a few days recently when gold bars have been scarce in some locations, which will have raised local premia, but not necessarily filtered through immediately into the underlying price. The latest Swiss trade statistics show that there was a net export of gold to Hong Kong in February – small, but only the third net export since June 2019 as the market started slowing in response to rising prices. Exports to India continued to recover, hitting 58t in February and exports to Thailand were the highest since mid-2018.

In the financial background the markets have continued to watch government yields, particularly the U.S. 10-year yield, which has been rising on increasing expectations of a sustainable economic recovery and rising business confidence. For some weeks in the first couple of months of the year this indicator was a key element helping to put pressure on the gold price as gold does not bear a coupon and therefore the perceived opportunity cost of holding the metal was rising as bond yields went up. Looking at this also from an inflation-expectation angle shows us that the Fed’s five-year breakeven index has worked up from just over 2.10% in mid-February to 2.28% most recently.

We have noted before that economies do need an element of inflation in the system if they are to operate effectively and that these concerns about rising yields have been over-emphasised; the Fed’s average 2% inflation rate target is exactly that – a target, not a threat. It would seem that as the physical market wakes up the perception is finally starting to seep into the market that yields are by no means the only influence of gold (and other commodity) prices. Professional money is still seeping out of the gold ETFs, although the rate of attrition has slowed and we look to be entering a period of price consolidation.

The gold spot price; working better as physical demand spreads

Swiss net trade with Thailand (tonnes) - a barometer of Far Eastern gold demand