Jan 2021

Jan 2021

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

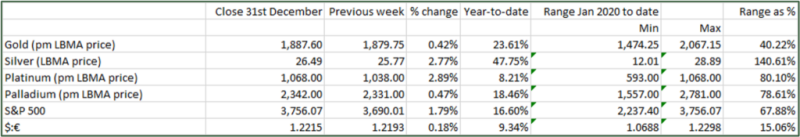

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

We wish all our readers and clients a safe and happy 2021.

While the table below shows gold closing at end-year at just below $1,890, this morning has seen it bounding higher on a weaker dollar and widespread expectations for further falls in the U.S. currency. It is being suggested that there is a fundamental shift underway in terms of foreign exchange reserve composition, and at least two government fund managers have today been reported in the press as adding to their gold holdings. While the tonnage may not be much, the sentiment is key, with the Reserve Bank Governor in Serbia raising reserves in order to “guarantee stability for this state and for all who want to do business with the state”, and the State Oil Fund of Azerbaijan saying that gold’s slot in its investment portfolio will rise from the 10% allocation last year, with a potential target of 15%. Gold has gained $30 over the weekend and is trading above $1,930 as we write.

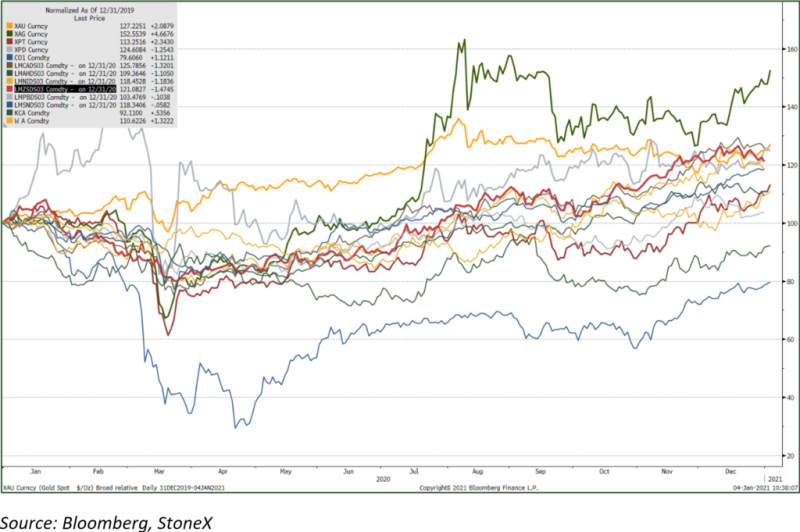

The base and precious metals’ performances over the whole of 2020 and through to this morning show Silver as the clear winner with a gain of 53%. Gold lies in second place with a gain of 27%. Copper gained 26% and Palladium 24% as the markets looked through the virus pandemic to a potential recovery in the auto sector and the changing emissions standards in China. Platinum was the underperformer, although its 30% gains over November and December also reflect a degree of optimism over the medium-term outlook, with a reasonable prospect for diesel demand when long-distance haulage picks up and – at last – the likelihood of fuel cells taking up some market share within the electrification of road vehicles over the next decade.

Elsewhere the U.S. Mint Gold Eagle sales for the full year came in at 25.4t; while this is not of itself a high number, nonetheless it is more than five times the tonnage sold in 2019. Approximate expenditure (based on monthly numbers) was $1.5Bn, up by a factor of 7.1. Silver Eagle sales were 877t, 1.9 times the level of 2019, for expenditure of $579M, 2.4 times the previous year’s level.

The Exchange Traded Products absorbed plenty of metal in 2020. The gold products took up 882.5t, which is equivalent to roughly 13 weeks’ global mine production and offsets at least in part the contraction in price elastic jewellery and investment products over the course of the year. Silver ETPs added 8,679t, equivalent to 15 weeks’ global demand on a broadly balanced underlying market.

Meanwhile on the futures markets, the net managed money exposure saw gold close the year with a net long of 336t; that is a net drop of 388t over the year. The year’s low was not, as might have been expected, in the immediate aftermath of the virus-triggered commodities meltdown in February and March, but much later in the year in mid-November as a result of steady long liquidation in the second half of the year and a small overall increase in outright short positions. The silver futures saw a contraction in both outright longs and shorts, and their pattern varied markedly from that of gold. Outrights longs bottomed out in early May, having contracted by 69% from the late January high, while there was no discernible trend in the outright shorts.

Sentiment is positive at the start of the New Year, with potential central bank activity capturing the attention of the press and widespread expectations for continued dollar weakness. The ban on flights out of South Africa is seeing some tightening in the forwards, given that gold and PGMs are largely transported by air; in the case of gold this is usually in the cargo holds of passenger flights.

Major metals; relative performances over 2020