Dec 2020

Dec 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

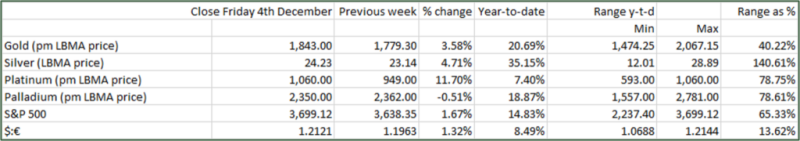

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

The World Gold Council has this morning released “Retail Gold Insights: Germany Investment, an in-depth market report based on extensive consumer research. You can download it here.

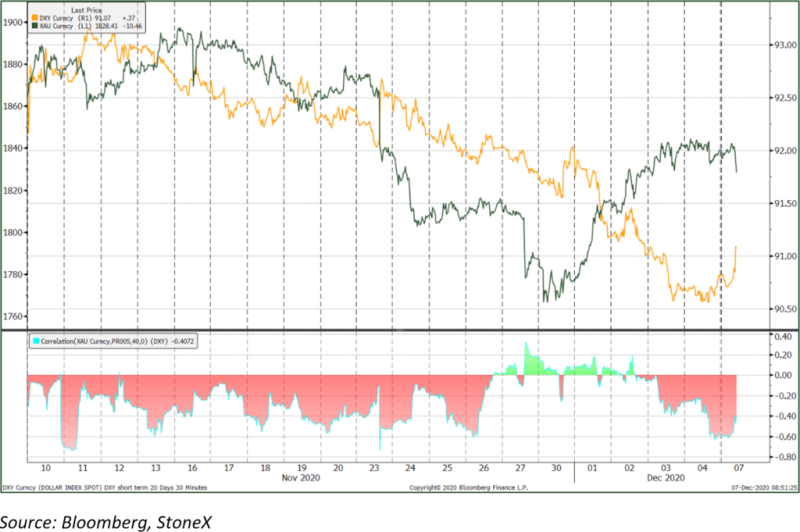

The past week, and especially early in London trading at the start of this week, has revolved around politics and vaccine developments; these have of course impinged on both the dollar and gold. As the chart shows the correlation between the two was positive for almost a week until mid-week last week, when it reverted to the more normal negative relationship. Bear in mind that correlation does not equate to direction.

All other things being equal, gold should be expected to move in the opposite direction to that of the dollar, purely because it is simply a dollar-denominated commodity. The same of course would apply to all other commodities. On the other side of the coin, however, is gold’s role as a hedge against risk and frequently either the dollar or gold will have the upper hand in times of distress. Occasionally when the stress levels are particularly high both the dollar and gold will strengthen. What is less common is for them both to ease when risk is receding, but this is what was happening in mid-November.

Now the more normal relationship has been re-established and the most recent developments are revolving around Brexit, with sentiment oscillating from one side to the other as the mood music has changed; one day it looks as if a deal is likely, another day it’s off the table; and this morning we have seen both points of view plus a neutral element thrown in for good measure, depending not only on which country one is in, but which press outlet one looks at.

In the background the roll-out of the vaccines has stimulated the continued move into risk-on assets, which has undermined gold to some extent, but tensions are rising between the United States and China. Meanwhile, there are reports that President Trump and Mitch McConnell, the leader of the majority Republican party in the Senate, will back the bipartisan $908Bn bill that was put forward a few days ago and which they initially dismissed. The Republicans are unhappy with the fact that a proportion of this fund is to be aimed at individual states. The fund is also substantially lower than the $2+Tn favoured by the Democrats, but Democrat House Leader Nancy Pelosi is in favour of using it as a springboard.

The increased Sino-U.S. tensions and the likely longer-term bearish dollar implications from fresh stimulus are both supportive for gold and there is encouraging evidence of continued bargain hunting in the Middle East and south Asia, and anecdotal evidence of an improvement in demand in the Far East, although that is relatively quiet. As we write, gold is trading at just over $1,830, a gain of $65 or 4% over week-ago levels. Selling persists in the Exchange Traded Products and is commanding attention in the press, but it is not (currently, at least) strong enough to be an over-riding force driving prices.

Gold and the Dollar, 30-minute moves and correlation over one month