Nov 2020

Nov 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

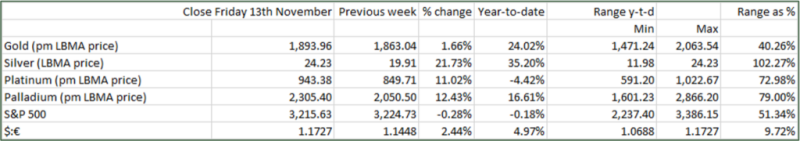

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Indian jewellery demand in Diwali; down but not out

Last week saw the Indian Diwali Festival, which runs for five days. This is a Lunar Festival so the annual dates shift; this year it started on Friday 13th November. The name Diwali means “Festival of Lights” and it goes back over 2,000 years; it is generally deemed to be a celebration of the triumph of good over evil and is the most important festival in the Hindu calendar. The first day of the Festival, Dhanteras, is seen as the most auspicious day for the buying and giving of gifts and gold’s religious significance in India means that gold is a very important part of this. As a result, India’s quarterly consumption of jewellery plus bar&coin has over the past ten years averaged 28% of the yearly total.

The second chart below shows a “seasonality” profile, with gold in rupee terms for each year back to 2015 overlain upon each other. Now in 2019, gold demand in Diwali was down by roughly 30% against the previous year, reflecting the change in price range that developed between May and September last year; normally price-elastic demand regions manage to adjust to higher (or lower) price ranges within a matter of weeks. Last year this didn’t happen because of economic uncertainties and then of course, the virus took over and India went into extended lockdown.

Business started to build up a couple of weeks before Diwali and looked encouraging, with domestic prices going to a small premium to the international market after spending much of the year at a discount. Overall, however, demand was down again this year and, in some areas, it looks as if it may have dropped by a further 30%; this would tie in with the fact that rupee prices were roughly 30% higher than at the Diwali 2019 Festival. World Gold Council figures show that in the first three quarters of this year, Indian gold demand, at 252 tonnes, was down by 244t or 49% against the first three quarters of last year. For the year, we could easily be looking at a 250-260t shortfall.

There are also some concerns being expressed domestically that after some large gatherings for the Diwali Festival there could be another wave of COVID infections in the country and we cannot rule out another lockdown. Indian gold prices remain at a small premium to the international market, but this has contracted from a week ago.

Meanwhile, elsewhere the gold ETFs saw redemptions of 52t from 12th-19th inclusive, but there was some small bargain hunting towards the end of last week. The Commitment of Traders report for managed money positioning on COMEX for the seven days to 17th November, as prices were unwinding the heavy falls of 16th November, saw outright longs and outright shorts come back up to the level of a fortnight previously.

As we noted last week, the first vaccine announcement saw a knee-jerk reaction from the financial community in a microcosm of what could well happen over the longer-term as markets revert to a new normal. Subsequent announcements have had diminished impacts on the markets as markets reflect on the fact that these developments are vaccines, not cures, and that we are not out of the woods yet. Gold and silver are essentially holding steady as a result.

Gold, narrow ranges with a mild downward trend

Gold in rupees; seasonality chart