Aug 2020

Aug 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

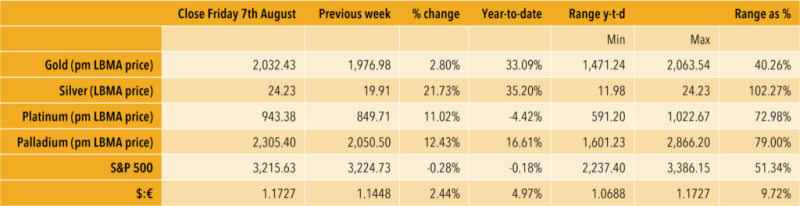

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Gold Eagle sales up almost six-fold so far this year.

Gold is through $2,000 but the move itself was simply a continuation of the trend, not a massive upward break. The change of Big Figure, though, has of course attracted a lot of attention.

Last week, with gold approaching $2,000, we wrote as follows: “Interestingly, the Commitment of Traders figures for the week to the close of business last Tuesday, when gold closed at $1,958 (after a weekly gain of $147 or 6.4%) showed both long liquidation and increased shorts among the Managed Money component. Clearly there was profit taking setting in towards the end of the month and after such a swift move; this week’s numbers will be instructive and may well show short covering”.

Well, in the event, there were increased shorts in the Managed Money sector in the week to last Tuesday, which exceeded the increase in longs so that the net position dropped to 353t, the lowest since mid-June when the LBMA afternoon gold price was $1,719.85. As we write gold is trading just above $2,030. While the Managed Money position on COMEX was declining, ETF holdings went from strength to strength until the end of last week when there was some light profit taking on the back of economic numbers which, at the headline level, were positive – but not necessarily as bullish overall as may at first appear; see below. ETF holdings added 26t in the week to Tuesday 4th August and then went on to touch an estimated 3,817t on Thursday before relinquishing three tonnes on Friday. Holdings now amount to 3,814t at a value of $248Bn.

The economic numbers from the United States were mixed last week. The main headline was the Nonfarm Payroll number, which showed an addition of 1.8M jobs during July, leaving the unemployment rate at 10.2%. The devil is in the detail, however, with the increase in employment running at a slower rate than in June as the virus started to reassert itself, especially in the economic powerhouses of Texas, California and Florida. The Purchasing Managers’ Index report was similar, in that the headline numbers were encouraging with a manufacturing number of 54.2 (anything above 50 is expansionary), with new orders at 61.5 and production at 62.1. Inventories were at 41.6, which is also positive, but the employment index dropped to 42.1. So, on balance, there are green shoots of recovery, but the undertone suggests that it will take a long time.

Meanwhile there was no agreement in Washington about the proposed emergency recovery fund in the United States, so the President signed a series of executive orders that will go some way to alleviating the position, but which falls substantially short of the $3 trillion programme that the Democrats were proposing.

This, along with increasing tensions between the United States and China, with the President signing orders last week that will, as of late September, prevent U.S. citizens from doing business with TikTok or WeChat, is helping to keep gold buoyant. Silver, ever the more volatile of the two metals, continued its hard rally last week and when gold hit its peak of $2,063, silver traded as high as $28.90, an eight-year high. The latest figures from the U.S. Mint show that sales of gold and silver Eagles saw another strong month in July, with Gold Eagle sales reaching 115,500 ounces for a seven-month total of 463,4500 ounces (14.4t). This is up by a factor of 5.7 times against the first seven months of last year, and some Mints around the world are running short of material in the face of relentless demand. So far this month, Eagle sales are running at the same rate as in July.

Silver is even more impressive in the short term, but less so for the year. Sales in the first week of August reached 918,000 ounces, against 1.1M ounces in the whole of July. For the first seven months of the year, sales were Silver Eagle sales were 5.5M ounces, up by just 21% over the equivalent period of last year, but these numbers are constrained by the fact that following logistical problems in March and April, a number of refineries were concentrating on producing gold and silver had to take a back seat.

Gold & Silver Spot, January 2009 to date