Apr 2020

Apr 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

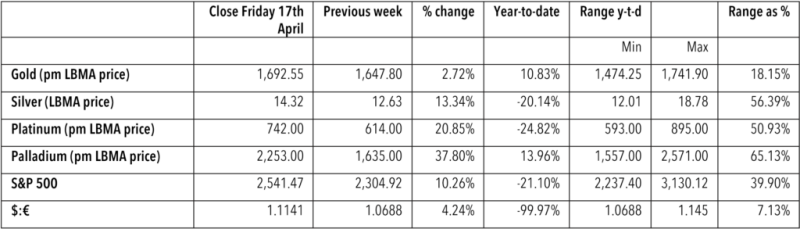

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Since we last wrote a fortnight ago the gold market has been subject to further dislocation, with the COMEX June contract moving to a near-$50 premium over spot, which is massive. The difference between the two would normally only be a matter of a few dollars, as a combination of the number of days between spot and the expiration of the contract, interest rates and market liquidity, or the availability of metal. The premium is narrower as we write today but is still wider than normal.

This does not, in fact, mean that there is a massive shortage of metal in the market, but the difficulty lies in the vastly reduced number of available flights to move gold around the world. It is usually carried in passenger flights as cargo, but with the grounding of the majority of passenger flights, this has made delivery difficult. The situation is partly exacerbated by some refiners, notably three of the big ones in Switzerland, working at reduced capacity. These are in the canton of Ticino, in southern Switzerland and close to northern Italy, and some of them have Italians on their workforce. Initially they were closed for a fortnight, but now have permission to operate at 50% capacity.

Furthermore, it is very rare for even as much as 5% of COMEX futures contracts to come to delivery, but the market has been trying to cover against any risk. There is a mechanism known as the EFP (exchange physical for futures), whereby a market participant will trade with another counterparty on an Over-the-Counter basis to exchange a long (or short) physical position for the equivalent position on a futures contract. Generally, banks prefer to be short of the EFP, i.e. short of the futures and long of the physical, as contract expiry approaches. As part of risk management, therefore, in the faces of minimal flight capacity, they have been looking to close out those positions in order not to risk having to deliver. The price of the futures has therefore been pushed up as short position holders have chased it.

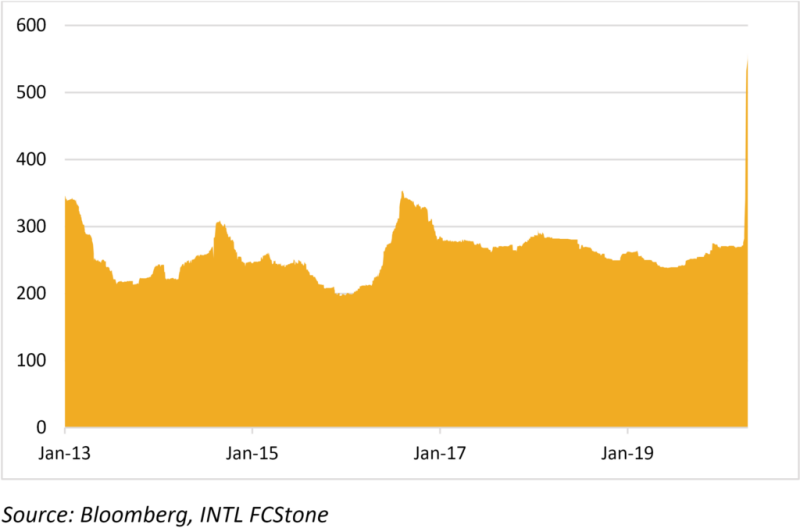

COMEX inventories have risen very substantially over the past fortnight and are at record levels (see chart below) of 580t, a 300t increase from the end of March.

Meanwhile coin demand has been rocketing in the United States and the U.S. Mint, which has six facilities in the country, has suspended operations at its Key West plant in New York State in order to protect the workforce; production of Gold Eagles has therefore been stopped for now. Silver Eagles are still on sale.

Thought for the week

Gold ETFs are at another of record 2,928t, with a current market value of $159Bn. Holdings by individual funds are updated monthly by the World Gold Council; at end-March the European funds were still catching up with those in North America. The April numbers will make very interesting reading.

Chart for the week

COMEX gold inventories, tonnes