Jan 2020

Jan 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

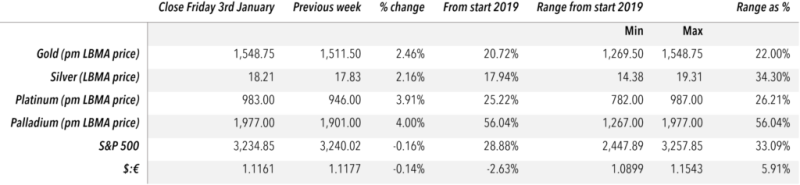

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest. We wish our readers a very happy peaceful and prosperous New Year.

Activity in the markets in the first week of the New Year have obviously revolved around developments in the Middle East. Gold is testing $1,600 , albeit not by much and most of the industrial metals came off in price, as the markets moved firmly into risk-off mode. Uncertainty is the primary driver here as market participants wait to see how circumstances develop.

Gold’s recent high of $1,558 (9th September 2019) is within sight and if this is cleared then the price will be approaching seven-year highs. Unsurprisingly the CBOE (Chicago Board Options Exchange) VIX index, which measures uncertainty as defined by options volatility, has shot up as the markets move firmly into risk-off mode, while Brent is approaching $70 (last at $68.60 for the first continuation contract). The dollar has strengthened but is within range and gold is taking centre-stage as the outperformer. Industrial metals are under some light pressure but in general the markets are not committing until things are clearer. While these latest issues have boosted gold towards recent highs it is nevertheless perfectly possible that this move will not go much further in the short term. For the longer term the price action is expected to be robust on the back of geopolitical risk and a possible retracement in the dollar, but as noted above the markets overall are unsettled and with the physical market still sclerotic we may well be due a correction.

Gold is carrying silver with it but not very convincingly, with the ratio widening. This too is a reflection of uncertainty as silver’s industrial characteristics work against the price in these circumstances. Similarly, equities have come under pressure, while other safe havens that have increased in price include the Swiss franc and the yen (typical currency safe havens other than the dollar) and fixed interest with Bunds and U.S. Treasuries in the vanguard. The markets are now watching for geopolitical developments and caution is the watchword.

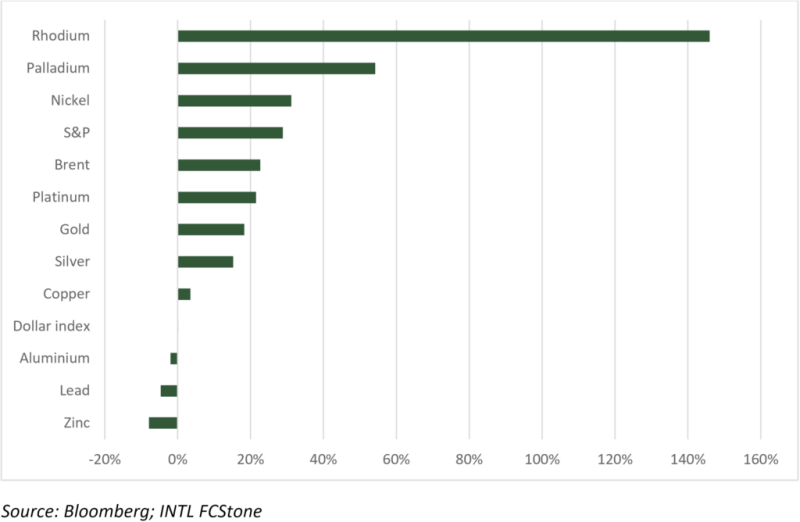

Chart — Relative performance of the major metals and assets, 2019