Aug 2019

Aug 2019

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

This past week has been steadier for gold, with some light profit taking appearing, but also fresh buying on dips in price and ultimately an upward move towards $1,515. There was one day in which the Exchange Traded Funds saw redemptions; this was in midweek when gold had moved up again through $1,500 after previously drifting lower and it is likely that some investors thought that $1,500 was going to prove troublesome. In the event, however, gold moved higher again to reach $1,515, as the markets focused again on the prospects for recession and the likelihood of more financial easing from central banks around the globe. This was triggered by the inversion of the yield curve in the United States (interest rates for longer tenors lower than those for shorter periods), and at the same time the whole of the yield curve moved below the federal funds target rate for the first time in history. Add this to the fact that many interest rates in Europe are below zero and the argument that holding gold carries an opportunity cost becomes invalid.

Next week the Federal Reserve Chairman Jerome Powell addresses the Fed’s annual Jackson Hole symposium and this will attract the markets’ attention; we suspect that he will maintain his wholly appropriate prudent central banker’s stance and look to keep the Fed’s options open with respect to its interest rate policy while addressing the prospects for global stimulus. Meanwhile the bond futures markets are discounting a 68.8% probability of a 25 basis point cut at the Federal Open Markets Committee meeting (8th September) and a 31.2% probability of a 50-basis point cut. The tailwinds behind gold remain intact and the market remains bullish for further price gains.

Thought for the week

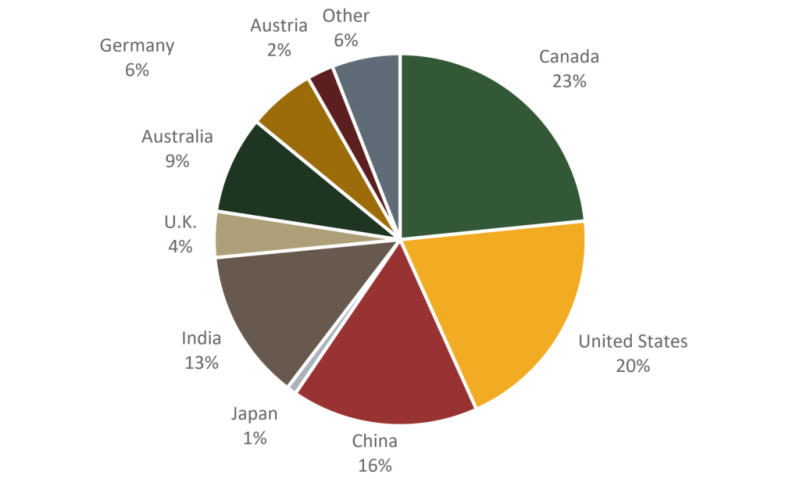

One legacy of the gold standard is the popularity of silver investment in the United States

Source: GFMS,Refinitiv; INTL FCStone