Jul 2019

Jul 2019

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

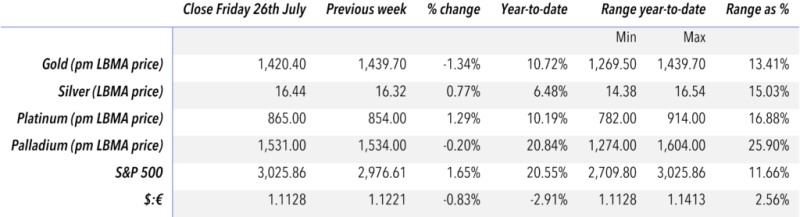

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Silver: the Cinderella metal

Silver’s strong rally, gaining 12% during a period of just three weeks, is testament to more than one factor. First, that silver can be one of the most explosive metals in the sector, partly by virtue of its history of volatility; second, that it also has something of a history of languishing when gold is directionless and then delivers a powerful move extended and accelerated by technical considerations; and third, that this time the move has been driven almost exclusively by “hot” money.

At a grass roots level, the market is a little cautious; there has been no sign of any buying based on the hopes that this move will continue, but equally there has been no real evidence of any re-selling. Clearly retail buyers are awaiting some kind of confirmation that this move is a genuine one, as silver has flattered to deceive in the past. At the professional level the net managed money positions on COMEX have swung away from a net short of 5,911 tonnes at end-May, the shortest position for six months; by 23rd July this had turned into a net long of 8,509 tonnes, with almost 7,000 tonnes of fresh longs and short-covering of more than 7,000 tonnes. It does now look as if there has been some profit taking as the price has stabilised just below $16.50/ounce. Further, there have been record-breaking ETF purchases.

Meanwhile the market has absorbed the statements from the European Central Bank Chairman last Thursday which were not quite as dovish as had been expected; even so he does appear to be preparing the way for a rate cut in the autumn and possible further economic stimulus. European bond yields are negative in the majority of countries and are continuing to slide lower. In the United States the markets are awaiting the Statement from the Federal Open Market Committee on 31st July. The fed fund futures are discounting an 81% probability of a 25-basis point rate cut this time especially as the U.S. GDP numbers were strong and Fed policy makers are widely believed to want to emphasise their independence from political influence, with the President pushing for more. Gold may well have a short-term downward reaction if the cut is just 25 basis points, but the overall sentiment remains positive.

Thought for the week

Silver is Cinderella; she spends ages below stairs then comes to the party and all the heads turn (but beware losing that shoe…)

Gold against U.S. 2-year and 10-year bond yields