Jul 2019

Jul 2019

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

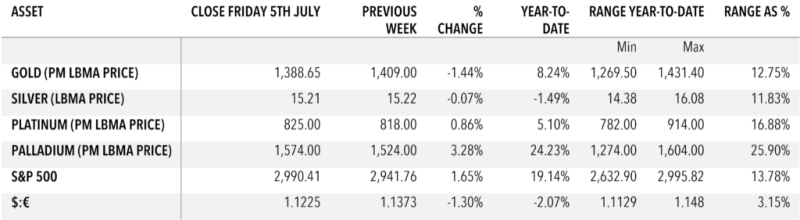

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Sales of U.S. Gold Eagles in June contained 5,000 ounces of gold, with a year-to-date total of 109,000 ounces. Year-to-date equivalent last year; 245,000 ounces. But when numismatic coins are included the total was up by 17%. Numismatics include collectibles, commemorative sets, etc. This is an interesting switch with U.S. Mint numismatics now outpacing the bullion coins.

Last week we talked about how Dubai had gone to a discount to the international markets as local holders sold material back into the market. Now, in the wake of the announcement from the Indian government that it is to raise import duties on gold, India has gone to a sizeable discount and the market is looking for an increase in smuggling. What has gone below the radar, though, is that the duty hike was not the only part of the policy. In addition to the gold hike the government is to apply a tax of 2% on withdrawals of cash from domestic banks (up to Rp1-crore, or ~$146,000 over a year), which makes any gains to the smugglers who use banks so small that it’s barely worth the risk. So the flows into India over the next few weeks and months will be fascinating.

That duty hike announcement, though, was certainly part of the influence that put gold prices under pressure at the end of last week, along with the strong gains in U.S. June employment numbers. The market view is that this reduces the likelihood of two rate cuts this year, although the CME Group’s market analysis tool is still showing a 95% chance of the rate target coming down to 200-225 basis points in the 31st July meeting and to 175-200 points in the 18th September meeting. Gold continues to watch Fed activity and this knee-jerk downward reaction is not unusual. The overall fundamental background is still favourable, though and as shown in the chart below the technical construction remains constructive.

Thought for the week

The “Calcutta Cup”, the trophy awarded for the winner each year of the International rugby match between England and Scotland, is so-called because it was cast in India from silver from melted-down rupees.

Chart for the week

Gold in U.S. dollar terms; two-year view;

The 10-day moving average has been severed but 20-day stands at $1,380 and the 50-day at $1,327.