Nov 2022

Nov 2022

StoneX Bullion round-up Tuesday 29th November 2022

By StoneX Bullion

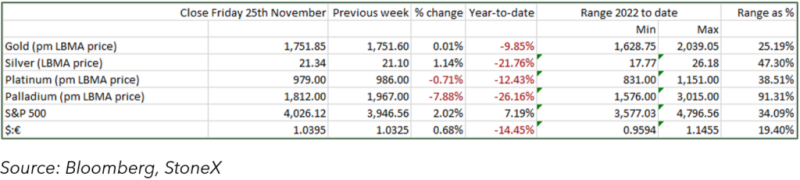

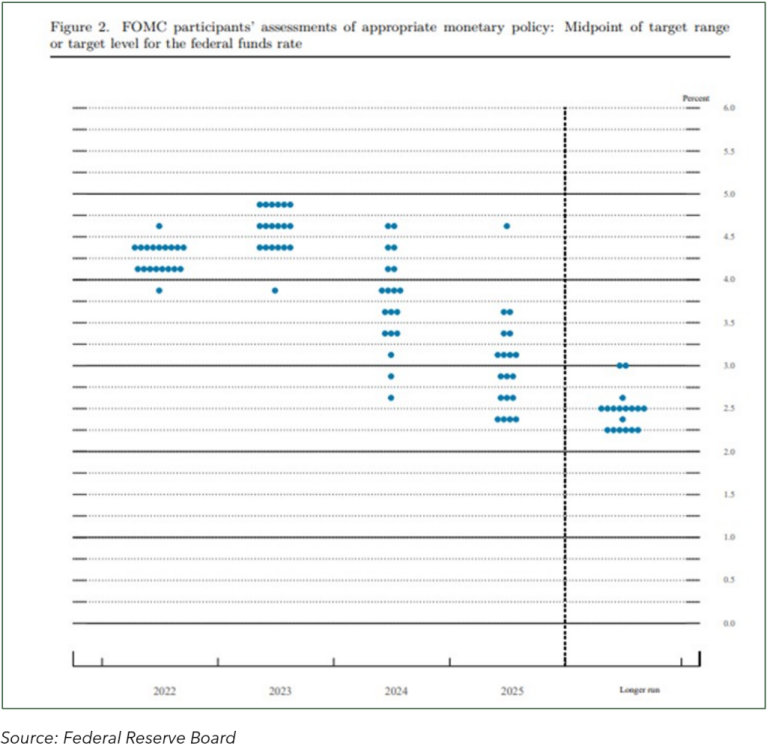

Since we last wrote a fortnight ago, the dollar has remained largely on the back foot with the Minutes of the Federal open Market Committee (FOMC) implying that the December hike will be 50 basis points, compared with the most recent hikes of 75 basis points. While that is less aggressive than previously, what is interesting is that the bond markets have pushed the medium-term target peak to 4.98%, in June of next year.

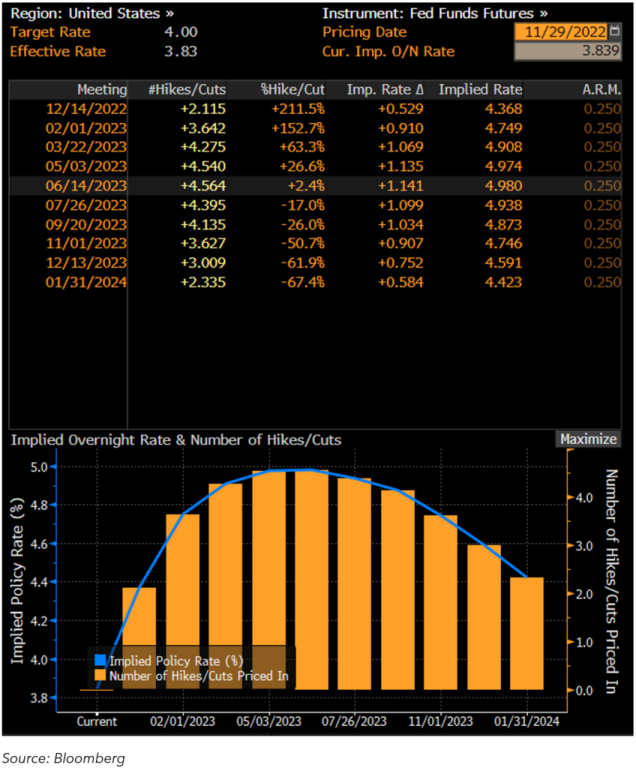

With differing views in the FOMC looking as if they are becoming more deeply entrenched, and the Staff now expecting the US economy to grow at below potential in both 2024 and 2025, there would appear to be a growing undertow towards a more dovish medium-term strategy.

This has helped to keep the dollar under some pressure, with a fall of 1.6% over the past fortnight and a drop of 7.5% since the peak on 27th September. In dollar terms, gold is net unchanged over the past fortnight (rising, falling, and recovering), while it has gained 5.8%. since the dollar’s peak.

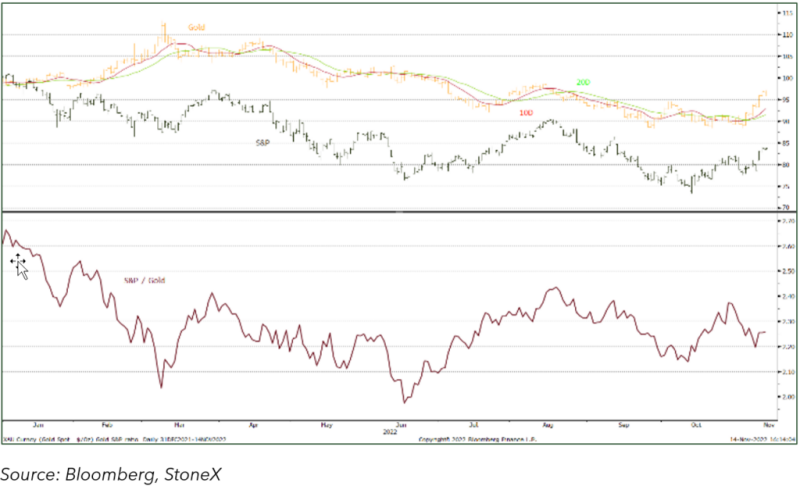

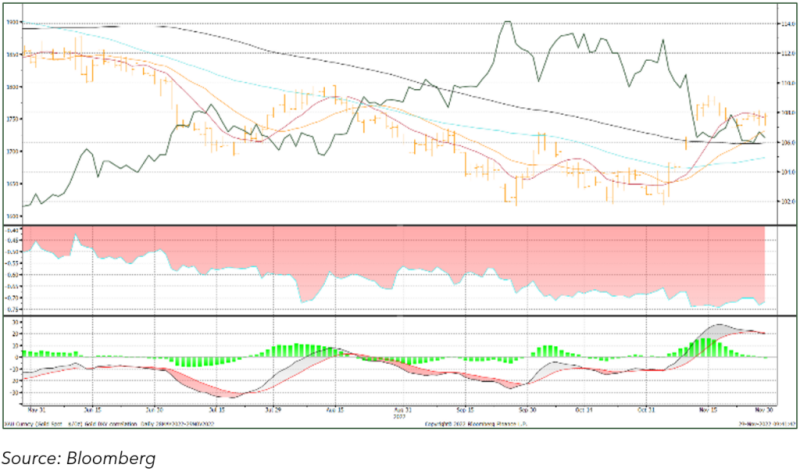

Gold is therefore still underperforming when considered purely in dollar terms, but the technical chart-related construction has improved with the moving averages now supportive (but the 10-day is putting up some resistance as we speak0, while the market enjoyed the “Golden Cross” a fortnight ago, in which the 20-day average crosses the 50-day to the upside.

With the dollar:gold correlation at its strongest (better than minus 0.67 since early November and currently at minus 0.73) the U.S. currency is still a key driver of the gold price.

This of course is not a surprise since the dollar is also encapsulating economic, financial and geopolitical risk. The rising domestic tensions in China over the weekend are supportive for gold in principle, although the latest trade figures from Hong Kong, which relate to October, do demonstrate that imports into China in October had eased against previous months (when taking Hong Kong export and re-export numbers combined. Domestic interest in both gold and silver appears to be reasonably solid, but the domestic situation is clearly undermining potential buying activity, at least for the time being.

Among other influences, the gold Exchange Traded Products are starting to attract some scattered buying, but there is not much conviction behind it yet. Of the 19 trading days in November so far, six have seen some buying, and the overall change in the month to date is a loss of 26t, taking the net loss for the year to 98t.

Silver ETPs are starting to turn higher, with five consecutive days of increases over the past week. Year to date, holdings have dropped by 3,862t, which compares with likely industrial, and investment (non-ETF) demand this year of just over 37,000t.

So, we are starting to see some investor interest in gold and silver in the ETPs, but it is tentative so far.

On COMEX, the gold Managed Money positions in the week to 22nd November (when spot had dropped from $1,779 to $1,747 – intraday prices – over the week) there was light long liquidation and an increase in shorts, taking the net position down by 149t to a net short of 19t. Silver (spot moving from $21.07 to $21.05, with an early fall followed by a rally) the overall net short contracted slightly, with a small increase in gross shorts, but a larger degree of long liquidation.

The FOMC will remain in the markets’ crosshairs. The next meeting is 13-14 December, and will include the latest dot plot, which shows how the different members expect fed funds to finish this year, 2023 and 2024. The September dot plot is shown here and expected a fed funds peak of 5.0%, in 2023. We expect this to have changed noticeably over the ensuing three months.

Key charts

US fed funds rates and projections; peak target now back out to June at 4.99%.

FOMC September dot plot

Gold, the dollar and their correlation

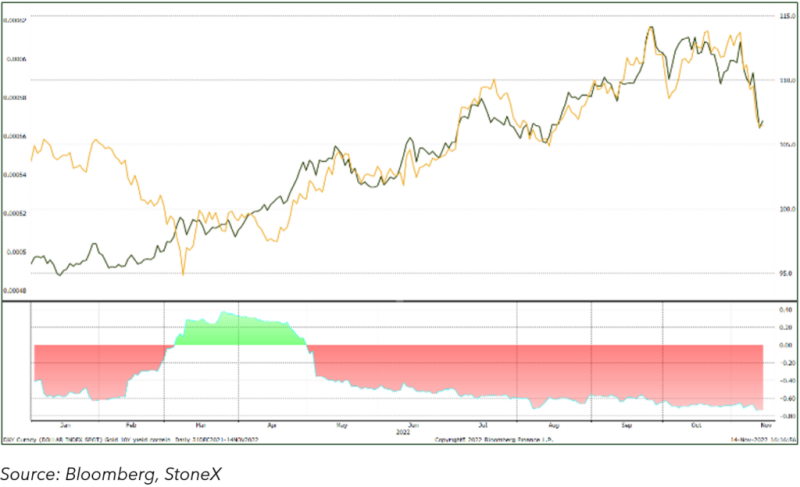

Gold (inverted) and the ten-year yield

Gold and the S&P; ratio