04

Oct 2022

04

Oct 2022

StoneX Bullion round-up Monday 3rd October 2022

By StoneX Bullion

We’ll take this most recent market assessment also as a range of charts and bullet points as I was on leave last week

- Gold caught a bid towards the end of last week as the Bank of England came out in opposition to the UK Government’s fiscal policy and announced bond purchases to take some heat out of the markets’ turmoil.

- Generally speaking the UK is a minor player where economic-political issues are concerned with respect to gold, but this time the dislocation caused a rally, which has held.

- The UK Government may have scrapped the prosed abolition of the 45% marginal tax rate, but the key fears in the markets are still liquidity and margins. So the Bank of England restored some order, not just because of the fiscal policies, but the risks to liability-driven instruments, which were designed as hedging instruments for financial institutions such as pension funds, and this risk was forcing pension funds to sell gilts to met margin calls.

- These elements all contributed to market uncertainty and for once, given the performance of recent weeks, gold responded to the upside.

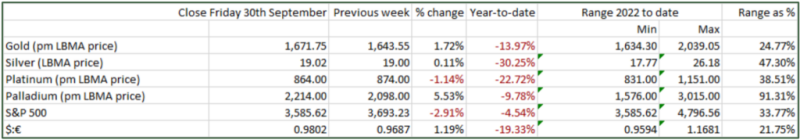

In price terms, this means the following:

- The downtrend established in the second week of August has not been disrupted, despite five consecutive gold up-days from its low of $1,614 a week ago to $1,660-1,670 now.

- The decline since then has rebounded through the first Fibonacci retracement level (23.6%) but it struggling to get much further.

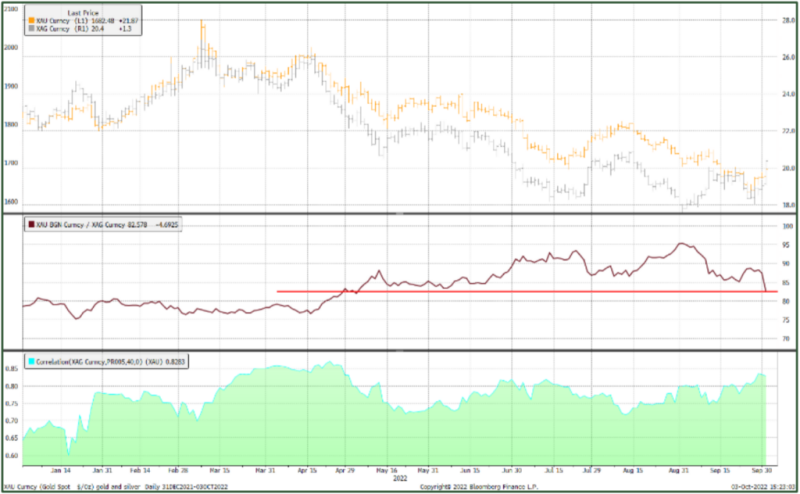

- Silver has outperformed after a late sharp move in this rally, which also suggests something of a return more normal conditions.

- The ratio has dropped to 83, the lowest since early April.

- UK demand for gold bars and coins has strengthened enormously in recent days as sterling gold prices rose by 5% in a week, before the Government’s U-turn this morning (Monday)

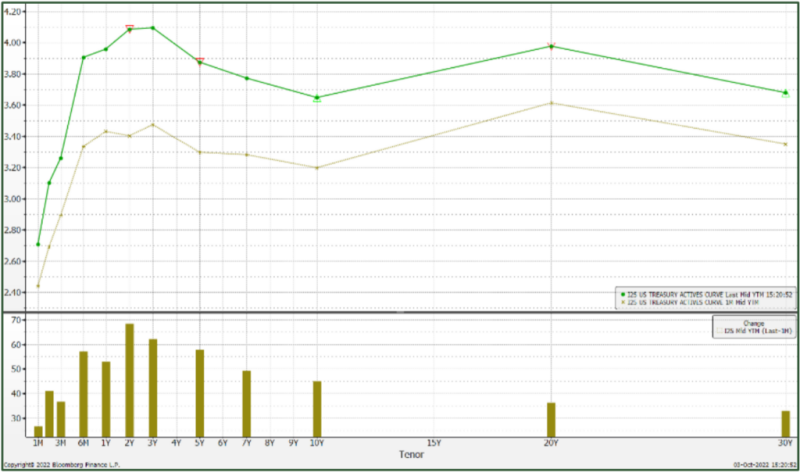

In the United States (unusual for the States to take a back-seat to the UK!) bond yields have been dropping:

- This follows a sharp rise over the previous quarter, a weaker than expected ISM Manufacturing survey (down to 50.9 from 52.0, but at least still in positive territory)

- And a weaker than expected construction number (-0.7% month-on month) weighed on sentiment. Further pressure came from the ISM new orders number, at 47.1 after 51.2 in August.

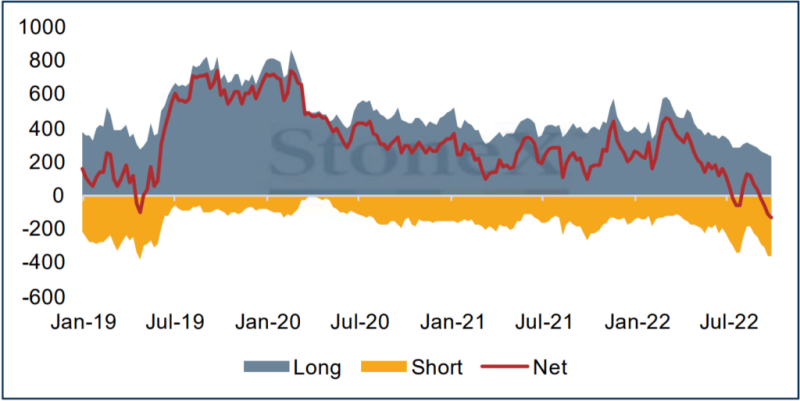

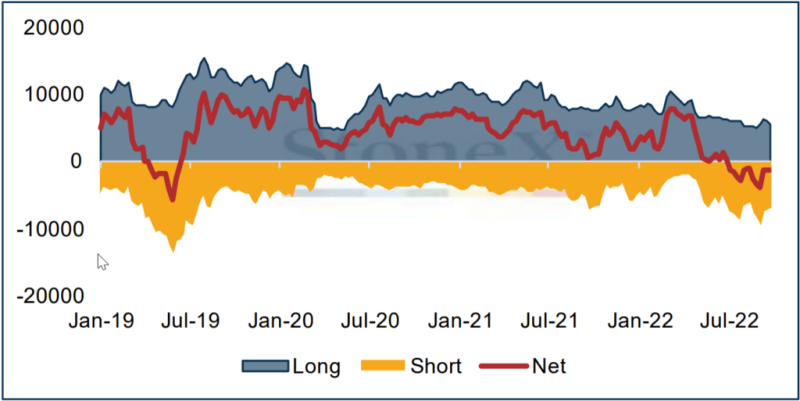

- The CFTC figures for last Tuesday 27th September, just before gold started rallying, showed it to be still friendless, with net shorts increasing again, to 134t to generate the largest net short since November 2018. No doubt that has been reversed since. Silver had seen some short covering, and closed at a net short of 1,301t (see charts)

Gold in Dollar terms, year-to-date

Source: Bloomberg

Gold in local currencies, year-to-date

Gold, the moving averages, the MACD and the RSI

Source: Bloomberg, StoneX

The US yield curve. Today and one month ago

Source: Bloomberg, StoneX

Gold, Silver; the Ratio and the Correlation

Source: Bloomberg, StoneX

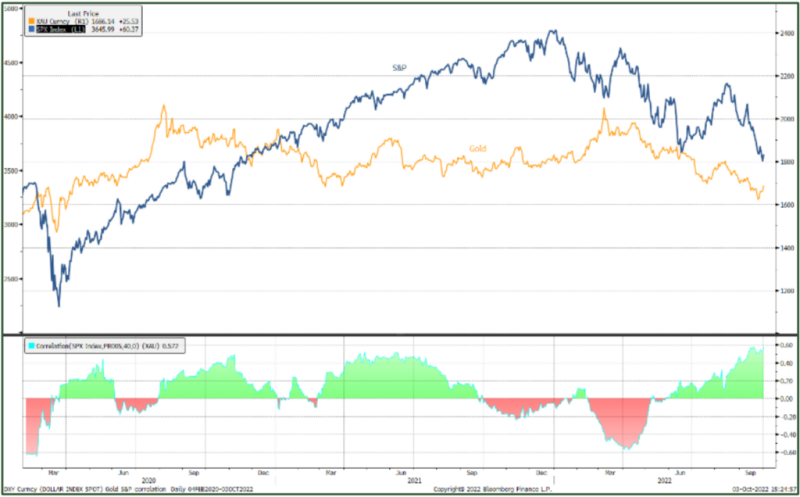

Gold and the S&P; Correlation

Source: Bloomberg, StoneX

Gold and Silver COMEX positioning, tonnes

Gold: -

Silver: -

Source for positioning charts; CFTC, StoneX

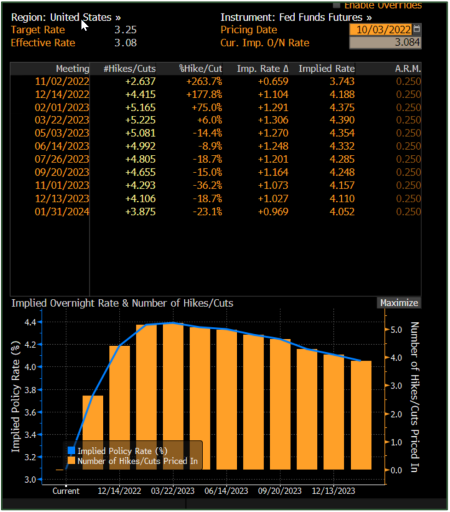

The bond market’s fed funds target projection; peak of 4.4% in March next year. Too benign? Recent figures may suggest not

Source: Bloomberg

Source: Bloomberg, StoneX

Tags