19

Sep 2022

19

Sep 2022

StoneX Bullion round-up Monday 19th September 2022

By StoneX Bullion

We’ll take this most recent market assessment with a range of charts and bullet points

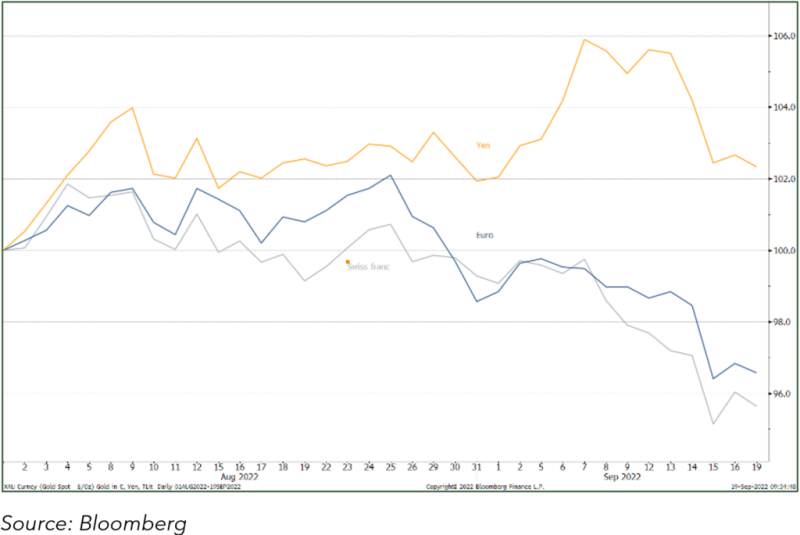

- Gold’s slump towards $1,660 has revolved largely around the dollar’s continued supremacy; all eyes on the FOMC (again)

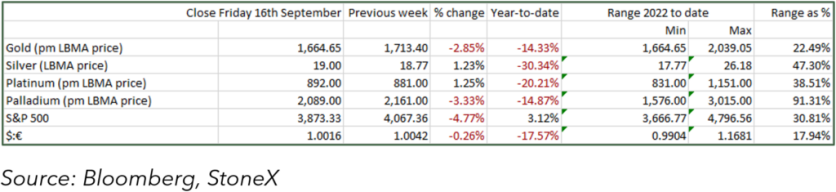

- The most recent decline started in mid-August, since when gold has dropped by 8% and silver, by 7%

- The gold:silver ratio is still declining after silver’s bounce in the first half of September. Now at 86, after touching 96 in late August

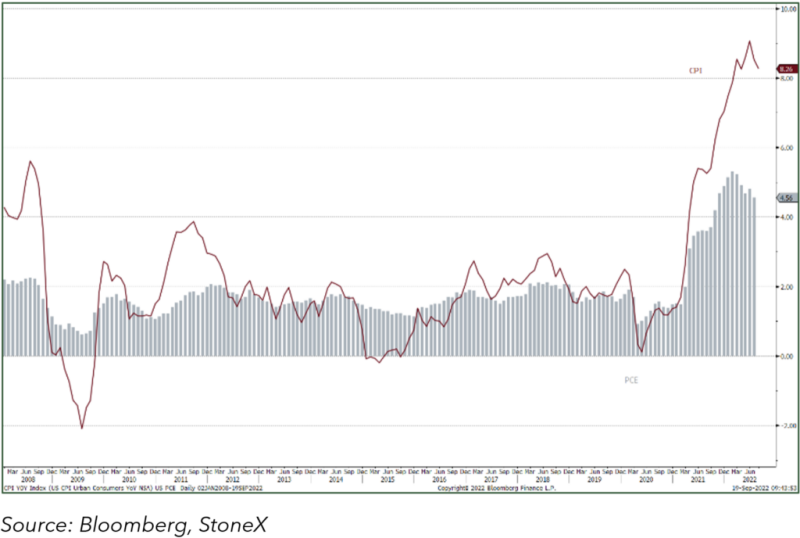

- The headline CPI in the United States for August came down to 8.2% Y/Y, driven by falling gasoline prices, (up “just” 26% Y/Y against 44% in July)

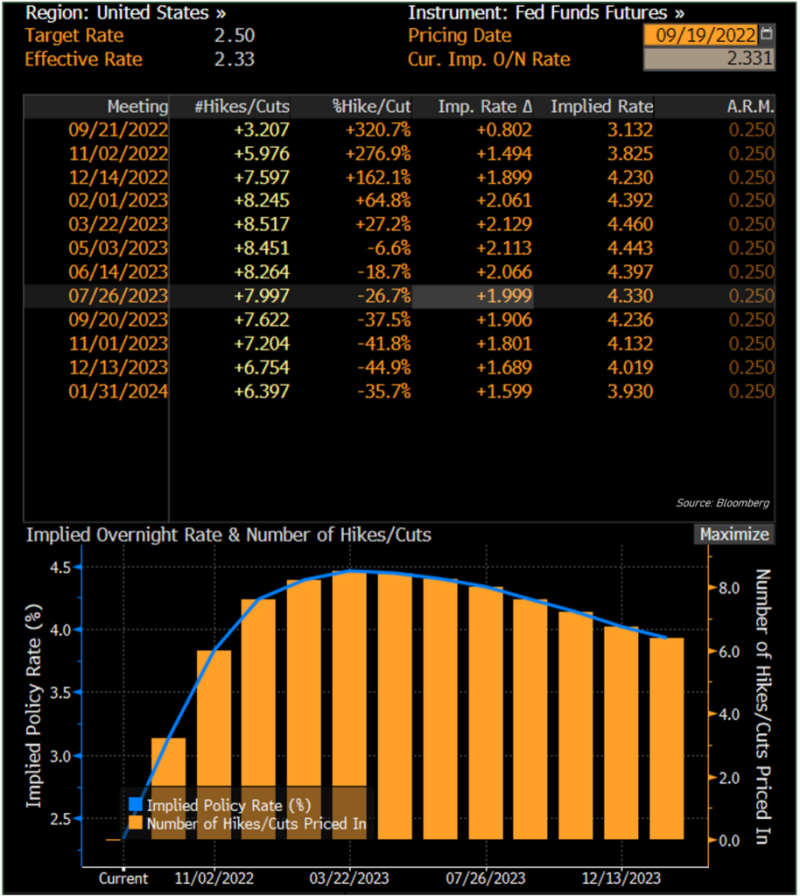

- The rise in core PCE to 0.6% has led to some talk of a 100-basis point rate hike from the FOMC this Wednesday; only a fortnight ago the debate was between 50 and 75 points

- The bond markets are now discounting a fed funds implied peak of 4.4%, next March. Too benign?

- From the close on 9th September to early on the 19th, the S&P dropped by 5% while gold shed 4%

- Since the start of the year gold has dropped by 9%, silver, 17% and the S&P by 19%

- In mainland China, with the yuan still under pressure, gold has reached an onshore premium of $40, but some of this may be tight supply rather than very strong demand

- All this uncertainty should be supportive for gold, but for now it takes a back seat to the dollar, driven by technical features. Oversold – again – with the RSI now at just 32 and finding some tentative support from the lower Bollinger Band

- If the FOMC undershoots this week there is scope for some profit tanking in the dollar and the bond markets which could help gold. But with sentiment the way it is, any rally is likely to be anaemic, at least for now

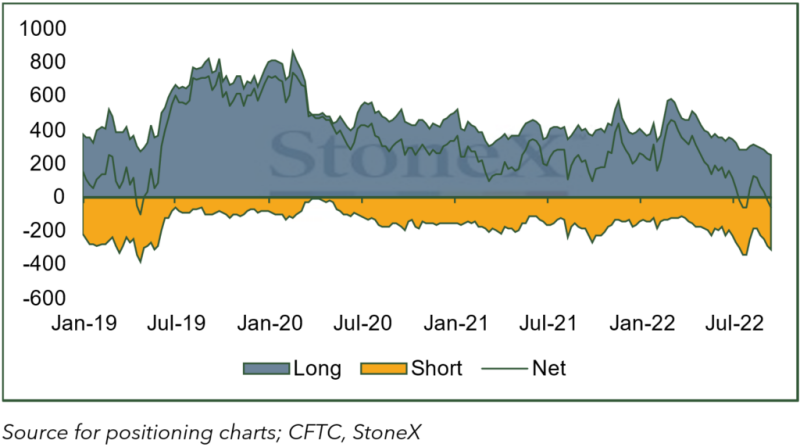

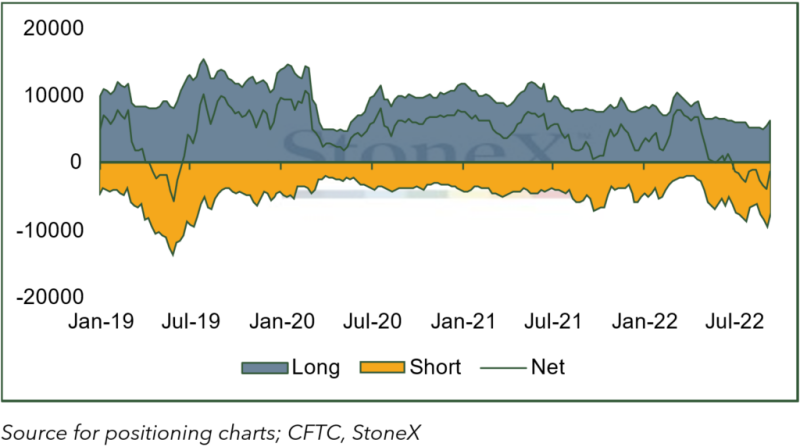

- The CFTC figures for last Tuesday 13th September, the peak of the recent rally, showed light long gold liquidation and some fresh shorts, while silver saw fresh longs and short-covering.

Gold in major local currencies, August and the first half of September

Gold, the Moving Averages, the MACD and the RS

Gold and the US dollar; Correlation

Gold, Silver; the Ratio and the Correlation

Gold and the S&P; Correlation

US Headline CPI and core PCE

Gold, Silver and the S&P, year-to-date

Gold and Silver COMEX positioning, tonnes

Gold

Silver

The bond market’s fed funds target projection; peak of 4.4% in March next year. Too benign?

Tags