Jun 2022

Jun 2022

StoneX Bullion round-up Monday 13th June 2022

By StoneX Bullion

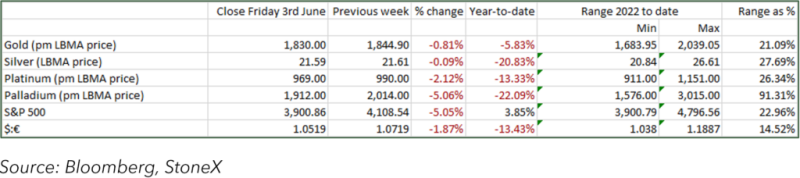

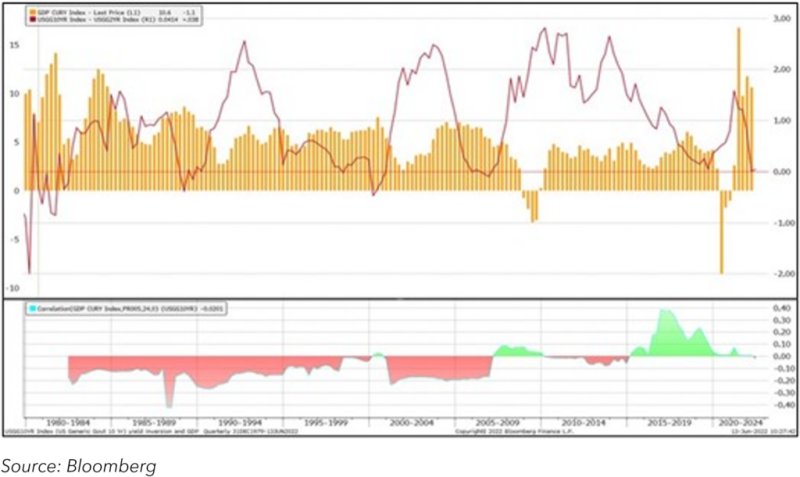

We noted last week that the U.S. yield curve was nearing inversion; well now we are at the tipping point, with the two-year and ten-year rates level. A yield curve inversion reflects risk-off sentiment with particular respect to fears of a recession. Investors tend to buy the long-term bonds with a view to locking in a reasonable rate of return; equally, as was the case last week following the unnerving inflation numbers from the United States, the short-term rates can rise sharply on expectations of increasingly aggressive rate hikes in order to choke off inflation.

This time around the number of job openings has started to slip a little in the States and hourly wage rises are still not keeping pace with inflation so real wages are still being eroded. Add to this the fact that, despite high savings levels, consumers are not looking to spend much any time soon and we are looking at a clear risk of stagflation.

U.S. yield curve nearing inversion; and its relationship with GDP

The Federal Open Market Committee, which meets this Tuesday and Wednesday 14-15th June, has a very fine line to tread in order to try and maintain a delicate balance, and arguably the European Central Bank has an even more difficult job to do as the European recovery is anaemic by comparison with the States. More than one bank has changed its view over the weekend, now expecting a 75-basis point hike this Wednesday, but we think this is unlikely, given that Fed Chair Jay Powell has been consistent in saying that the Fed will give clear signals to the markets (which should in theory help confidence and allay uncertainty) and the signals have been for a 50-point hike for a good few weeks now.

It is therefore likely that there will be another 50-point hike in July, which would take the fed funds target rate to 1.75% - 2.00%. The consensus is that the September hike might only be 25 basis points as the Fed aims to keep activity on an even keel. And by that stage the Fed balance sheet run-off (i.e., the reduction in Fed holdings of Treasuries and Mortgage-backed Securities) will be reducing and this should give some natural buoyancy to bond yields.

So, what does all this mean for gold and, by implication, silver?

Essentially gold is being pulled in two directions.

Accelerating inflation is supportive, while aggressive interest rate hikes work in the opposite direction.

A lack of confidence in central bank officials is supportive; confidence in therir ability to control the situation is not.

The fact that consumer expenditure may yet be delayed is supportive in the sense that it reflects uncertainty but is mildly bearish if it means that it helps inflationary forces to be eroded.

The equity market sell-off in the wake of the CPI numbers would, if big enough, be bearish for gold in the short term (liquidation to raise cash), but bullish in the longer term as positions are re-established.

But gold is not just about inflation; there are geopolitical issues also and of course the big geopolitical conflict at the moment lies in Ukraine and spills over into international tension (apart from the inflationary impact since Russia and Ukraine normally provide 30% of the world’s wheat supplies).

Al of which tends to explain why gold, having reached an overbought position last Friday on the approach to $1,875, is still firmly stuck in its five-week narrow trading range. Silver, as a result, is still underperforming as it is keeping an eye on economic activity and the surrounding uncertainties (remember 60% of silver fabrication demand is industrial).

Gold and the S&P/gold ratio

On the COMEX exchange, the Managed Money positions in gold betrayed a relatively bullish sentiment in the week to last Tuesday, with fresh longs and short covering developing although gold prices remained flat. Silver, on a small tun up towards $22.50, saw a small degree of long liquidation and some fresh short activity, presumably as Money Managers took the view that with gold going nowhere fast, silver was going nowhere even faster. Meanwhile gold Exchange-Traded Products have seen four consecutive days of net purchases, but only in small volume, while silver has seen net liquidation. So, the ETPs and the money Managers appear to be of similar minds.

Gold and silver; outright, correlation and ratio