Jun 2022

Jun 2022

StoneX Bullion round-up Monday 6th June 2022

By StoneX Bullion

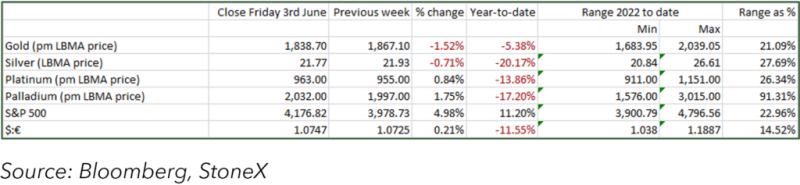

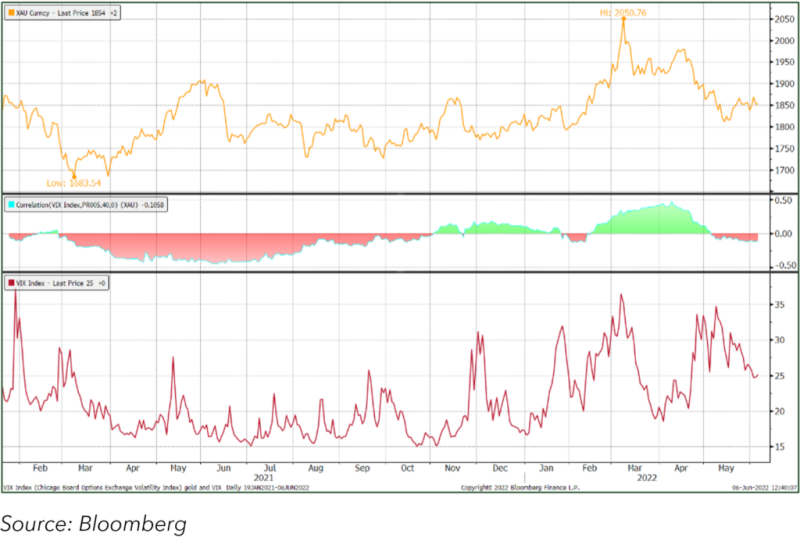

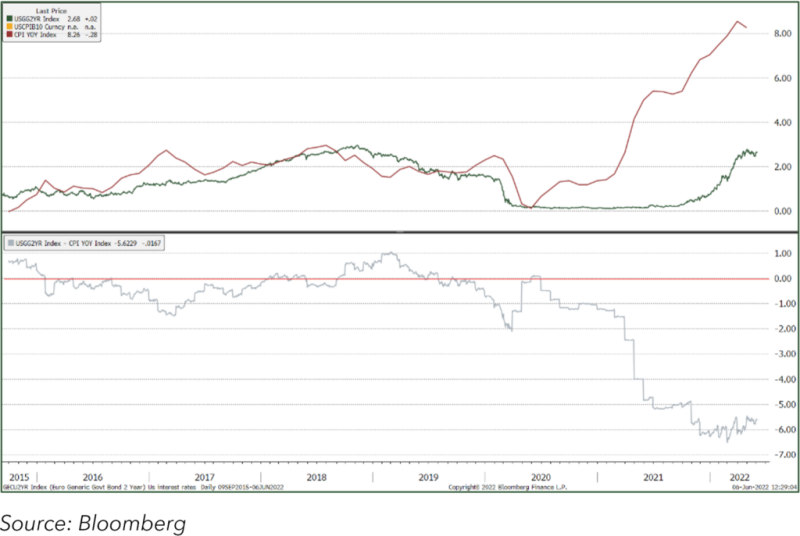

Gold remains caught between conflicting forces, with the near-daily changes in expectations for the Ukraine conflict, and with some signs of easing in the housing market in the United States. Headlines are proliferating about inflationary forces in an increasing number of countries and real interest rates are in some cases deeply negative, which is supportive for gold prices, but the market currently lacks sufficient impetus to break convincingly higher.

On the other hand, there is creeping confidence in the prospects for renewed Chinese economic activity (although it is widely seen as doubtful that this year’s GDP will even reach 4%, compared with earlier government targets of over 5%) and this, at the start of this week at least, is cascading into European equities markets. Restrictions were lifted in Shanghai last week and Beijing at the start of this week. Inhouse dining and office working is reviving, and residents are permitted to move freely provided they can show a negative test with 72 hours – this is itself a loosening from the previous 48-hour limit. There are still some clusters emerging, however, for example in Inner Mongolia and the city of Dandong in the north-east.

The easing of restrictions on movements may help to inject some life into the domestic Chinese jewellery market, which has been sluggish of late.

Gold and the VIX uncertainty Index

On the other side of the world the Federal Reserve Board has started to shrink its balance sheet (this is done by not reinvesting maturing securities issues rather than actively selling any) and this exercise is expected to last for a year at the very least. This policy will go together with rate hikes, and it remains to be seen how the dynamics between the two will play out. Tightening gives a natural buoyancy to bond yields, and it is certainly possible that this could allow the Fed to be less aggressive in its interest rate hiking than the bond markets have been discounting. For now, the Fed Committee members are talking in terms of 50 basis point hikes for at least the next two months, but the talk of 75 basis points now seems to be off the table and there is even talk of rate hikes coming down to 25 basis points by September. This month’s Federal Open Market Committee meeting is next Tuesday and Wednesday 14th and 15th June); this is one of the four meetings per year that produce Special Economic Projections along with the dot plot, in which we see the expectations of the individual Committee members for the fed funds target rate at the end of this year, next year, and thereafter.

At present U.S. two-year yields are 2.7%, while headline inflation is 8.2%, although there are still some dislocations to drop out of the year-on-year calculations. So, while the headlines about rate hikes are likely to generate knee-jerk reactions in the markets (they always do in the short term, even if the bond markets had theoretically already discounted changes), the longer-term view should revolve around persistent negative real rates.

U.S two-year interest rates vs CPI

So, the essential financial parameters remain supportive for gold, but the professional markets are still not committing in any size. The tangible parameters, in the form of the Commitment of Traders and the Exchange Traded Products, are as follows:

Gold ETPs have been mixed over the past week, but have lost very small amounts on balance, while since the start of May they have fallen by 49t for a net dollar outflow of $2.9Bn. Over the year to date the net change has been a gain of roughly 250t, of which almost 200t have gone in since the Russian invasion of Ukraine. Silver, meanwhile, has been slightly more positive but is still seeing redemptions on balance, with losses of 870t since the start of May and of 438t since the start of the year. The latter figure, however, is small when taken in context, at just 1.6% of where they stood at the start of the year; current holdings are just over 27,000t compared with annual mine production of just over 26,000t.

In the Managed Money sphere, which reflects sentiment among professional operators using COMEX, gold sentiment turned down in the week to 31st May, when gold prices were failing to make much headway over $1,865, generating some long liquidation and fresh shorts to a net position of 158t, compared with a twelve-month average of 266t. Silver saw contractions on both sides of the market, with the net position swing back into a small, long, having briefly gone negative the week before. Silver prices are putting up a better performance than gold; after under-performing between mid-April and mid-May when gold was directionless (this is normal silver behaviour under those circumstances), the ratio has contracted from 88 in mid-May to 83 now, suggesting some bargain hunting on a value basis, and potentially also discounting the control of the virus in China and the associated prospects of enhanced economic activity. Bear in mind that over 60% of silver demand is industrial, as opposed to jewellery or silverware.

While gold prices are unchanged week-on-week as we write, the downtrend reaching back to mid-April was broken in mid-May and so the current period Is essentially a period of consolidation as the market tries to make up its mind which way it wants to go. The fundamentals suggest further gains, but conditions are still quiet and may well remain so until the Statement from the FOMC next week. Silver has now cleared $22 and is looking to build a base above that level.