Apr 2022

Apr 2022

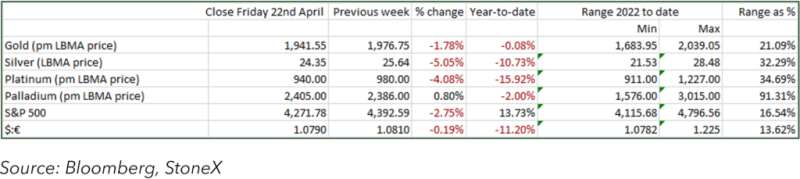

StoneX Bullion round-up Monday 25th April 2022

By StoneX Bullion

The latest sentiment in the precious metals sector has become somewhat sour, with eyes in the professional market turning once again to the Federal Open Market Committee meeting next week with expectations for a 50-basis point rate hike, along with a likely decision on the timing and size of balance-sheet run-off (i.e. reducing holdings of Treasury securities and mortgage-backed securities). Since the pandemic took hold the Fed, along with other central banks around the world, has engaged in a long series of securities purchases, helping to keep interest rates down and increasing liquidity in the markets, and thus helping to avoid an economic melt-down.

Now the markets are fretting about the level of inflation in the system and several central banks are looking to raise rates, in part as an effort to keep inflationary forces at bay. This is a difficult path to navigate; while the United States’ economic recovery is robust – more so than many might have expected – Europe is still struggling to a degree while the renewed surges in the COVID virus in China, and the lockdowns that are accompanying the zero-tolerance policy, have undermined the domestic economy and the outbreak in Beijing has dented confidence further.

All in all, despite gold’s role as a hedge against risk, its inability to clear the $2,000 resistance level has seen some profit taking and some stale bull liquidation and put prices under pressure. As we write gold is trading at just above $1,910, a fall of 4.3% from the test of $2,000 that capped a near two-week bull run driven by geopolitical concerns and the belief that a 50 basis point rise from the Fed was fully discounted in prices. Fed Chair Jay Powell was overtly hawkish at the end of last week and while he was still only talking in terms of a 50 basis point hike, the markets are now pricing in as much as three consecutive 50 point hikes from the Fed. As we have noted before, it is not the number of hikes that matters, it is the cumulative increase in rates that is more influential, but if these increases come thick and fast then gold is likely to be put under some pressure. The speed of last week’s fall carinal discounts monetary aggression

The technical picture has deteriorated and the medium-term uptrend from February has now been severed; spot prices are now very close to oversold conditions, which in principle should allow for a recovery in prices. While the dollar is independently strong with yields surging, especially in the nearer term maturities, the change in gold market sentiment has taken its toll internationally; as the chart shows, prices in euro, yen, and Swiss francs, for example, have all turned down. The Commitment of Traders figures for the week to last Tuesday 18th, when gold was peaking, tend to confirm the change in mood, with a small degree of long liquidation and some fresh shorts taking the net long position down from 364t to 315t; the average net long over the preceding twelve months was 266t.

While the professional market has stood back, Chinese gold demand is also under some pressure as a result of the various lockdowns in place – although for the longer term the pent-up demand in the market will bring about fresh interest.

in India, the other major grass-roots gold consumer, the Akshaya Tritiya Festival falls next Tuesday 3rd May. This is the second-largest festival of the Hindu Calendar (behind Diwali/Dhanteras, which follows the second harvest, and this year will be on 24th October); it relates to prosperity and is seen as auspicious for marriages and investments such as property and gold. India COVID cases, after eleven weeks of decline, have been edging higher over the past fortnight and while there is no widespread lockdown, this could undermine gold purchases running up to the festival. In the Middle East, however, there is some interest, partly price-driven, but also related to the Eid Festival, which is next Monday and Tuesday.

In the west, coin demand remains strong, especially for silver coins and particularly in the United States and premia are still high. Among gold ETF investments globally there have been only three days of redemptions so far this month, but seven days of redemptions in the silver instruments. This additional caution in the silver market is also reflected in its recent underperformance against gold, with the ratio knocking up against 80 once more,

Gold – slipping in all major currencies

Gold, Silver and the Ratio