Jan 2022

Jan 2022

At last!

By StoneX Bullion

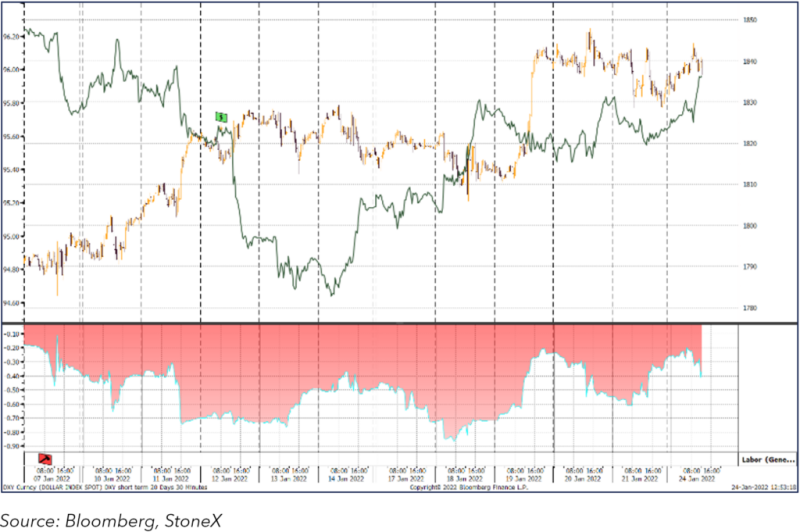

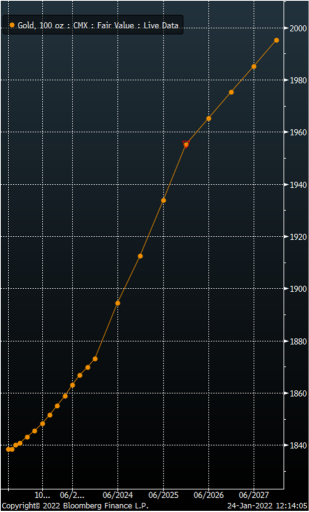

It was starting to feel like Groundhog Day – the same range, time after time… then last week gold finally broke out to the upside. Not by much, but the range has changed and we are now in a period of consolidation. With the exception of just under a fortnight in November last year when gold sped up to test $1,875 and then sped back down again (this was the “sell the rumour”), and of one brief spike down to below $1,700 in September (heavy Asia sell-off triggered by a very strong U.S. employment number, triggering more intense fears about the outlook for U.S. interest rates) gold traded in a range between $1,715 and $1,825, equivalent to just 6%. But on closer investigation the trend has been steadily higher since mid-December. The break higher, in the middle of last week, came about in response to an elevated inflation number from the States that put some pressure on the dollar. Technical features then combined to spur gold higher, with momentum boosted as spot pushed upwards through the 10-day moving average, and the 20-day crossed the 200-day to the upside.

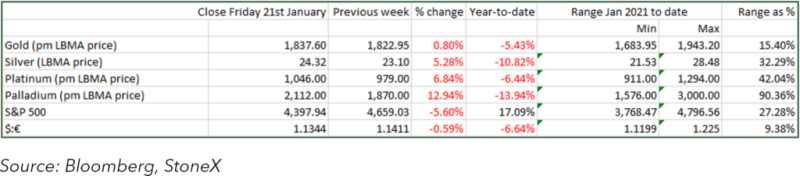

The catalyst for this “buy the fact” episode, when gold rallied reasonably hard, was when the Fed took uncertainty out of the market by confirming the intention to start tapering. Gold did move into overbought territory but has subsequently relaxed and the heat has been taken out of the market. Spot volumes have not been especially high and there has been more interesting activity in the forwards, as gold’s forward curve has steepened in line with U.S. rates and the current curve suggests that fair value one year out is 100-110 basis points, which implies three fed funds rate hikes this year.

Gold forward curve

Source: Bloomberg

In the physical market there is little interest in gold in India at present, with Dubai prices dipping into a discount to loco London, which suggests that some material may find its way out of Dubai and into the Swiss refiners. There is some patchy buying interest in parts of south-east Asia. Looking ahead the 1st February is the start of the Chinese New Year, which is typically a lively time for the domestic gold market, but appetites may be cooler this year with many people concerned about any travel under the policy of zero tolerance.

On the other side of the market, though, the story is different in silver. The silver forward curve has remained flatter than that of gold, which ties in with the fact that a number of Mints are on allocation (i.e., they can only take up a certain amount of what they want due to tightness in the market). This is particularly interesting since January is the month in which the U.S. Mint sends large quantities to the distributors. The figures for January to date show gold and silver sales, taking a simple linear extrapolation from the three weeks to date, both running at roughly 5% below the January 2021 levels.

Silver shipping is still being exacerbated by sustained dislocations in the supply chain and all of this points to silver remaining volatile. So far in January we have seen the gold:silver ratio contract sharply. In 2021 silver’s underperformance, in the face of virus-related economic uncertainties, widen from 64.1 at the start of February to a peak of 80.8 in early December. This month, after a correction, it topped out at 80.7 (6th January) and closed down to 75.2 on 20th. There has been a mild widening since, with spot trading at just over $24 as we write. But it does look as if any attempt to clear 80 will fail. Further strength in gold is likely to see silver rally again.

The Federal Open Market Committee meets this week on 25th and 26th January. This is not a meeting that generates specific economic projections or a dot plot of fed funds rate expectations; those are the meetings in the third month of each quarter. But as always, the markets will be watching closely for any nuances in tone either from the Statement or from Jay Powell in his Press Conference and Question-and-Answer session. It is quite a big week for U.S. numbers, with consumer confidence due on Tuesday, and Q4 GDP and durable goods orders due on Thursday and the markets in general are nervous.

Gold and the inverse of the dollar