Jan 2022

Jan 2022

A cautious start to the New Year 2022

By StoneX Bullion

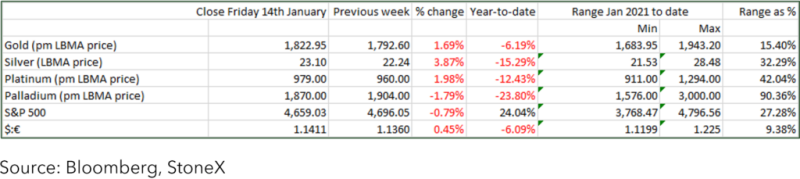

Price performance since the start of this year has seen gold eke out small gains, while silver has come under some light pressure, although neither of them have moved by much. Gold’s interesting move last week came on the back of the Consumer Price Index release from the United States. The number was more or less as expected, but even so gold popped upwards out of the $1.775-$1,820 range that it had been trading in the final weeks of 2021. It did not make any further gains however and is now consolidating in narrow ranges just above $1,802.

Last week was the first time since the late 1980s (that this writer can remember, at least) that the press coverage on the gold market has been so completely focused on a U.S. CPI number, which demonstrates how much emphasis is being placed on whether inflation Is transitory or permanent, and what the world’s various governments and Treasuries are going to do about it. In the event the headline number was 7.0% year-on year, and the components do suggest that this is still transitory, although as the base effects and supply chain dislocations fall away the underlying level will be higher than pre-pandemic. Food, for example, came in at just 6.3%, while was a very aggressive 29.3%. Energy commodities, for example, were up 48.9%. Fuel oil was up 41% and “all types” of gasoline were up 50%. All items excluding food and energy were up 5.5%.

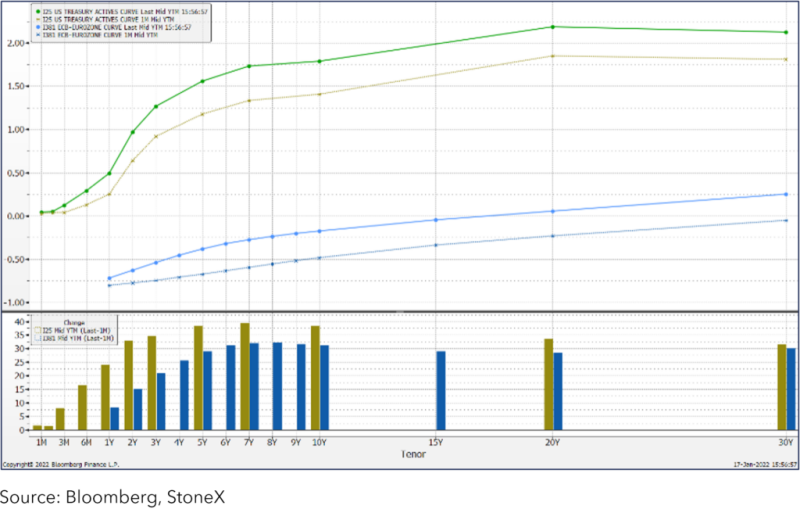

We have noted before that a modicum of inflation is useful for an economy as it encourages spending. The broad consensus is that by this time next year inflation in the States should be back below 3%. Even on this basis, real yields in the bond market are likely to remain in negative territory and as is well documented, European nominal rates are negative and likely to stay that way. This chart shows the U.S. and EU yield curves as of 17th January and a month previously; we can see that even the U.S. 30-year bond yield is below 2.5%. while the EU nominal rates are negative as far out as 15 years, even if the whole profile has risen by roughly 25 basis points over the past month.

So as far as rates of return are concerned, gold is not under much that from the bond yields in either the States of Europe. It is interesting to note that the US curve is flattening, which normally implies a degree of uncertainty over economic activity and/or monetary policy; the EU curve is not, which suggests that the markets are still expecting some tightening to come from the ECB as we look towards a potential recovery in Europe’s economic activity. This may well reflect the fact aht the EU is still lagging the United States with German GPD, for example, believed to have contracted in Q4 2021.

The U.S. and European nominal interest rates

Within the gold and silver markets themselves, the Commitment of Traders figures released last Friday and reflecting activity up to the close of business last Tuesday suggest that after some end of year book-squaring, most professional market operators have taken a cautious view, with gold and silver longs contracting and shorts expanding, but not by much. At 231 tonnes, the net outstanding gold long weas actually down by 16t from a week previously. Gold had risen to $1,823 having been at $1,782 on its lows the previous Friday, and was $25 higher than a week previously, suggesting good Over the Counter interest. The picture is similar for silver; net longs down, but prices rising towards their peak on the following day of just over $23.

Meanwhile in the background there is good physical demand in the markets, especially in the silver market in India, while Chinese demand is solid ahead of the New Year (which starts on 1st February), although it may not be dramatic as people are nervous of travelling for the holiday so the gift giving may be relatively muted this year.

For the time being the environment is friendly towards gold, although not aggressively so; the primary headwind would be the potential for renewed dollar strength on an interest rate differential argument. As we move further through the year this may reverse as the ECB starts to tighten and political uncertainty is likely to develop around the mid-term elections in the United States. If, as current opinion has it, both Houses of Congress become Republican majorities then President Biden’s policies may be even more difficult to implement than they have been thus far, which could put some pressure on the dollar. By that stage, though, it is to be hoped that the global economic environment has improved, which may prove to be a headwind for gold, cushioned by a mild dollar.

Gold, Silver and the Ratio