Nov 2021

Nov 2021

Yet again the Fed is in focus

By StoneX Bullion

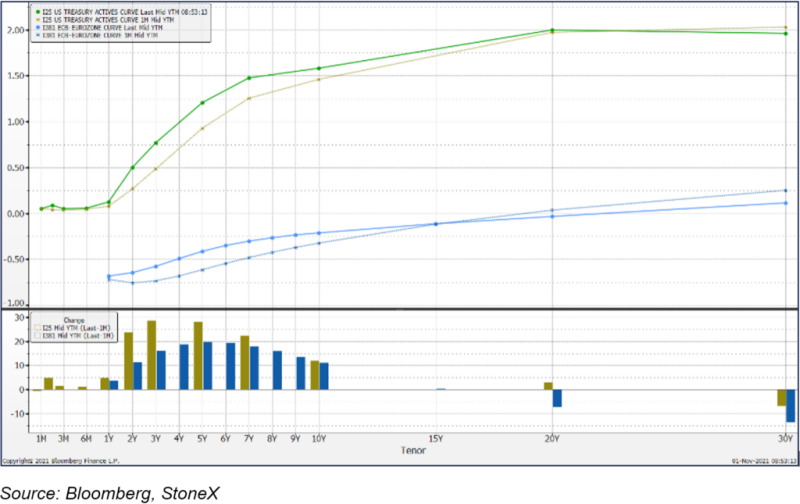

this time gold falls before the meeting, rather than afterwards (although that can’t be discounted either).

For some months now the markets have been Fed-watching even more closely than usual, as economies have been recovering from the impact of the pandemic, supply chain dislocations have exacerbated inflationary pressures that are generated in an economic recovery and, with not much room for manoeuvre due to low prevailing interest rates, they are having to walk a tightrope. In the past months there have been growing hawkish sounds from some members of the Federal Open Market Committee (FOMC) who do not subscribe to the belief that inflationary forces are transitory. While the jury is still out about this, with strong arguments that it is transitory (base effects falling away, and the hope that supply dislocations will work their way through over the next few months), there is increasing credibility in the concept of persistent inflation, which revolves around public expectations of rising inflation in the future.

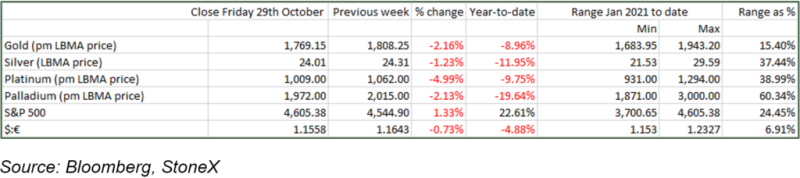

Meanwhile the yield curves have been flattening while their overall profiles have been rising recently (see chart below), which suggests that the participants in the bond markets are trading in fear of stagflation (in which economic activity is under pressure even as prices rise).

As a result this week’s meeting of the FOMC, concluding on Wednesday 3rd, will be under even closer scrutiny than normal even though Fed Chair Jay Powell has already flagged up the likelihood of a firm announcement about tapering dates and has also said that he expects the tapering programme to be complete by mid-2022. Despite the fact that the tapering programme has been in view for weeks if not months, there is always a knee-jerk reaction in financial markets in the wake of the meeting. This time gold is pre-empting it, with prices failing to hold over $1,800 for the third time since mid-September as they slid towards $1,770 in New York hours on Friday.

The economic numbers released for the United States on Monday were arguably in line with stagflationary thinking, with the Employment Cost index exceeding expectations and personal income falling by 1.0% month-on-month, which was below expectations. The University of Michigan sentiment index, a key element watched by the Fed, was better than the markets had been expecting, at 71.7.

This was actually less influential on gold than the action in the currency markets, which saw a pre FOMC rise in the dollar, extended by strengthening technical indicators for the currency and this put gold under pressure. As we write, however, the dollar is not overbought, while gold is neutral so it may well tread water ahead of the outcome of the FOMC meeting. For the longer term, the fundamental financial background remains supportive.

Yield curves: rising overall but the profile is flattening

Gold; triangle formation complete; breakout ensued – and then failed; negative correlation with dollar contracting