Mar 2021

Mar 2021

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

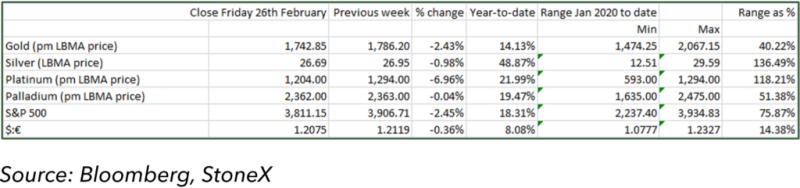

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Unnecessary panic?

Last week’s sell-off in the bond markets, which lifted yields and impinged on gold, was arguably overdone. There is an increasing amount of noise in the press and among some other observers to the effect that inflation is back on the horizon, and this has been putting bonds under pressure and the associated rise in yields has affected gold, with spot prices dropping from $1,866 at the start of February to test lows of $1,720 at the end of last week, a fall of 8%. Subsequently, at the start of this week, we have seen a small bounce towards $1,740.

To our minds this talk of inflation is borderline scaremongering. Most governments will argue that a small degree of inflation is healthy for an economy and indeed the Fed and the ECB are targeting 2% inflation – and with the Fed looking at “average rates”, we should not expect a rise in interest rates until inflation is comfortably and stably at 2% or above. Fed officials are talking of no interest rate increases until 2023 at the earliest. An inflation rate that is too low risks an economy slipping into deflation, which is associated with weak economic conditions. A small degree of inflation lessens the chances of harmful deflation if an economy is weakening.

Certainly the 30% gain in oil prices over the past twelve months has attracted attention, but all that has happened is that Brent has regained the price levels of last January 2020. Higher oil prices can generate a rise in cost-push inflation, but can also impede economic growth, especially if consumer spending is low, which it still is. And as we move further towards the green / hydrogen economy, oil demand may well start to show some price-elasticity.

On the other side of the market, the inflationary argument revolving around pent-up consumer demand has merit, but as Fed Reserve Chair Jay Powell has pointed out on several occasions over the past few months, the unemployment rate in the United States [the same applies elsewhere], and the fall in the participation rate (the percentage of the workforce that is actively looking for employment) means that underlying demand-driven inflationary pressures are relatively constrained at present. At least one academic study (ECB working paper, February 2019) argues that “when coming from a prolonged period of low inflation, [the passthrough of labour-cost developments] could be moderate until inflation stably reaches a sustain path”.

The fall in gold prices over the past month or so can be more likely attributed to a glimmer of confidence returning to the markets as a result of the roll-out of vaccines and which has arguably meant that gold has also been looking at interest rates for short-term direction.. The erosion in gold ETFs is also attracting attention (a 71t fall since the start of the year, to 3,803t). The United Kingdom, United States and India appear to be in the vanguard with respect to vaccination programmes, but the roll-out in parts of the European Union has been sluggish, which is likely to maintain pressure on the EU economic confidence for the foreseeable future.

Given these conflicting forces gold has responded more to the combination of rising confidence and rising yields than to any fear of untoward inflationary pressures. It is still arguable that the massive amount of liquidity in the financial system, with trillions of dollars of capital looking for a home, mean that gold still has medium-term tail winds. For now, though, it may be a question of wait and see.

Brent crude and gold; indpenedent profiles and the correlation between the two.