Feb 2021

Feb 2021

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

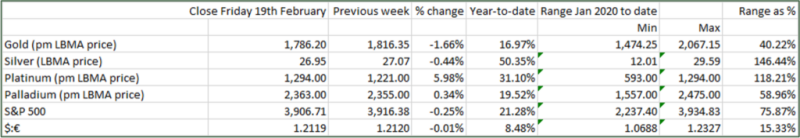

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Swiss Gold Trade

The Swiss trade figures are usually a good barometer for the state of the precious metal markets, given the importance of Swiss refineries that make loco Zurich a de facto terminal market.

Gold trade with China and Hong Kong swung to net imports in March last year as lockdown took over and since then these imports have reached a total of just 127t (against 214t in 2019 and 595t in 2018), reflecting the fall in jewellery and bar&coin demand in particular, which obviously suffered badly last year. The World Gold Council “Gold Demand Trends” publication pegs China’s jewellery demand at 415.6t last year, down from 638.0t in 2019 and an average of 676.6t over 2011-2019. Bar & coin demand dropped only marginally, to 199.1t from 211.1t in 2019 and from an average 2011-2019 of 264.3t.

So the combined contraction last year was 234.4t against 2019. Swiss trade, meanwhile, swung from a net export of 213.8t in 2019 to net imports of 127.7t, a reversal of 341.5t.

This could in principle be a positive sign for the market when recovery finally sets in, as it implies a net drawdown in domestic inventories (subject of course to any scrap return). While the WGC records a recovery of 155.3t in the two categories combined for H2 against H1, the Swiss trade figures for January still posted a net import from the region, albeit that the trend is declining and only 6.6t (net) came in, which suggests that either the domestic jewellers were not expecting much recovery in purchases ahead of the Lunar New Year, which this year fell in mid-February, as opposed to January in 2020, or that they were well-furnished with inventory. The February figures will therefore be interesting.

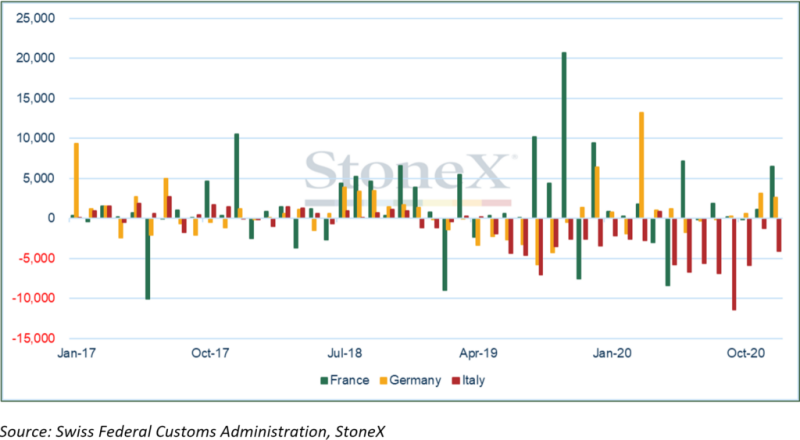

Taking France, Germany and Italy show some interesting patterns .For much of 2018 and 2019 the trends were mixed, with occasional monthly sales into Switzerland, notably from France with a little from Germany, but in both years all three countries were net importers, with France taking in a net 19.9t in 2018 and Germany, 16.2t. Then the situation started to change, with Italy posting net exports in ten months of 2019 for a net return to Switzerland of 30.9t. Germany was also a net exporter of 15.6t, reflecting a small contraction in coin demand in 2019 and probably some slowing in the electronics sector, but the French appetite remained strong with net imports of 33.4t (these numbers from the World Gold Council’s “Gold Demand Trends”. During this time Italy’s recoded jewellery demand was broadly flat so this suggests that inventories were being reduced.

Then in 2020, as the pandemic took hold, Germany’s demand for bars and coins almost doubled, while jewellery demand contracted marginally in all three countries. French imports fell while Germany experienced a 37.2t swing to net imports of 21.5t. In March 2020 alone, Germany imported a net 13.3t from Switzerland Italy remained a distress seller over the year, with recorded net exports to Switzerland of 55.6t.

In January of this year trade has been more muted. France and Germany both imported, while Italy remained a net exporter.

France, Germany, Italy; net gold rtade with Switzerland, January 2017-January 2021 (kg)

Meanwhile in India the jewellery market has been picking up since early January and local prices are posting a premium to loco London of roughly $5 and this has tightened conditions in Dubai (augmented by improved demand in the Middle East as a whole). Switzerland is a consistent net exporter of gold to India although as the chart shows this declined dramatically in the middle of last year as the pandemic took a strong hold, and even turned into a minuscule net import of 280kg in June last year. The net exports trend is on the rise again, with 34.6t going during December and 38.7t recorded for January; this compares with a monthly average in 2019 of 32.0t so these early numbers suggest that the market is back on trend.