Feb 2021

Feb 2021

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

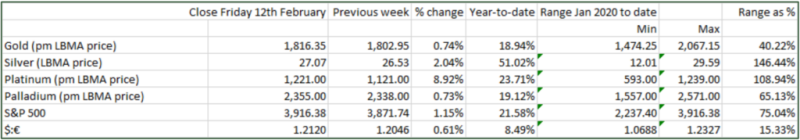

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

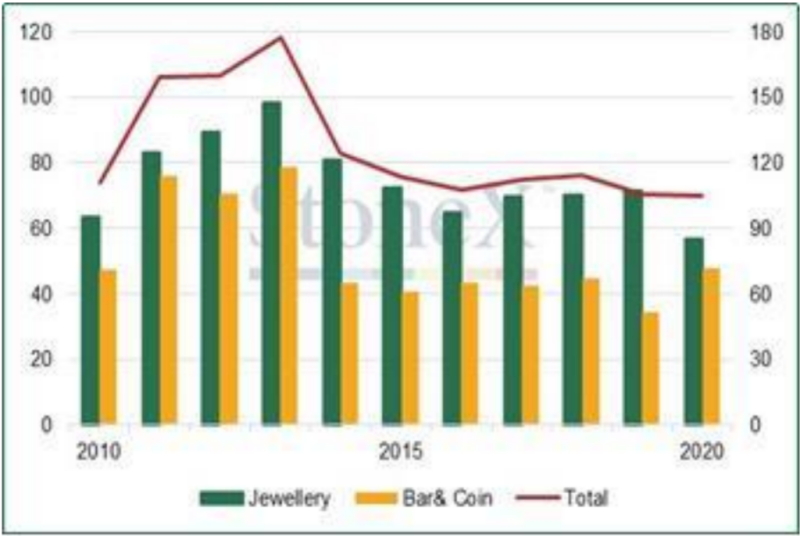

We have written before about the role of gold as an investment not just within professional circles, but at the retail level. Breaking down the most recent World Gold Council numbers, from “Gold Demand Trends” for the full year 2020, throws up some interesting results.

“Investment-grade jewellery” is largely sold in the Middle East and Asia, where the gold purity is high (21-carat typically in Saudi up to 99.99% purity (“four nines”) in the Far East); these pieces are sold by weight, and priced based on the prevailing gold price (usually the LBMA afternoon price of the previous day) plus small refining charges. The contained gold value therefore is not impaired by the range of logistical and tax charges that apply in the western hemisphere, or the dilution that comes from lower caratage.

For example, broadly speaking, from 2016-2018 the tonnage of investment-grade jewellery plus world bar&coin purchase fluctuated either side of 2,700t before the slowdown in 2019 as the gold price changed range from levels based on $1,300 to levels from $1,500 upwards. This was then compounded by the development of the pandemic, which hit retail demand very heavily in Asia especially, due to consumer nervousness and, of course, lockdown.

But—while the tonnage dropped substantially in the Middle East and Asia (see the table) in 2020, bar & coin purchases in the west gained over 85% over 2019, mitigating the tonnage effects to some extent and keeping the overall approximate expenditure broadly level. These numbers here are annual, but breaking them down in to quarters shows that the rough annual dollar expenditure in these sectors in 2019 came to $105.3Bn; in 2020, $105.4Bn. Given the degree of lockdown across the world last year, that is actually a positive result, and reflects the risk-hedging in the western hemisphere in particular, in the middle and latter parts of the year. There was, understandably, a hefty drop in Q2 2020, from $22.7Bn to $17.9Bn, before a recovery to $27.8Bn in Q3 and then soaring to $37.0Bn in Q4, driven especially by bar and coin purchases in Europe and North America, at the same time as ETPs were declining.

Yet again we have the dichotomy between the professional and the retail sector; in a microcosm of what we saw in 2013 when the professional sector was rotating towards risk and the retail sector (in China) absorbed all the gold that came out of the ETPs; the pattern in November in particular saw professional selling on the back of the U.S. election result and vaccine announcements. This time the retail purchases came from the west, so there is a slight difference here; partly a return of confidence, but partly also some sustained nervousness at grass roots level.

So far this year we have seen small redemptions from the ETPs, especially since mid-January, while coin sales have again been very strong, so this pattern is, for now at least, being maintained.

Retail gold product sales

Investment-grade jewellery, bar & coin