Jan 2021

Jan 2021

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

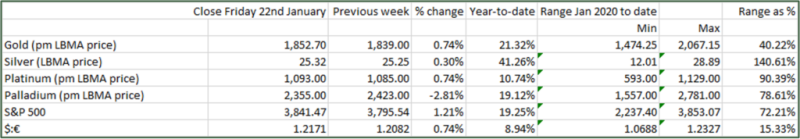

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

We wish all our readers and clients a safe and happy 2021.

We noted last week that the political and economic environments were putting gold under short-term pressures, but that the underlying financial environment was positive. Very little has changed in the interim overall, but the eyes of the world were on Washington last Wednesday. President Biden’s inaugural speech has been well received, with its tone of inclusiveness and the repeated use of the word “respect”. From a financial standpoint, Treasury Secretary Janet Yellen underscored the message that has been coming from the Federal Reserve Chair Jay Powell for some months, which is for an extended period of ultra-low interest rates, while there is an increasing view among economists that the U.S.‘ economic recovery should take hold in the second half of this year.

This may yet turn out to be optimistic as it is still impossible to postulate as to the likely control of the pandemic and in the latter part of last week the U.S. employment numbers, with new jobless claims coming at 0.9M, against an average for Q4 of just over 0.7M, were not encouraging.

What is brighter is the economic data coming out of the Far East, with China’s economy consistently forecast to top 6% this year (and China has now overtaken the United States as the largest recipient of foreign direct investment). While there are concerns about the outlook for consumer spending given the potential for fresh lockdowns, a huge gap between the incomes of the richest and the poorest and continued consumer reluctance towards discretionary spending, the uptick in gold demand, which we noted last week, has continued and now appears to be spreading into other areas of the Far East. The Lunar New Year falls on 12th February and will certainly be fuelling some of this interest, so the key will be whether the appetite persists into the second half of February and thereafter. After a severe contraction in gold demand in China (and elsewhere) last year, with Chinese imports down by more than 700t in the first eleven months of the year, there is doubtless pent-up demand waiting to be unleashed.

Meanwhile coin sales are strong, with several Mints running out and more than one on allocation. The latest figures from the United States Mint, for example, show that so far this month, Gold Eagle tonnage sold has been 2.6 times higher than in January 2020 and silver sales are up by 24%. In dollar terms, the gains are more impressive at a factor of three for gold coins and a gain of 75% for silver. Bear in mind that January is largely sales to distributors, but those distributors have the experience to judge investor appetite.

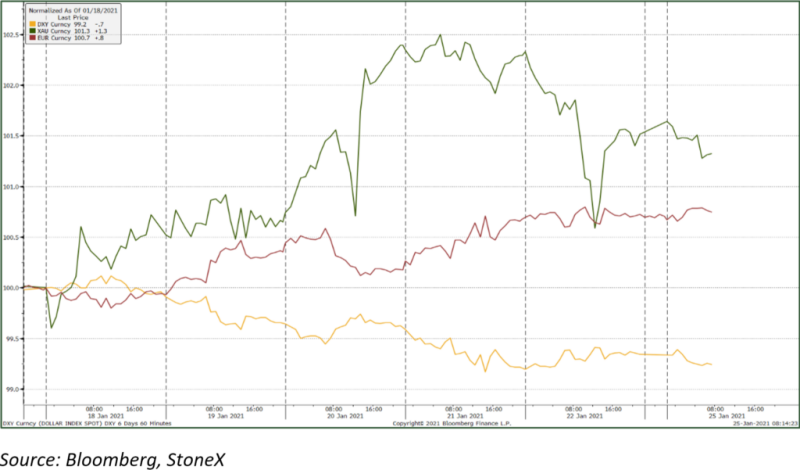

Gold, the dollar index and the euro; one-week view

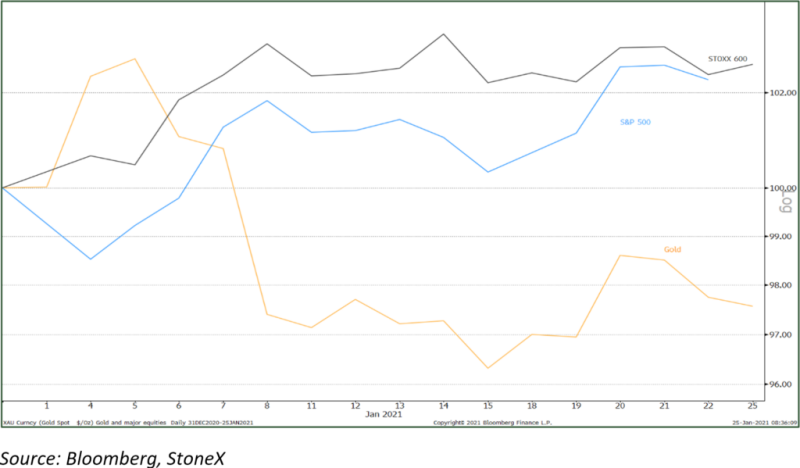

Gold, the S&P 500 and the European STOXX 600