Jan 2021

Jan 2021

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

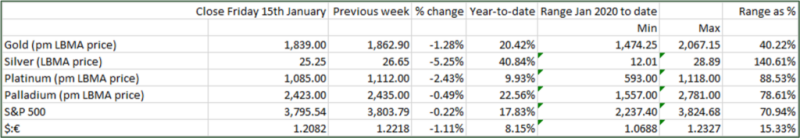

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

We wish all our readers and clients a safe and happy 2021.

Gold posted another decline in price last week, albeit substantially smaller than in the previous week. The change in the United States Presidential Administration and the new complexion of Congress have continued to command the markets’ attention and, as usual, the dollar has been the main barometer of sentiment.

Congress is now de facto Democrat controlled, as the 50:50 split in the Senate between Republicans and Democrats means that Vice-President elect Kamala Harris will have the casting vote in the Senate, should it be needed. This gives us a “blue ripple” (not quite as strong as the “blue wave”), in that it should be easier for the Democrats to push through their legislative programme. We have already had a foretaste of what is to come, with Mr. Biden announcing plans for a $1.9Tn support package to be released this month. This will need Congressional approval and there are elements in the package to which the Republicans are likely to object (including the proposed doubling of the federal minimum wage to $15/hour, expanded and extended unemployment benefits, and low interest loans to small businesses), but it is expected to go through. A second package is expected for February.

This, along with the continued roll-out of the COVID vaccine, are both positives for the use economy, in theory, but the virus continues to rage and the economic recovery in the States will take a good while yet.

So we have a new Administration looking to take strong steps towards boosting the economy; and also the Treasury Secretary in-waiting Janet Yellen said last week that she does not want to engineer a weaker dollar and much prefers the currency to be valued by market movements.

In principle, therefore, all these factors work against gold (although the risks in the dollar remain skewed to the downside for now), especially when we take account of Jerome Powell’s comments last week that while we should expect a jump in private consumer spending when confidence starts to return, the underlying economic conditions are not inflationary and he does not expect a rise in consumer spending to have a marked effect on inflation. The Federal Reserve is not raising interest rates “any time soon”. U.S. real interest rates (i.e. inflation-adjusted) are negative, as are real interest rates around the world, and likely to stay that way for the foreseeable future, along with easy monetary policy.

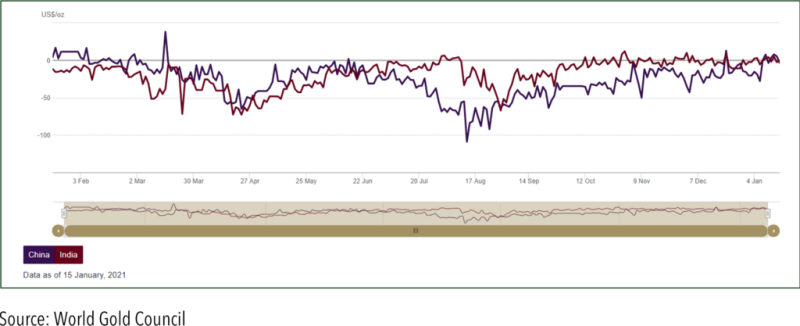

This all means that gold is facing short-term pressures, but that the underlying financial environment is positive. The slippage towards $1,800 has over the past week has attracted some physical bargain hunting, especially as we are approaching the Chinese New Year (12th February) and have entered an auspicious period in India; after many months of total disinterest, there is now some buying activity building up in both centres. This week’s first chart comes from the World God Council website and illustrates the gradual recovery in these markets; local prices are now flat or at a very slight premium to the international markets, after months of deep discounts.

Shanghai and India; price differential against loco London

Spot gold in dollar and euro terms (note how the euro price has been flat over the past week)