Jan 2021

Jan 2021

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

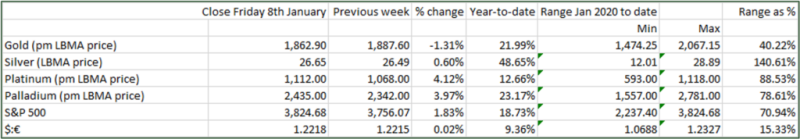

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

We wish all our readers and clients a safe and happy 2021.

It has been a roller-coaster time for gold so far this year, with the price closing last year at $1,890, then bounding up to $1,958 (on an intraday basis) last Wednesday as the dollar weakened and the market started looking through COVID to the prospect of substantial stimulus from the Biden Administration. This rapid move was thrown sharply into reverse in the second half of the week and especially on Friday, however, with rising U.S. yields and a stronger dollar taking the wind out of gold’s sails.

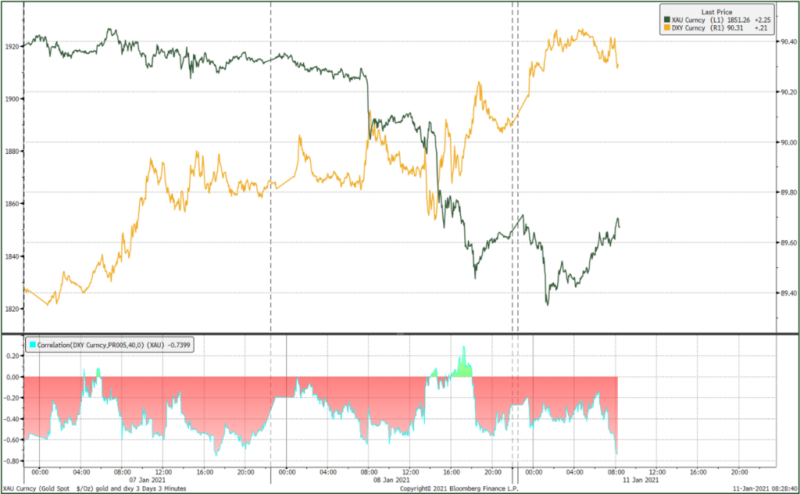

The dollar spiked on Friday morning and prompted a $33 drop in gold in as many minutes, from $1,912 to $1,879 as the London market got into full swing. The next sharp drop came early in the New York session, the third was after hours in New York and the fourth developed as the Asian markets opened at the start of this week. The speed of the falls certainly suggests that stop loss orders (automatic trade orders) will have been hit and momentum trades will also have been executed. Stop-loss orders are exactly what the name implies; they are orders resting for a trade (in this case, a sale) when a price moves through a specific level , which closes out a position that has become loss-making and thus prevents further losses. Momentum trading, again, is perfectly reflected in its title and is a trade that will be executed when a price movement has developed a certain rate of change. It could be either a trade opening a position or closing one.

The falls have put a negative technical construction on gold’s chart, with the spot price hovering around the important 200-day moving average. On the other hand, it is heavily oversold now, having been heavily overbought a week ago and this will help to give the price some support as we can expect some bargain hunting. The Exchange Traded instruments have been rebuilding positions so far, this year, after profit taking and book-squaring towards the end of the year.

This move will have shaken out some weak-handed holders. While sentiment in the short term is arguing that the rise in U.S. yields, in the expectation of further stimulus, is working against gold, the prognosis for the medium term remains positive, with economic and financial elements supportive. Quite apart from the political turmoil in the United States, President-elect Biden has promised massive fresh stimulus and is expected to go into detail this coming Thursday 14th. With the world’s major central banks having injected over $7Tn in liquidity last year, and with more to come, there is a lot of liquidity looking for a home and the background fundamentals continue to point to gold as a safe haven asset, for the next few months, at least. If as and when the virus is brought under control and confidence returns, both in terms of business investment and consumer spending, then the markets will move more tangibly into risk-on assets and value stocks; gold would be likely to go into retreat when that starts to happen with conviction.

In the background we have the commodities rebalancing process among some of the major commodity indices. The rebalance of the BCOM and GSCI (Bloomberg and Goldman Sachs respectively) started last Friday and runs through to this Thursday, 14th January. The houses have their own methodology for determining the composition of the index for each year, and while this is quite complicated, a part of the logic tends to consider the performance of the different components over the preceding year. The calculations, certainly in the case of the Bloomberg index, take place in Q3 or Q4 of the preceding year and are published as soon as possible thereafter. This year, both indices are thought to be making small increases to their gold weighting and small reductions in their silver allocations.

Gold and the Dollar; three-minute moves, 7th-8th and early trading on 11th January

Spot Gold in Dollar and Euro Terms