Jul 2020

Jul 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

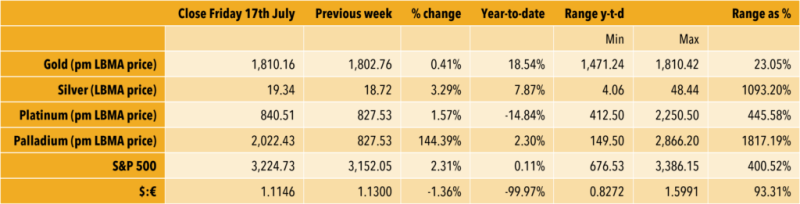

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

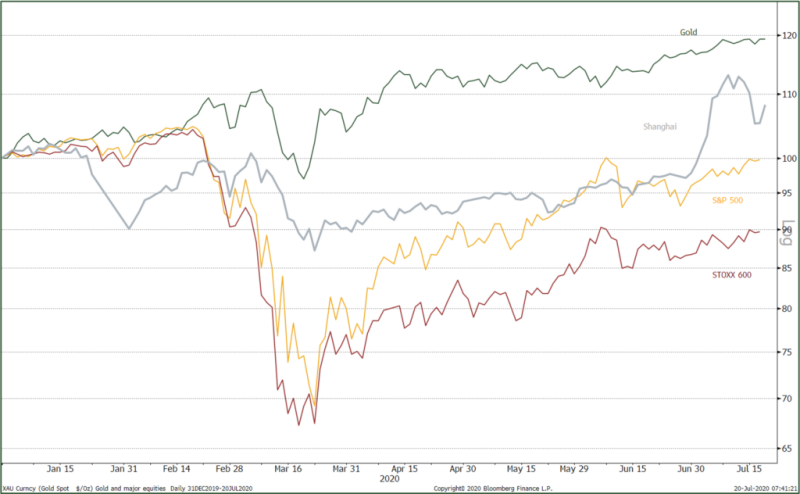

Gold’s moves in recent weeks have been gentle and in a now well-defined uptrend (see the second chart, below) that started in early June and which has seen the price rise from $1,677 (intra-day) to $1,810 as we write this morning. That is a gain of 8% over the period.

In fairness this has been set against a background of a mild weakening in the dollar; gold in euro terms has gained 4.5% over the same period, which is also an impressive gain for a period of just six weeks, and the moves equate to an annualised increase of 46% in euro terms and 102% in dollar terms.

The background is of course the persistence of the Coronavirus and the associated uncertainties over the economic outlook and financial stability; in addition, there are rising geopolitical tensions. This is not at all unusual during times of economic or financial stress.

Meanwhile the Exchange Traded Funds have been steadily amassing more gold over the year as a whole; of the 143 trading days so far this year, 119 have seen additions into the funds. Combining the granular detail from the World Gold Council for the year to 10th July (+778.3t) with the Bloomberg figures for the period thereafter gives us a year-to-date increase of 800.4t for a net dollar inflow of more than $37Bn. To put this into context, that tonnage is not far short of half the amount of gold mine production over the period.

Added to this is the fact that silver has now come to life and joined in gold’s bull run and has cleared the $19 threshold to trade at $19.30 this morning, an 8% gain year-to-date. The gold: silver ratio has contracted to below 94. When gold is in an established trend (bull or bear) silver almost invariably moves further as it is a naturally more volatile market and when silver finally decides to move with gold then that gives added credibility to gold’s action.

The fact that gold is moving gradually makes the bull market that much more solid than if it were to spike, because it means that the technical formation on the charts is more robust; it also means that price-elastic buyers are not put off. In the current circumstances, of course, price-elastic gold jewellery buyers are still out of the market and although there are some glimmers of interest in India, there are also signs of some selling in parts of south-east Asia.

First Chart for the week:

Gold and the major equities markets

Second chart for the week:

Spot Gold