Jul 2020

Jul 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

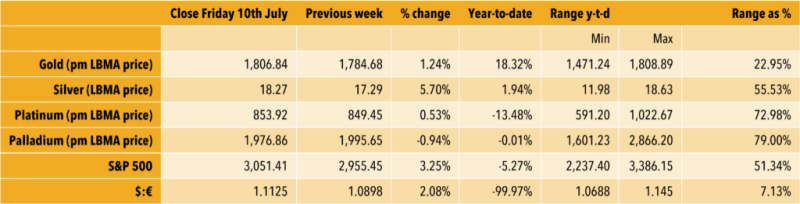

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Gold has continued to trade on either side of $1,800, while silver, in typical silver fashion, has now got the bit between its teeth and is trading above $19, a gain of 5% since the start of the month. So far this year gold has gained 19%, silver 6% and copper is up by 4%, but for much of the period silver was the underperformer as it fretted about the economic outlook. Historically when gold has rallied, silver has gone with it, and due to its higher volatility it has been the outperformer. If gold is lifeless then silver will generally then look to the base metals for its guidance.

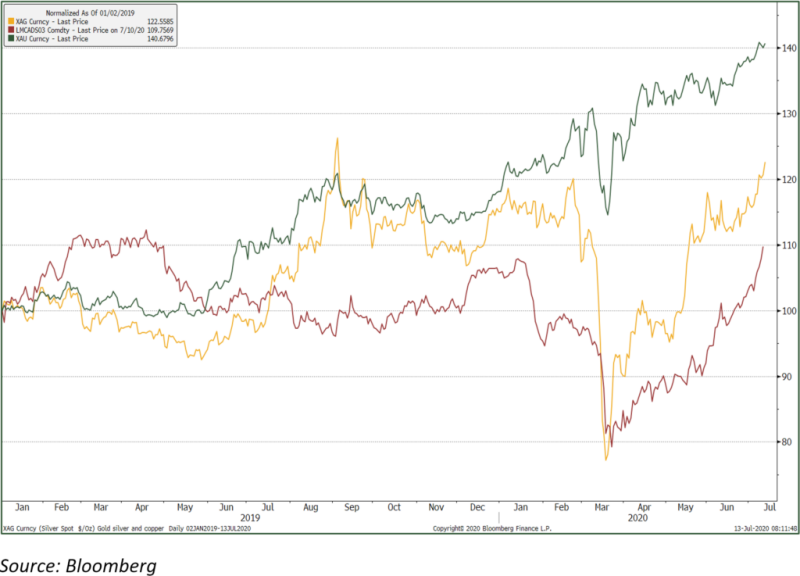

Over the past five years the relationship has started to falter, with the ratio (see second chart below) gradually widening and reaching 92 in the middle of last year, before silver burst into life and caught up with gold’s strength, which was being driven primarily by geopolitical and economic concerns, much of which was wrapped up with the Phase One trade talks.

In early 2020, however, the ratio shot out to over 100:1 as the markets took a heavy fall and silver dropped to 10-year & 11-month lows with a 36% drop, while gold fell to just four-year lows with a contraction of 12%. In this instance silver was firmly in the base metal camp, where it largely remained until mid-June, although it did bounce back rapidly from its downward spike and has now recouped all its losses.

The $18 level proved to be a strong barrier for all of June, while gold was struggling to clear $1750; now, however, with gold marking a relatively strong upward break silver has joined forces and the ratio has closed into 94. To be fair the buoyancy in copper is helping matters, especially as part of this is driven by supply virus-driven supply disruptions in Latin America, which accounts for over 45% of world silver mine production. The news over the weekend that workers at Antofagasta (Chile, copper) have voted to strike has fuelled the move.

Approximately 80% of silver supply is price-inelastic and it is accordingly not possible to ascribe a market-clearing price to it. Gold is usually the final arbiter and at present silver, back in gold’s slipstream, is looking livelier than it has for a while. Wither the psychologically important $20 level can be challenged successfully in the near term is, however, questionable.

First Chart for the week

Silver, copper and gold from the start of 2019 to date

Second Chart for the week

Gold, Silver ratio, January 2015 to date