Jul 2020

Jul 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

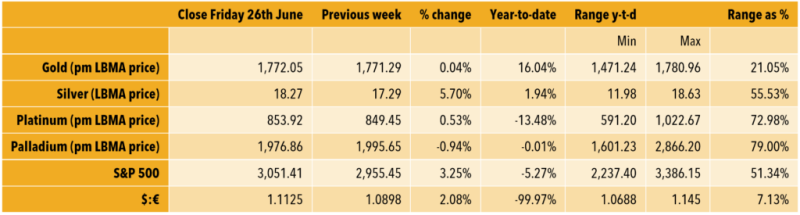

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

As we enter the second half of the year, here is a very quick wrap-up df the first half and the prices’ relative performance. Gold is clearly the stand-out performer as professional and western investors have hedged against risk, offsetting the loss of the physical markets in Asia.

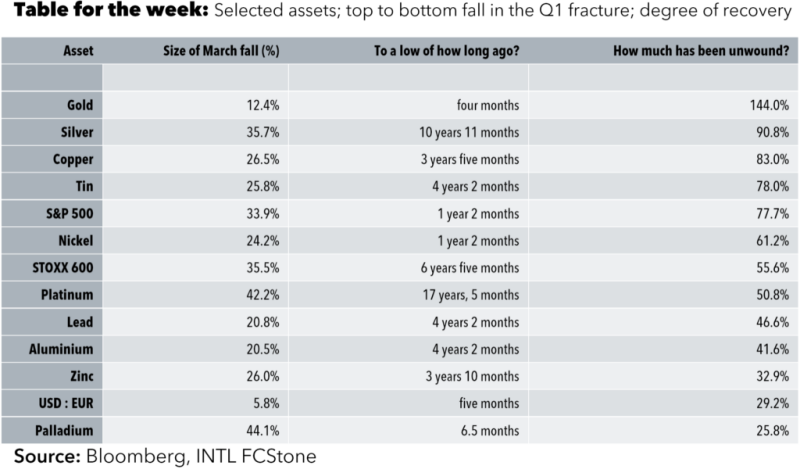

Gold commanded plenty of attention when briefly falling along with the equity markets in the first quarter. Initially, as the equities came off gold continued to rise, but when the equities really started to drop, gold came down under distressed selling and liquidation ahead of possible margin calls. This is perfectly normal but does always seem to capture the headlines. The resilience of the market is shown in the accompanying table. Gold only fell to a four-month low and has more than recouped all its losses—in fact it had unwound its fall by mid April. With the exception of the $:€ rate gold sustained the shallowest fall; at the other end of the scale came palladium, with a 44% drop. This, though, was only to a 6.5 month low, reflecting the previous rampant bull market in the expectation of increased usage in the auto sector in a year or so’s time, and the possibility of disruption to supplies. The metal that suffered the most in terms of lost ground against historical lows is platinum. Whereas palladium has been in a structural deficit for much of the last decade and before, platinum has largely been posting surpluses from 2010-2019 inclusive, and has accrued a cumulative surplus of 2.75M ounces (85t), equivalent to 21 weeks’ global demand (Metals Focus numbers).

The outlook for the second half-year is of course shrouded in uncertainty. If we take a base-to-best case scenario that assumes that authorities—and individuals—have learned lessons from the first wave, then we could postulate that a second wave would not take hold. Sadly, this does not appear to be the case, at least at an individual level. This argues in favour of gold over the other assets as demand destruction exceeds supply disruption, but with the exception of nickel and aluminium, we believe that the lows of the year are already in.

Meanwhile gold traded above $1,800 at the end of June as the markets continue to watch the resurgence of the virus in the United States in particular. Silver is a little reticent, torn between going with gold as a quasi-risk hedge, and the uncertain outlook for the global economy. The $18 level is still proving to be effective resistance.