Jun 2020

Jun 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

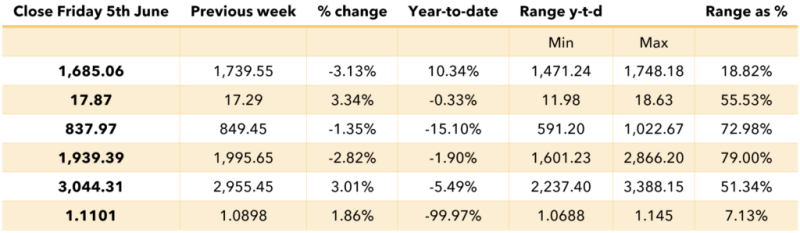

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Summary: dynamics are changing slightly in gold; west sells, east is buying

After saying last week that it looked as if bullish factors were starting once more to gather behind gold, last week ended with a heavy sell-off in response to the United States’ employment numbers. This does not mean that the market has gone into reverse, though, as the fall has brought out some substantial buying interest in Asia, and the onshore Chinese discount to loco London has narrowed. What it does suggest is that some professionals are taking profits, while it is possible that the physical market in the East may be starting to flex its muscles again (see the chart below, which highlights the key reversals). That said, it is also likely that some professional investors will be re-establishing positions at the lower levels, especially as the next Federal Open Market Committee meeting takes place this week on Tuesday /Wednesday 9th/10th June.

The numbers coming out of the professional markets do tend to confirm the feeling expressed above, reflecting and informing the price action last week. Outright long position holders on COMEX trimmed their positions in the week to 2nd June, during which time gold had put on $60 to test $1,760 on the Monday, so some profit taking, and a few fresh shorts, Is not surprising. No doubt the numbers for this week will show more of the same, although if the market continues to rebound this morning it will be hard to identify as the figures are only released weekly, to the close of business on Tuesday. There has been some profit taking from the gold ETFs; just over eight tonnes have been taken off in the past two days, leaving holdings at roughly 3,500t.

Meanwhile all eyes have been on the state of the world economy and the U.S. employment numbers have been of especial interest. New weekly jobless claims have been very heavy over the past six weeks and the Nonfarm Payroll number for May was released last Friday. The April the number had fallen by 20.7 million and the markets were expecting another hearty fall. The outcome was a big surprise, with gains of 2.5M and taking the unemployment rate down to 13.3% from 14.7% While this is obviously still very high, with 21M still unemployed, it is a lot better than the markets’ were looking for and the S&P 500 gained almost 3% on the news.

So, on balance gold is responding with some vigour to external developments; the overall sentiment pervading the markets is positive.

Chart for the week

Spot gold and the active contract, the past month