Jun 2020

Jun 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

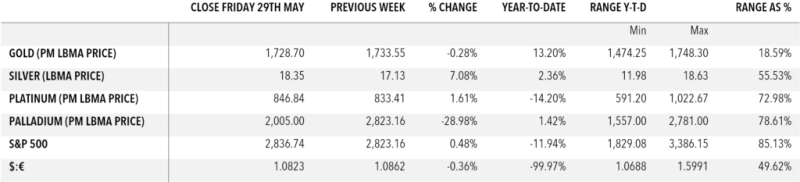

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Gold is currently surrounded by conflicting forces, but the bullish elements are starting to overpower the bearish forces. While the tragic circumstances of the COVID-19 virus appear to be receding in some areas, they have still not gone away and uncertainty pervades the world in terms of the speed and safety of the easing in lockdown restrictions. Economic and financial concerns will be with us for a long while longer yet, and this is one of the elements that has been supporting gold prices.

That said, the fact that gold retraced by over $40 to dip below $1,700 last week as the EU authorities came to an agreement on additional funding suggests that the covid premium is working its way out of the gold price to a degree. The agreement was a compromise between different EU governments and involved the implementation of €500Bn of grants and €250Bn of loans (this is separate from the massive programme that is already underway). The significance here is not just the fact of the debt issuance; it is that this has come from the Governments rather than the central bank—and, probably more significant still—is that it is a joint effort across the EU after months of disagreements.

So much for the bearish factors. What the markets are now looking at is the increasing tensions in Greater China, the U.S.’ response and the local tensions in the United States with civil unrest spreading across more than 70 cities following the death of a suspect at a policeman’s hands last week. Gold has now regained all the losses it sustained last week and as we write is trading above $1,740, approaching eight-year highs once more. While the physical markets in the Middle East and Asia remain incredibly sluggish through a combination of lockdowns, high prices and a likely sustained change in purchasing patterns, investment in the western hemisphere has remained very strong. This is illustrated by the performance of the gold Exchange Traded Funds, which have now added gold for 49 out of the past 50 days, for the addition of 389t and a net dollar in flow of $20.9Bn. To put those tonnage numbers into context; if that rate of addition were sustained across a full calendar year it would amount to 2,201t. The global jewellery makre last year absorbed 2,119t. The actual absorption into ETFs over the past twelve-month basis more modest at 914t, but nonetheless this is significant tonnage.

Thought for the week

Gold Exchange Traded Funds have added approximately 660t so far this year

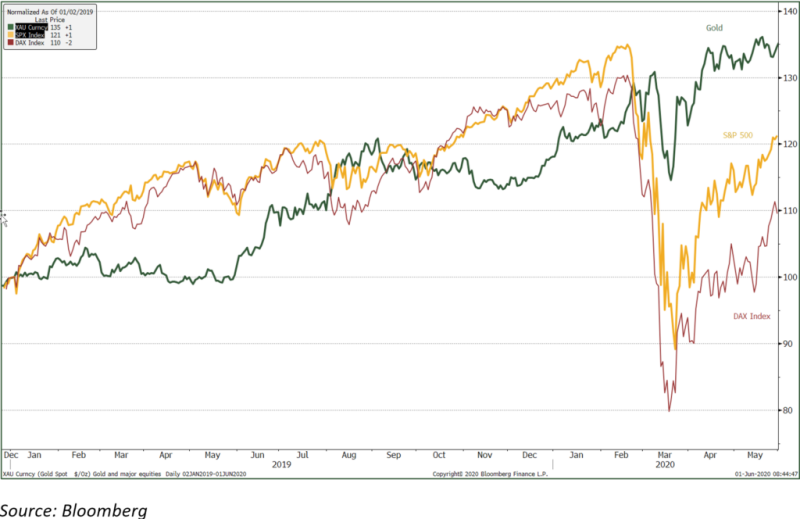

Chart for the week

Gold and the major equities markets; 2nd January 2019 = 100