May 2020

May 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Gold and silver have been holding to very narrow ranges since our last note, with gold centred around $1,700/ounce and silver revolving around $15/ounce. Conditions have been cautious as the world’s economies and the financial sector have carried on watching the developments with respect to the Corona virus. China’s economic revitalisation has been admirably swift, and a good pointer to this is the fact that last week the pollution levels were up to 85% of the 2019 norm, suggesting that it is all systems go in the industrial sector. While some countries are gradually easing lockdown restrictions, the non farm payroll figures in the United States, the most keenly watched employment indicator, were released last Friday and, as expected, show a vicious downturn in employment in the country. The unemployment rate tripled to 14.7% which is the highest level since the Depression in the 1930s, with 20.5M jobs going in April. The number is inflated because some of these losses are temporary, nonetheless they are frighteningly high. The April numbers are concentrated largely in the lower-paid areas of the economy and are expected to extend into the white-collar sector in May.

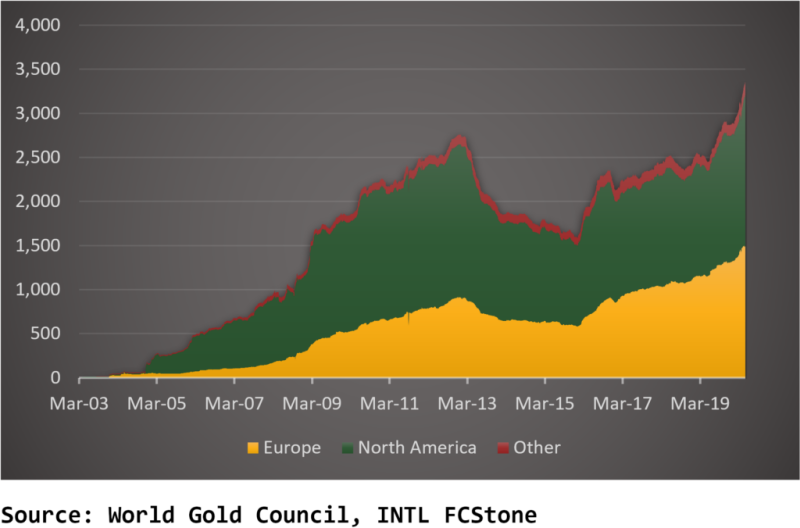

Meanwhile the latest ETF numbers from the World Gold Council, which tracks 118 gold-backed ETFs, show combined holdings of 3,355 tonnes of gold; the latest figures from the GFMS team at Refinitiv peg world gold mine production last year at 3,360t. Meanwhile the ETFs continue to absorb gold at a rapid rate, with a particular acceleration in North America in recent weeks. Over much of 2018-2020 the European funds were catching up with those in North America, but in April there was a dramatic turnaround with North American funds adding 144.2t (a gain of 9%) while the Europeans only added 20t, or 9%. It has been suggested that some of this may be due to the dislocation on COMEX when it was proving very difficult to get metal into New York (or anywhere else for that matter) as a result not just of the temporary closure of three of the big refineries in Switzerland, but also the lack of flights and that investors were closing positions on COMEX and going into ETFs instead. They may well have been part of this, but the overall numbers don’t bear it out on a large scale. Indeed the latest CFTC figures, which date from the close of business last Tuesday 5th May, show that outright managed money longs on COMEX dropped by 43t to 442t since the end of March, with outright shorts rising from 13t to 28t, the net managed money long on COMEX fell to 414t. This is the lowest since mid-June 2019 and is equivalent to 74% of the average net long over the past twelve months.

Thought for the week

Physical demand frog old crumbled in east and south-east Asia in the first four months of this year; bullion investment in the west came to the rescue

Chart for the week

Gold-backed exchange traded funds