Apr 2020

Apr 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

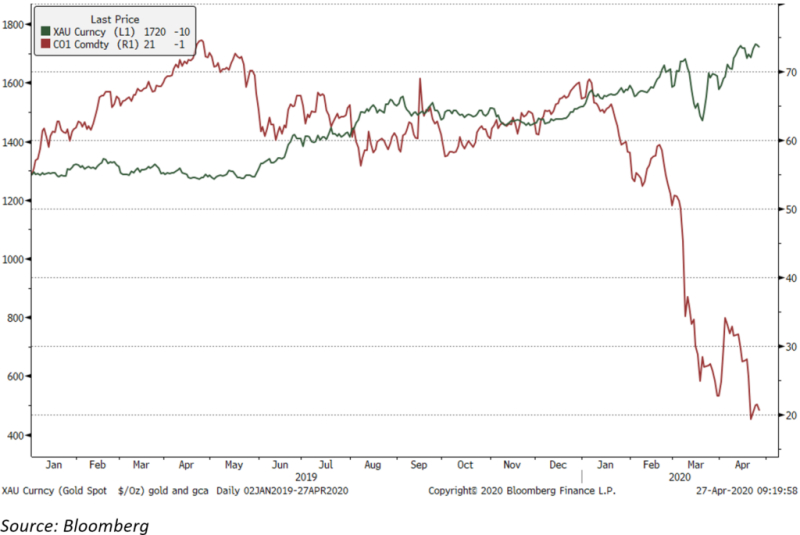

The massive implosion in the West Texas Intermediate (WTI) oil price last Monday came as traders and speculators were scrambling to get out of long positions in the NYMEX May contract, which expired at the close of business the following day. The specific problem was largely a technical one, although of course it comes from the heavy over supply in the oil market with much of the world’s economy in lockdown. The May contract dropped to below minus $30/bbl., which basically meant that traders who were on the wrong side of the market basically had to pay counterparties to take the oil. WTI is a more tightly focused market than Brent crude, which has a wider array of storage facilities, notably floating storage (although the rates from that have shot up). WTI, by contrast, goes largely into the United States, where the major hub is Cushing in Oklahoma, which is almost full.

The collapse in the May WTI price meant that the contango between May and June widened very sharply. To this extent it was reminiscent of what has been happening in the gold market, with a big and highly variable contango between spot and the first continuation contract on COMEX. The essential difference here is that while there is a massive glut in oil, the lack of airline flights has meant that it has been difficult to ship gold to the right place efficiently. There is no shortage of gold, it is question of getting it to where it needs to be.

In the markets themselves, platinum and palladium fell very sharply in a spillover from the WTI markets, with palladium shedding almost 14% before starting a recovery. Gold and silver were also affected but not to the same extent and after absorbing some selling pressure down towards $1,650 gold recovered well on the back of risk hedging and has opened this week above $1,720. The CFTC figures for the close of business last Tuesday reflect this earlier selling, with long liquidation and increased shorts in the gold contracts. Silver is trying to keep up with gold and the ratio between the two has been holding steady in the region of 113:1. It is still cautious, though, and keeping an eye on the weak economic outlook. The CFTC figures show that silver followed gold in the futures trading, but to a lesser extent.

Thought for the week

Silver’s demand base is 19% jewellery, 26% coins and bars (though this is likely to rise this year) 6% silverware and 51% industrial. (GFMS numbers)

Chart for the week: Gold and Brent