Apr 2020

Apr 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

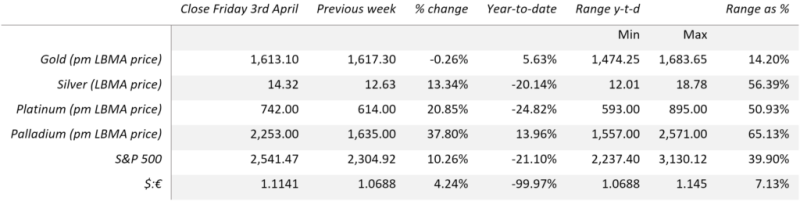

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

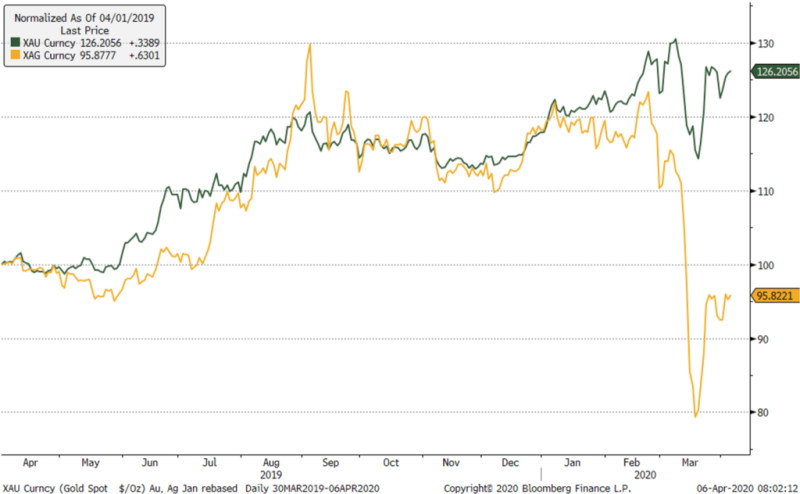

After gold and silver's change in range in mid-March in response to the United States’ liquidity injections and stimulus programme, last week was a week of consolidation. This was partly as these markets needed to settle, but also because of volatility and uncertainty everywhere meant that market participants in a number of asset classes were cautious and essentially retreating to the side-lines. Cash has definitely been the place to be. Gold has been consolidating around $1,620 and silver has traded between $13.80 and $14.60.

In the rest of the financial sector, the dollar has been strengthening again as it continues to act as the major haven. In principle, therefore, we might expect yields in the U.S. short term bonds to fall as Treasuries are one of the major areas that attracts funds; yields have however been rising over the past week, which at first glance makes little sense. In fact what has been happening is that the first tranches of U.S. bonds have been coming into the market as part of the support package a; while it would be exaggerating to say that there has been a problem absorbing them, there has been a lot coming into the market and it has taken time.

Elsewhere the underlying retail and professional demand numbers give us a more rounded picture:

Exchange Traded Funds; after redemption of 62t in mid-March, since 23rd March the gold funds have added 111t for a net inward investment of $5.7Bn, to stand at 2,838t. The silver funds have been more variable; there were redemptions in early March, a rebuild over the following fortnight and most recently some light sales to leave the holdings at the start of this week at 20,156t, which is the equivalent of 39 weeks’ global silver mine production.

U.S. Eagle Sales; gold has already sold 33,500 ounces of Eagles this month, but the Mint has yet to put up any silver numbers.

COMEX positioning; gold and silver went in opposite directions in the week to last Tuesday 31st March, just as prices were easing slightly from their highs; gold saw light liquidation and some fresh shorts; silver added to longs and saw some short-covering, which makes sense as silver rallies are almost invariable aided by short covering because of its reputation for volatility.

Thought for the week

Gold ETFs at a record 2,838t, would the be the third largest central bank holdings and comprise 8% of world official sector gold holdings.

Chart for the week

Spot gold and silver rebased to 4h January 2019=100