Mar 2020

Mar 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

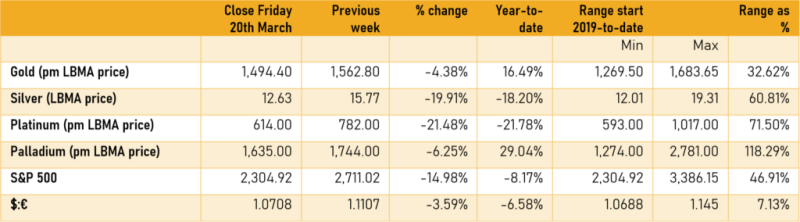

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

The malaise continues in asset classes around the world and silver has been a huge loser in terms of price. Silver hit a new low of $11.57 (intraday) this morning, its lowest since February 2009, and down by 40% since the recent high of $19.57 on 4th September last. This compares with a 32% fall in the S&P 500 in just 22 days, while the French and German CAC40 and DAX Index respectively lost almost 40% in just 20 days from the third week of February. This morning these indices have given back the sharp gains that they made at the end of last week with another heavy drop this morning, as have Asian equities as more nations self-isolate and the markets look to a potential deep recession.

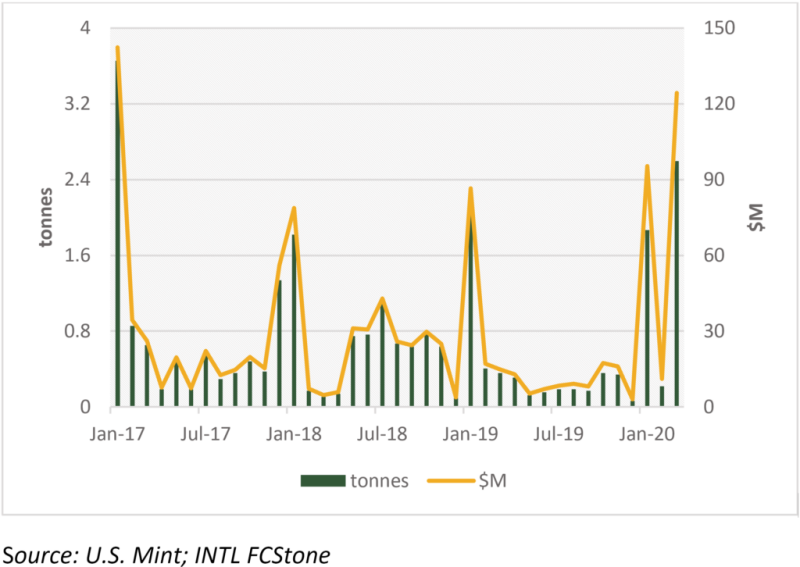

In demand terms, though, silver is one of the few bright lights in the system. Coin and bar sales have been picking up very strongly and there has been a big resurgence in silver demand in India, which is the world’s largest silver consumer, typically with a 20% global market share of jewellery, silverware and bars and retail investment. Far Eastern activity is strong and the latest figures from the U.S. Mint show a huge uptake in silver Eagle coins.

This is a welcome sign that investors are prepared to come into the market and bargain hunt in their droves and that the markets have not completely ground to a halt. Gold coins have also been picking up in the United States. The U.S. Mint is showing silver coin sales 3.20M ounces so far in March, which compares with 650,000 ounces in February and 3.85M ounces in January which is always inflated as the Mint sends out dealer allocations in that month. The monthly average last year was 1.24M ounces. Gold coin sales have also picked up, with 83,500 ounces of U.S. Eagles sold so far this month against a monthly average last year of 12,583 ounces.

It is unlikely that this massive pace can continue for an extended period, but it is an encouraging sign to see that this sector, at least, has sprung to life where others are closing.

Thought for the day

Do not be surprised if gold falls when other asset classes are tumbling; gold settles in two days whereas most other equity markets settle in three or longer, so gold is usually cashed in to generate cash against potential margin calls, and distressed selling in general.

U.S. Mint silver coin sales and approximate dollar expenditure