Mar 2020

Mar 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

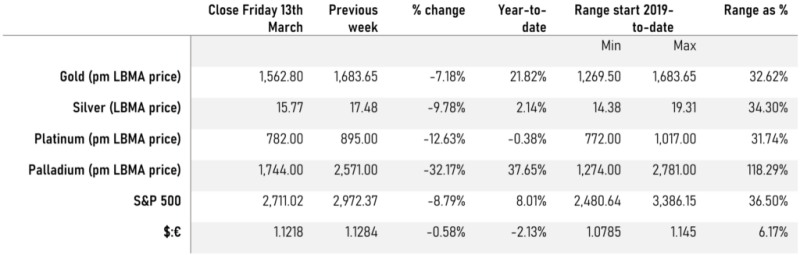

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

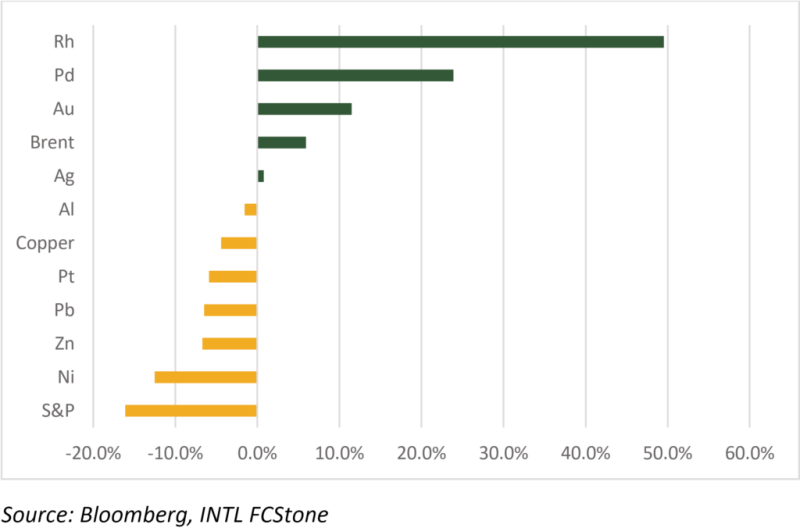

Since our last review, written a fortnight ago, gold has obviously suffered a sharp reversal and taken silver with it, as the rest of the commodities sector has also plunged. Putting this into a broader context, however, shows that gold is the third best performer in this year to date among the precious and base metals, along with the S&P.

The sharp falls last week came in thin liquidity and it was almost a case of “if you blink, you will miss it” (especially in the case of palladium). Essentially this was a combination of liquidation, stops being hit and distressed liquidation in order to raise cash to meet margin calls, because gold settles in two days, whereas the majority of equity markets settle in three days or longer, meaning that gold almost invariably comes down when the other markets are in distress.

This latest fall has been generating some substantial bargain hunting for gold in the retail sector, notably in Europe. The story in the Exchange Traded Funds is mixed, with very heavy inflows into gold on either side of the weekend of 7/8th March, (47t in two days), but with heavy liquidation (17t) at the end of last week. Total gold holdings stand at 2,686t, equivalent to 42 weeks’ global gold mine production, while silver, in which there was light liquidation last week, stands at 19,111t, equivalent to roughly 37 weeks’ global mine production.

The co-ordinated efforts from a number of central banks over the weekend, notably with the Federal Reserve making its second cut within one month, and both off-cycle, puts further downward pressure on interest rates, while the return of quantitative easing will expand their balance sheets and there is quite a good correlation here between the Fed’s balance sheet and the price of gold. This is partly because of the fear of future inflation, although that is clearly not a valid argument at present (unless and until the supply chains become severity disrupted); it also reflects the fact that balance sheets tend to expand in times of distress as the central banks try to ensure that businesses do not go down – and gold of course tends to thrive in the longer term as a result of distress. In the short term, though, these sharp falls should not come as a surprise.

Chart for the week

The major metals, oil and the S&P; performance year-to-date