Feb 2020

Feb 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

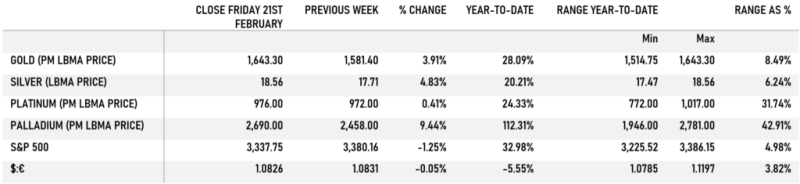

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Gold has developed a momentum all of its own over February as the markets have recoiled from risk. The primary beneficiaries of this risk-aversion have been gold, the dollar and U.S. Treasuries. To be fair, the dollar index actually started its bull run at the start of this year, since when it has gained 3.2%, and 2.2% in February; the U.S. two-year bond yield has dropped from 1.6% in early January to 1.28%; while gold has risen by 10.3% in dollar terms since the start of the year and by 15.2% in euro terms.

Volumes have been very heavy both on the futures exchanges and in the Over-the-Counter markets. Figures for the Commitment of Traders for gold up to 18th February (the latest date for which numbers are available) show outright longs in the Managed Money sector standing at 866 tonnes, the highest since October 2016 (when it closed at $1,268 and five weeks before it went into a month-long bear market, bottoming out at $1,128/ounce). The outright short position was 124t, which seems high but is lower than the 52-week average of 150t. CFTC figures for silver show that there has been sizeable short-covering since the middle of March whole the outright longs have been fluctuating. As a result the net long stood last week at 10,723t, the highest since September 2017 and equivalent to 31 weeks’ global demand.

The Exchange Traded Funds have also been lively, with gold now accumulating metals for 22 consecutive days, starting on 22nd January, and taking in 70t since then for an investment flow of £3.5Bn, according to Bloomberg data although the World Gold Council figures, which list individual funds, are roughly 400t higher so it may well be that Bloomberg is not capturing quite all of the data. The Bloomberg numbers show record holdings of 2,611 tonnes, which, if these funds were a central bank, would be the third largest holder in the world behind The United States and Germany. We understand that a tremendous amount of this buying has been coming from Europe; the WGC figures will not be updated until the end of month at which point we will be able to quantify the holdings. At end-January European funds were holding almost as much gold as those in the United States. Silver funds have been more variable with intermittent profit taking appearing; currently they stand at 18.988t, equivalent to 31 weeks’ global demand.

While the markets remain heavily risk-averse gold prices are likely to stay elevated, but the speed of this most recent upward leg suggests that when the reversal comes it could be vicious.

Thought for the week

The Chairman of the Hong Kong Jewellers Association said recently that he has never seen the Chinese jewellery market this bad in 40 years’ experience.

Chart for the week

Gold, the S&P 500 and the yen; the yen is not trading as a risk-off asset this time because of concerns of Asia virus contagion