Jan 2020

Jan 2020

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

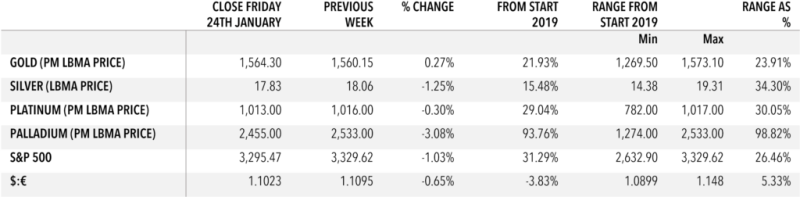

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

The tragic developments in China with the onset of the Coronavirus has clearly been the key development influencing the markets in the past days. For much of last week the markets overall (equities, currencies) remained relatively resilient although risk-aversion was growing. At the start of this week, however, the news is not good, with further fatalities reported and increasing numbers of cases outside China.

Equity markets have now started to slide, and safe haven assets are in demand. Gold is testing $1,590 as we write, amid fresh concerns over the outlook for the Chinese economy. The even more bitter irony is that this has come at Lunar New Year, when, normally, over 500 million Chinese people are on the move both domestically and internationally, There have been some travel blocks put in place with, most recently, Hong Kong refusing entry to any non-resident who has been in the Hubei Province in the past fourteen days.

Local gold buying for the New Year, usually the Festival that provides he strongest period of gold buying in China, was looking sluggish even before the break of the virus and the latest developments have obviously not helped. With the rest of south-east Asia only showing very sporadic signs of buying and the Indian sub-Continent still very slow, the vast majority of buying interest has come from the professional sector. Given that there was some long liquidation on COMEX in the week to 21st January (during which gold rallied from $1,546 to $1,558) there has clearly been activity in the OTC market, while the gold Exchange Traded Funds have added 31 tonnes since 17th January, for a net dollar investment flow of $1.56Bn.

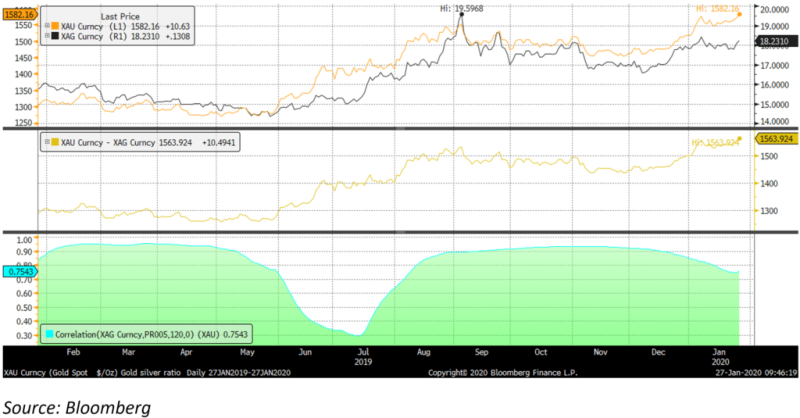

For much of last week silver was more concerned with the impact on the industrial outlook and the gold:silver ratio widened as silver drifted lower and gold was strengthening. Normally in a fully-fledged gold bull market the gold:silver ratio would narrow due to silver’s higher volatility. Last week it was much more in the base metals’ camp (copper at the lowest now since the first week of December), but with the markets now veering towards panic silver is picking up, the ratio is narrowing and may well narrow further.

Thought for the week

Major safe havens in times of nervousness include gold, T-Bills, the dollar, Swiss franc and yen.

Chart for the week

Gold, silver; spot, ratio and correlation