Oct 2019

Oct 2019

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

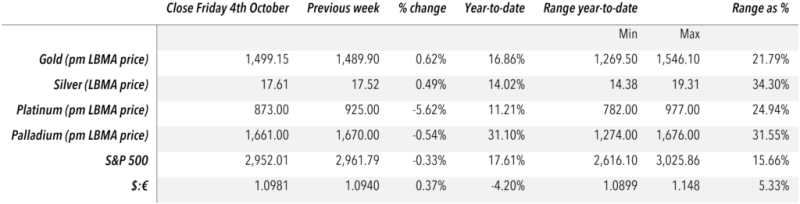

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Last week we talked about how uncertainty in the U.S. industrial sector was starting to spill over into the consumer side of the economy and that this might herald further slowing in the U.S. We also reported that the physical market in gold was flat and that there was, yet, no sign of any interest in India ahead of Dhanteras and Diwali, which are on the 25th and 27th of this month. Diwali is the most auspicious day in the Hindu calendar for the buying, gifting and receiving gold.

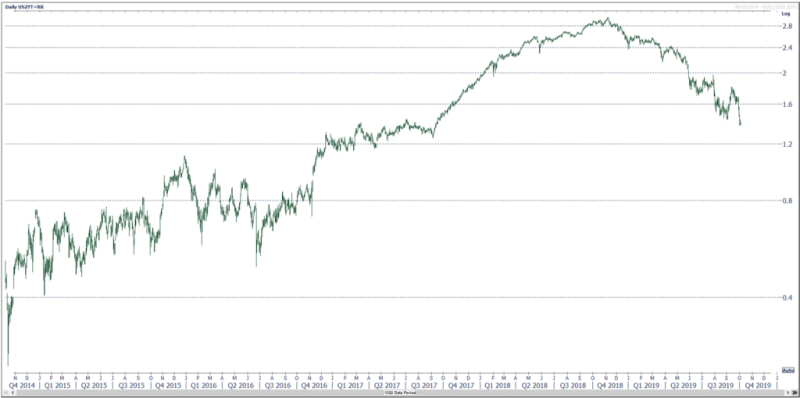

Things are starting to change in the metals markets while the economic numbers are still mixed. The U.S. remains cautious on the industrial side with very disappointing non-manufacturing numbers released in the middle of last week, and keeping Treasury yields under pressure (see chart below). The employment numbers released last Friday, though, were slightly better than expected and the unemployment rate itself dropped to a near 50-year low. Now all attention turns to the U.S.-China trade talks which move to the stage where the top politicians become involved after preparatory work by officials. These talks start 10th October. Meanwhile on the other side of the Atlantic the German economy remains under pressure; the manufacturing weakness persists and this morning’s numbers show industrial orders falling by a little more than had been expected, reflecting weak domestic demand.

Meanwhile the picture is starting to improve in the physical gold market. Regional consumers are at last starting to get used to the higher price ranges and there have been areas of demand developing into the lower prices of the past couple of weeks. The $1,500 level is increasing its psychological significance and falls below this level are starting to attract interest. It will be interesting to see how the Chinese market responds when it opens again tomorrow after the week’s national holidays, while momentum is now starting to build in India and there are reports of “aggressive buying” from some jewellers with the discount to loco London narrowing now towards $20-$30, a notable improvement on recent weeks.

The figures from the U.S. Mint show that demand for Gold Eagles in the first nine months of the year remain subdue (down 29%year-on-year), while silver is running 7% above the first nine months of 2018.

Thought for the week

Negative interest rates in Europe make gold cheaper to hold than bonds

Chart for the week

U.S. Treasury yields moving lower in the face of weakening industrial activity (2‑year yields over the past five years)