Sep 2019

Sep 2019

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

When we last wrote two weeks ago, silver had mounted an ebullient challenge on the $19 level and we noted how volatile this particular price can be. Sure enough after failing at the highs the market found itself subject to some profit taking and the recoil was sharp enough that there was bound to be some stop-loss selling. In fact the COMEX outright long positions did contract but not by much and there was even a degree of short covering during the following week while the price was retreating to $17.35. Since then silver has essentially been in a range centred on $17.50-18.40 as most markets became cautious ahead of the Meeting of the United States Federal Open Market Committee (FOMC) meeting last Tuesday and Wednesday 17th-18th September. The FOMC is effectively the policy making committee of the Federal Reserve Board, the U.S. central bank and as trade wars have been taking their toll on economic activity and business investment these meetings have been very keenly watched. In fact they usually do command a lot of attention anyway, but in recent months the evolution of the Fed’s policy has kept the markets’ scrutiny.

The FOMC itself is of divided opinion about how to handle the situation. In the United States, consumer confidence is relatively high with solid employment and a healthy housing market, while business is weaker and investment, as noted above, is low because of uncertainties. As a result the Fed opted to cut interest rates by 25 basis points and to tweak other areas of their management of bank reserves in an effort to keep sentiment calm and to steer the best course through these uncertain times.

In the European Union the majority of interest rates are negative, as they are also in Japan. The Press Conference after the meeting, the Fed Chairman was asked if they would adopt a negative interest rate policy. His answer was that when the Financial Crisis hit the system in 2008 they did look at that option but chose instead to use plentiful forward guidance, publicising policy plans in advance, in other words, as well as Quantitative Easing. He suggested that they would follow a similar plan this time, if necessary. This makes sense as negative interest rates elsewhere do not seem to be solving the prevailing economic problems.

Meanwhile the President of the European Central Bank has opted for further economic stimulus in Europe, while the Bank of Japan did not, preferring to see how things develop over the next few weeks – this presumably includes a veiled reference to the U.S. / China trade talks. These talks were started last week by officials and senior Government Trade Representatives. The summit meeting takes place in October. Until then, and quite possibly beyond, the uncertainties in the global economy and the geopolitical risk in the Middle East in particular continue to provide a robust environment for gold, and by association for silver.

Thought for the week

Silver has the highest electrical and thermal conductivity of all natural metals.

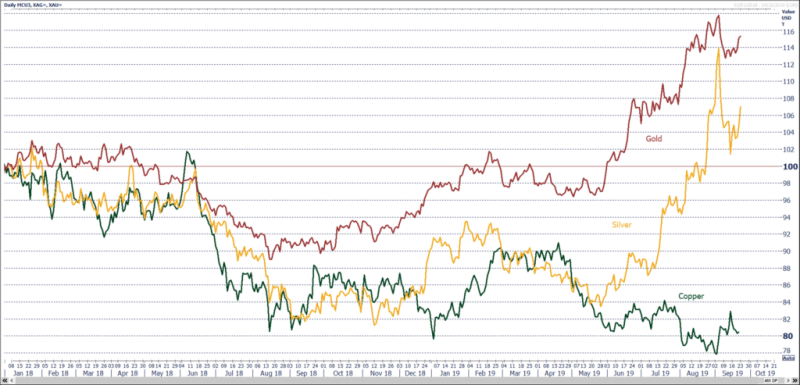

Gold silver and copper; silver continues to behave more like a precious metal than base, which points to bullish sentiment for gold also.

Source: Refinitiv