Aug 2019

Aug 2019

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Gold pushed through $1,500 last week as the tailwinds in the market remained intact, with global slowing and increased expectation of more central bank easing, many interest rates (notably in Europe) below zero, geopolitical tension and sustained publicity about the number of central banks that are adding to their gold positions. The CFTC numbers for the week through to close of business last Tuesday 6th August, when gold’s afternoon LBMA price was $1,465, showed a massive increase in outright longs, adding 103t to a total of 774t, the largest such position since September 2017. There was further short covering to take the net long to 706t, also the highest since September 2017. Gold gained over $40 on 7th August with over 15t going into the ETPs, amid an escalation of international tension when the yuan slipped below seven to the dollar and the U.S. Administration reacted by designating China as a “currency manipulator”. With the subsequent consolidation we can postulate that there has been some profit taking since then.

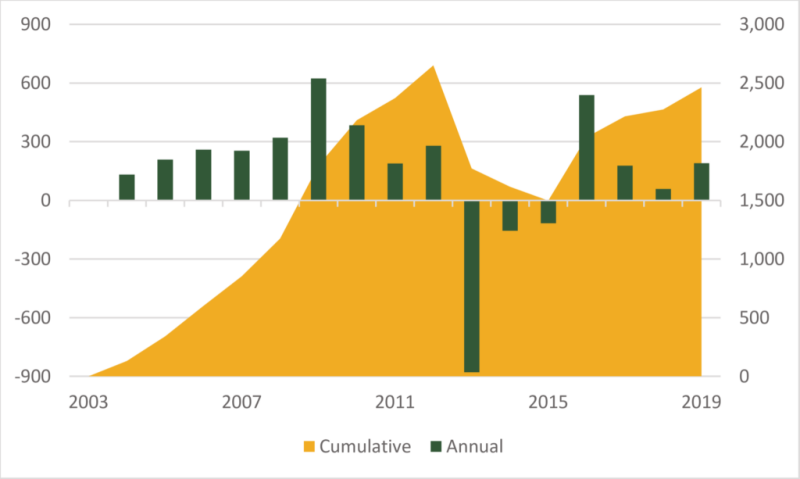

The major Exchange Traded Products have added 62.7 tonnes of gold since 29th July, for a net dollar inflow of $2.9Bn. This works out at daily rate of 6.7 tonnes and compares with just 59t net absorption over the whole of 2018. The chart below shows how ETPs have fared over the past 18 years, with 2019‑to-date.

Thought for the week

While gold is enjoying substantial support from external forces, silver is still unconvinced with CFTC numbers showing profit taking and fresh shorts in the week to last Tuesday.

Net Exchange Traded product movements, 2000-2019 (to August); tonnes

(Source: GFMS,Refinitiv; Bloomberg, INTL FCStone)