Aug 2019

Aug 2019

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

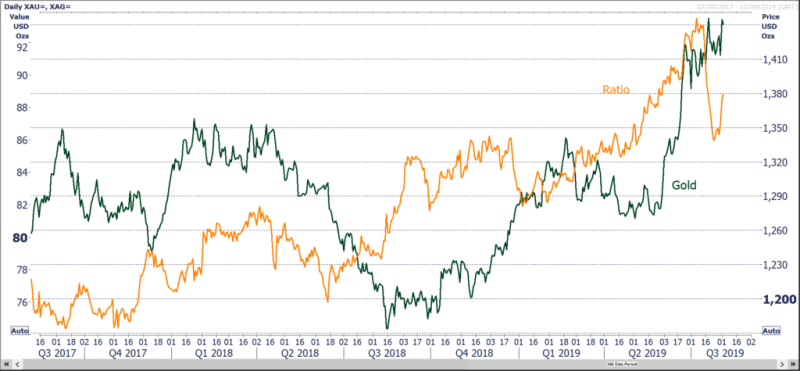

Gold and silver; playing catch-up

After silver sprang to life a fortnight ago, tending to confirm the positive sentiment behind gold and aided also by the strength in the mining equities, gold took over the spotlight last week after the meeting of the Federal Open Market Committee (FOMC), in which the fed funds target rate was reduced, as expected, by 25 basis points. After testing $1,430 before the FOMC announcement, gold initially dropped as the announcement came in inline with expectations (this is usual), and tested support at $1,400 early the following day. Thereafter, as the market absorbed Chairman Jerome Powell’s comments in which he would not commit the FOMC to a specific course of action, the market reacted to the associated uncertainty and gold was a strong beneficiary, along with Treasuries. In our view all Mr. Jerome Powell was doing was taking the responsible view, allowing for international economic developments and thereby giving the Fed a degree of flexibility. By the end of the week gold had moved up to test $1,450, a few dollars below the six-year high that was posted in mid-July, responding to uncertainty, a fresh spotlight on the strength of central bank gold purchases (World Gold Council Gold Demand Trends Q2 2019) and increasing coverage of the expansion of accommodative policy across the world.

Silver was the underperformer, reflecting the industrial side of its fundamentals and the gold:silver ratio, after briefly dipping below 86:1, had reached 89:1 by the ed of the week.

Among the Exchange Traded Products, gold added 24 tonnes for a net dollar inflow of $1.1Bn. Silver ETFs were mixed, adding a net 6.5 tonnes over the week for a net dollar inflow of just $3.3M, as the market cools down.

Thought for the week

GFMS Gold Survey half-year update; official gold coin fabrication up 4% in H1 2019 as a safe haven against slowing growth and financial uncertainty, reaching 98 tonnes.

Africa and Asia grew; Europe and North America were down.

Spot gold and the gold:silver ratio