Jul 2019

Jul 2019

Weekly markets round-up for StoneX Bullion

By StoneX Bullion

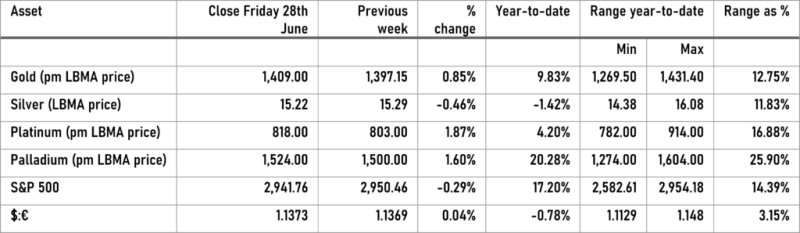

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Gold has finally paused for breath and is finding initial support in the $1,400 region but if this were to give way that does not mean that this recent move has been a flash in the pan. Next support stands at $1,350. There has been a fair amount of resale from private holders in some of the key markets, with Dubai prices, for example, moving to a discount of more than $2 to loco London, as locals have been selling coins and bars, plus jewellery, back into the market to take advantage of the increase in price. This is by no means unusual and is part of gold’s attraction for jewellery in particular in the Middle East and Asian regions. The jewellery is high purity, typically 21-22 carat and upwards in the Middle East and up to 24-carat (99.99% purity of “four nines” as it is known in the trade). Consequently, when it is resold it is done on weight (as it is in the original purchase) and price according to the prevailing market. This is in contract to Europe and North America where the lower caratage and a string of additional costs (taxes, distribution etc) means that the value of the contained gold gets heavily diluted.

In the professional market gold ETFs have continued to add metal although not at the frenetic pace of the previous week, while fresh longs and more short covering in the week to Tuesday 25th June were obviously a driving factor in the soaring price. Conditions needed to settle down and have now more or less done so and we should look for a period of price consolidation.We noted last week that silver can sometimes lead gold with speculators and investors finessing gold positions with silver because of the latter’s volatility. Silver though is still focusing on the industrial outlook and is still running into resistance on any approach to $15.50. Silver used to be a currency in its own right, but is no longer a mainstream reserve asset. Both the rupee and the renminbi used to be minted from silver, but this is no longer the case and the vast majority of the residual silver central bank stocks had been sold off into the market by the middle of this decade.

Thought for the week

Jewellery, bars and coins typically comprise 39% of global silver demand and can reach 90% of private physical gold demand

Gold and silver jewellery, bars and coin demand (% of global offtake)