Nov 2021

Nov 2021

Weekly markets round-up

By StoneX Bullion

Since our last market round-up in early November gold has been on something of a rollercoaster, rising from $1,816 to as much as $1,874, sliding lower to $1,780 by the 23rd of the month and then putting in a volatile performance last Thursday and Friday, along with much of the rest of the financial sector, as news broke of the Omicron covid variant.

The rally in the first half of the month was driven in part by the confirmation from the Federal Open Market Committee on 9th November that tapering would begin in November, while also signalling, along with the Bank of England and the European Central Bank, that interest rates would remain highly accommodative (Fed Chair Powell has made it clear on a number of occasions that the economic parameters for rate hikes are more stringent than those for tapering). This was already well anticipated by the market and for once, gold did not show a knee-jerk downward reaction. This in turn encouraged fresh buying interest in the professional sector along with substantial short covering on COMEX which was almost certainly mirrored elsewhere. The approach to $1,880 saw gold firmly in overbought territory and some shorts started to reappear. Thereafter profits were taken, before the nomination by President Biden of Jerome Powell for a second term as Chair of the FOMC, with Lael Brainard as Vice Chair. This was taken as moderately hawkish, for two reasons: first, that Lael Brainard is much more dovish than Jerome Powell and there had been rumours that she would be appointed to the role of Chair; second, that now the Fed has steered its way through balance sheet expansion, Chair Powell may be minded to start hiking rates next year. The November FOMC meeting was not a meeting that generates special economic projections; those come in the meetings in the last month of each quarter, so this is still supposition rather than written in stone..

These developments helped take some of the steam out of gold’s rally and prices came down accordingly.

Next, the weakening in price brought out physical buyers in major consuming areas such as India, China and parts of south-east Asia, with local markets moving to a premium.

Silver danced to gold’s tune, but as usual was more volatile, with spot prices gaining 10.1% against gold’s 6.6% rise, running up to $25.36 before dropping back to $23.60 just before the news broke about Omicron.

The markets were extremely volatile at the end of last week, with fears about the potential threat to economic growth putting substantial pressure on the base metals and silver, which dropped a further 3% to $23 before finding some support. Gold was also very volatile, rallying from $1,788 to $1,810 then tumbling towards $1,785.

Conditions are calmer at the start of this week. The dollar, which also slid over most of Friday, has regained some stability, Treasury yields are rising slightly and equity markets, after staging heavy falls at the end of the week, are inching higher, as is gold.

With the markets still waiting to see how virulent, and transmissible this new variant will be, gold is likely to be relatively solid, although silver remains potentially vulnerable.

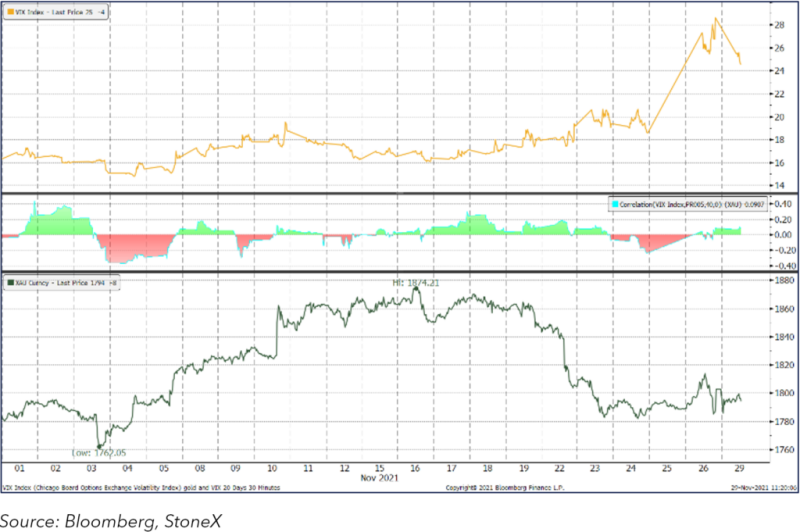

Gold and the VIX uncertainty index; the correlation has been swinging between positive and negative

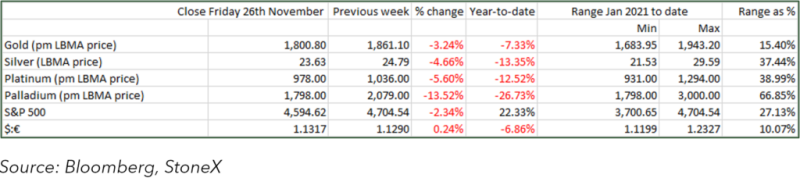

Gold, Silver and their correlation