Jun 2021

Jun 2021

Weekly markets round-up

By StoneX Bullion

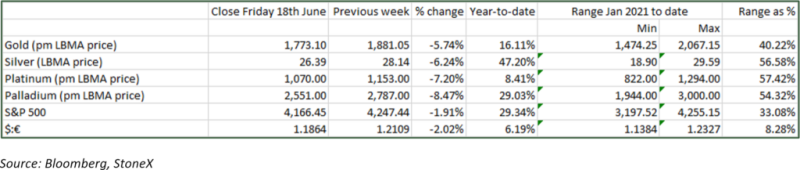

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

Markets overreact to the Fed. Bargain-hunting time.

Last week the Federal Open Market Committee held a two day meeting, after which its policy and economic projections were released. The tone of the meeting, judging from the projections paper, was less accommodative than it has been in the past, but the changes were not actually that material. To judge from some markets’ reactions one would have thought that the meeting had been much more hawkish and signifying a substantive change in policy. Gold, already under some pressure, took a heavy loss and fell deep into oversold territory; now, though, it is meeting substantial bargain hunting and we should expect a further rally.

Probably the key element that unnerved the markets was the “dot plot” that accompanied the meeting. This is the chart that shows where the Committee members expect to see the fed funds target rate at the end of the coming years. In March, the Committee was expecting rates still to be where they are now right through to the end of 2023. Now the expectation is that by the end of 2023 the rate will be 50 basis points higher than where it is now.

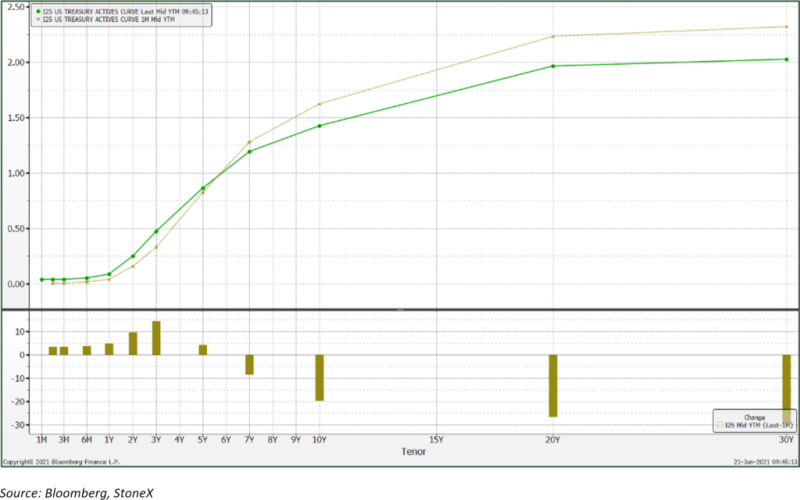

A flattening yield curve (see the chart below) can imply expectations that growth will slow so the implications of the recent changes is that the markets are expecting the slight shift in Fed policy to take some heat out of the economy further down the line. This commentator thinks that the fall-out last week was a gross over-reaction. Granted, Fed President James Bullard was hawkish at the end of last week and suggesting rate rises next year, which rattled already flustered markets, but for the time being the Fed is still only looking at a 50 basis point rise - and in 2023. It's hardly a heavy shift to the hawkish side. And they are still holding to the transitory nature of inflation in the near / medium term, although it does seem clear that a split in opinions is developing. There are a number of Fed members making speeches this week so the markets will be watching very closely for any further shifts in nuances. On Wednesday four are scheduled to speak, namely Raphael Bostic (Atlanta), Neel Kashkari (Minneapolis), Thomas Barkin (Richmond) and Robert Kaplan (Dallas), but the key will be Jay Powell’s testimony to the House of Representatives Tuesday.

Meanwhile gold is finding plenty of bargain hunting now that it has dropped below $1,800. Over the past fortnight gold has posted eight “down” days, dropping by 7.5% on an intraday basis from $1,902 to a low of $1,761. As we write, spot is trading at $1,785, where it is meeting some resistance from a Fibonacci retracement level. The next technical resistance level is the 50% Fibonacci retracement at $1,818 and then the 200-Day moving average stands at $1,837. So from a technical (chart-related) standpoint gold has a lot of work to do to get back on its feet, but what we do know is that weak-handed holders have now been shaken out. There is bargain hunting going on at what looks like both the professional and retail level, and it is telling that last Friday saw the ETFs add 8.8 tonnes for a net dollar inflow of $501M. This was the largest tonnage inflow since 19th March, when gold was in the region of $1,740. Meanwhile the drop in the ten-year bond yield takes it further into negative territory in real (inflation-adjusted) terms, which is also supportive for gold.

U.S. yield curve flattening, and the long end is down substantially from a month ago.

Gold, the U.S. ten-year yield and the correlation between the two