May 2021

May 2021

Weekly markets round-up

By StoneX Bullion

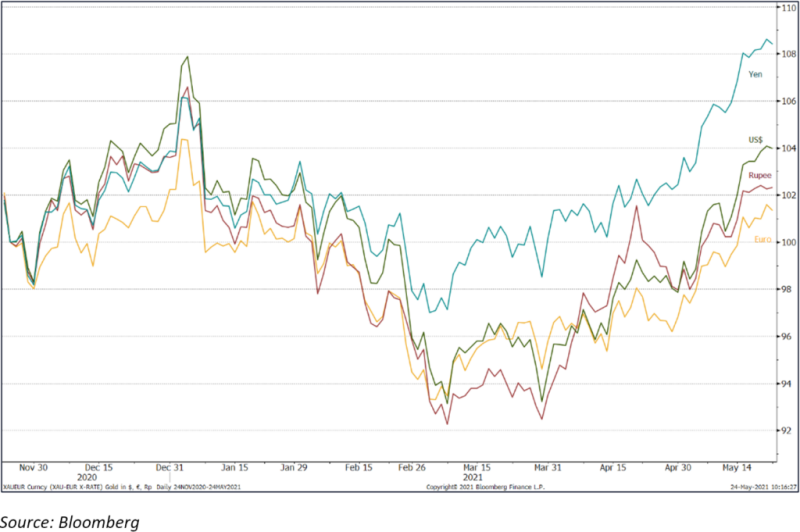

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

As we write gold has just enjoyed seven consecutive days of net price gains from 13th May onwards and has started this week on a relatively upbeat note. The overall tone remains positive as the markets look at prospects for inflation, geopolitical risk and continued economic uncertainty in the face of the Indian variant of the COVID virus and the slow rate of vaccination across much of Asia. It is now in overbought territory on the basis of the standard parameters (e.g. Bollinger bands and the Relative Strength Index) and is certainly due for a correction before it becomes over-extended.

What is interesting to note, though, is that gold has been increasingly resilient to economic numbers that might otherwise take some of the heat out of the market. An example is the U.S. manufacturing data that were released last Friday; the IHS Markit flash manufacturing Purchasing Managers Index (PMI) rose to 61.5 in the first half of May, up from 60.5 in April and the highest since October 2009 (new orders up to 65.3, the highest reading since the series was implemented and the eleventh consecutive month of expansion); this gave the dollar a boost and saw gold drop by roughly $10 from over $1,885 towards $1,876, but the rebound came relatively swiftly.

EU PMI’s, also released last week, were also strong, with the flash figure at 56.9, a three-year high, with the Services figure at 55.1 and manufacturing at 62.8, just off April’s record of 62.9; here, too, there are some calls for the European Central Bank to put the brakes on a little; but the ECB Head Christine Lagarde said last Friday that it is “far too early and it’s actually unnecessary to debate longer-term issues”. The Federal Reserve Board Minutes, released in the middle of last week, did make their first allusion to potential tapering, but this is still some way off and the ECB has not yet mentioned tapering. Judging from Mme Lagarde’s comments last week, it is not even on the horizon yet.

As we noted last week, mild inflation in isolation is good for economic growth and it is when it becomes a threat that gold really comes into its own. At present the balance of opinion among neutral bankers is that inflation this year will be transitory. Either way the tone in the gold market has brightened; ten of the last eleven days have seen investment into the gold Exchange-traded products for an addition of 42 tonnes; while managed-money positioning on COMEX as of last Tuesday 18th May (the most recent date for which figures are available) shows that outright longs have risen from 363t in mid-April to 441t, while over the same period there has been a net reduction of 33t in outright shorts. The net position, at 286t long, is the highest since the start of February and just six tonnes higher than the twelve-month average.

After this recent run, gold is ready for a correction, but the overall atmosphere in the market remains positive, reflecting economic and geopolitical uncertainties.

COMEX managed money gold positioning (tonnes)

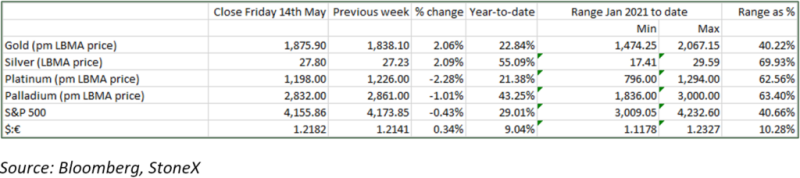

Gold in dollar and other key currency terms