May 2021

May 2021

Weekly markets round-up

By StoneX Bullion

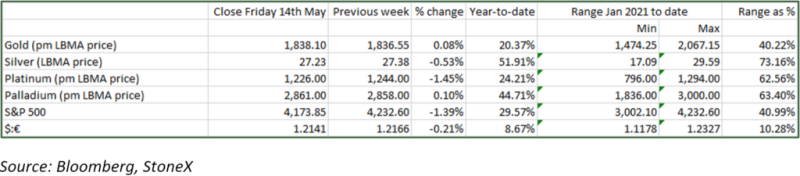

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

We have noted before that a degree of inflation is important in order to help stimulate spending and investment, both at the institutional and the private individual level. In that set of circumstances gold is not necessarily going to take centre stage because inflation is at that point, not a risk – quite the reverse. Where gold does come into its own as an inflation hedge pure and simple is when inflation is accelerating and when it starts to threaten economic health – for example in the oil-crisis fuelled inflationary cycles in the 1970s.

Real gold and U.S. inflation (CPI)

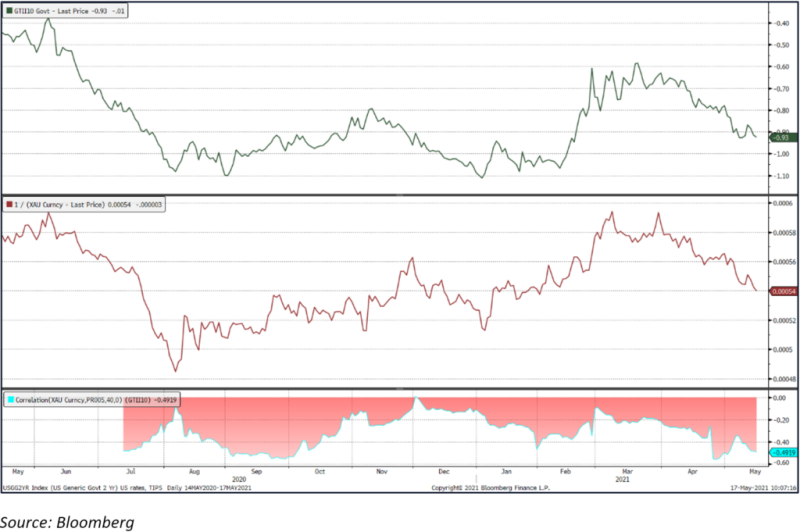

To that end, the current near obsession with inflationary forces, justified or otherwise, is less significant for gold than what real yields are doing. This of course is directly related to inflation but puts gold at one stage removed. Gold is currently scaling three-month highs at $1,850; this is being driven not just by the level of real interest rates, but the resurgence of the virus in parts of Asia as well as intensifying tension in the Middle East. Notably, gold Exchange-traded products, which have been steadily eroded so far this year, have now enjoyed six consecutive days of net investment and this can become self-fulfilling given the frequency with which the numbers are made available.

To return to the inflation and interest rate argument; the weakness in the nonfarm payroll figures, released on 7th May, helped to boost gold’s rally, to just over $1,840, taking it firmly into overbought territory. This more or less set the scene for a downturn when the U.S. CPI number was released last Wednesday. Coming in at 4.2% year-on-year and 0.9% month-on—month, the number was accompanied by headlines including words such as “spike” and “alarm”, along with a sharp fall in equities and a surge in the closely watched ten=-year yield. Gold slid accordingly, but the lesson here is that the fall, predicated on the expectation for further rises I the bond yields, was very short-lived – because of course a year-on-year gain of 4.2% put real yields a lot further below zero than previously. The year-on-year numbers are distorted as the effects of the pandemic were in full swing last April, but a month-on-month rise of 0.9% did ruffle feathers.

The Fed swung into action with several speakers continuing to argue that inflation forces are transitory; whether they are or not (this writer is in the “transitory” camp), while nominal yields also turned lower. The question about the persistence or otherwise of inflationary forces pits the bottlenecks in the supply chain, which are feeding into higher (in some cases much higher) raw material prices and therefore technically transitory, against the likely unleashing of pent-up consumer expenditure as the economy fully opens up; plus the fact that Chinese labour costs, which used to be much lower than in the west, are now closer to parity and so Chinese trade is exporting inflation into the west. We also don’t yet know to what extent the labour market will pick up when the U.S. stimulus cheques stop coming (September).

So the market is awash with conflicting forces. All of which is to gold’s benefit as gold thrives on uncertainty.

Gold (inverted) and the real ten-year yield plus the correlation; note the real yield is currently at minus 0.9% and even if the current inflation forces persist, the Fed would be extremely unlikely to take rates high enough to render real rates positive – even if it were inclined to do so – which, currently, it is not.