May 2021

May 2021

Weekly markets round-up

By StoneX Bullion

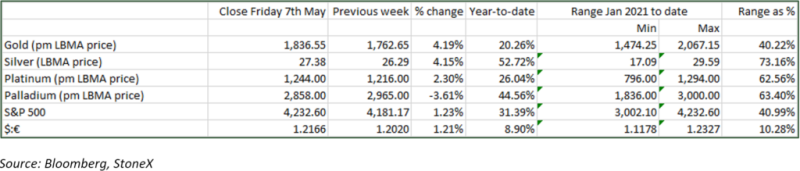

Welcome to a very brief overview of the recent performance in the markets. The essentials are captured in the table below and each week we will show a chart of interest.

All eyes on the United States last week as the nonfarm payroll figures, released last Friday, adding considerable spice to the bull run that started at the end of March; since then the price has risen from $1,658/ounce to $1,836 at the start of this week, a gain of 9%. Silver has, as usual, run further, from $24.03 to $27.69, in increase of 15%. The latest moves came in response to a series of broadsides from members of the Federal Reserve Board’s Open Market Committee, with at least four members going public about the firm intention to keep rates as low as possible for as long as necessary and opining that the run-up in inflation that is developing in the States will be only transitory. This makes sense in that the pandemic was in full flight this time last year, putting downward pressure on any number of economic indicators; therefore the year-on-year changes are distorted and as these anomalies drop out of the system, so the inflation numbers are likely to go into reverse.

That said, the distortions in the supply chain across the majority of economies have resulted in supply shortages in a range of economic sectors and this is likely to persist for some months. Add to that the rapid increase in prices of raw materials and there is a genuine inflationary push developing.

How long will it last? Hard to say, given that the stellar performance of some base metals and the rapid increase in crude oil prices cannot be sustained in perpetuity and therefore these inflationary influences may also wane in coming months, taking some heat out of the system.

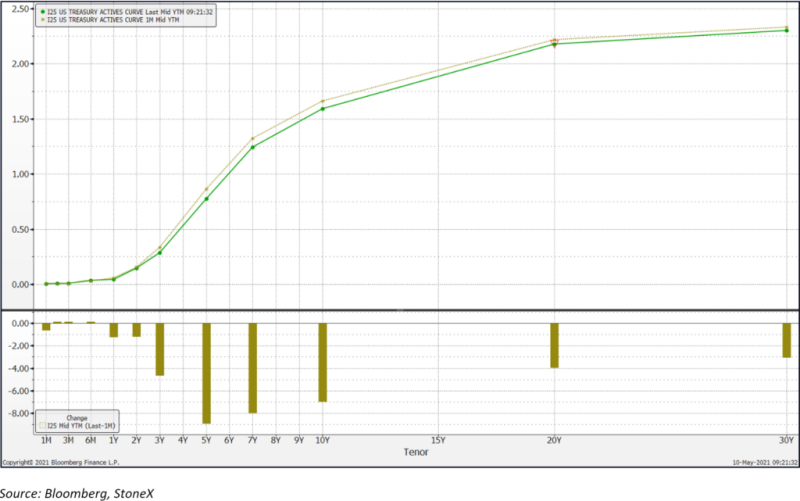

This justifies the Fed’s stance in keeping rates low for as long as possible- - although the yield curve is still relatively benign and indeed slipping lower (see chart below) discounting only rates of only 2.5% for the longer term. On this basis it is arguable that gold is not looking at inflationary pressures for support, but is still concentrating on the level of real interest rates, the high degree of liquidity in the system and the possibility of financial stress further down the line on the basis that the debt:GDP ratio is very high across the industrialised world.

The U.S. yield curve, now and a month ago

Gold in dollar and local currency terms – up 66% in Turkish lira since the start of last year